Key Notes Top investors, including two major funds, offload large volumes of PUMP tokens to exchanges. Despite a recent listing on OKX and $722 million in daily trading volume, PUMP faces strong selling pressure and bearish momentum. Analysts warn of a potential 40% further drop, with $PUMP breaking key support at $0.004035. PUMP token, the native cryptocurrency of the Solana meme coin platform Pump.fun, is down by more than 35% over the last week, dropping under its private sale price of $0.004. This massive price crash comes amid heavy exchange…

Tag: Token

BNB Announces TAG Purchase: Token Turns Parabolic

Key Notes BNB Chain buys 40 million TAG tokens under its revamped $100M incentive program. TAG defies broader crypto market correction with a 9% daily gain. The token has recorded an 80% surge in 24-hour trading post-announcement. While most of the crypto market shows signs of cooling on Tuesday, Tagger (TAG) is trending on exchanges with a strong 9% daily surge. The cryptocurrency is trading around $0.0006421 with a market capitalization of $69.6 million. The rally follows BNB Chain’s BNB $759.8 24h volatility: 2.6% Market cap: $110.86 B Vol. 24h:…

Bitget users can gain ESPORTS in 1.86m token airdrop by locking up Bitcoin

ESPORTS makes its debut on Bitget PoolX. Starting July 21 until July 28, users can earn a batch of Yooldo Games tokens from a 1.86 million airdrop by locking up to 20 BTC. In a recent announcement, Bitget announced the… Original

Bitcoin padá pod 100 000$ .. WTF?? #btc #bitcoin

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Hľadáte najnovšie správy o kryptomenách a bitcoine? Nehľadaj ďalej! Patreon kanál: —————————————————————————————— —————————————————————————————— Zabezpečte svoje kryptomeny Hardwarovou peňaženkou: Ledger nano HW Trezor HW —————————————————————————————– Zrieknutie sa zodpovednosti: Informácie v tomto videu tvorcom Crypto invest kanál nie sú finančným poradenstvom. Toto slúži iba na vzdelávacie a informačné účely. Akékoľvek informácie alebo stratégie sú myšlienky a názory súvisiace s akceptovanou úrovňou tolerancie voči riziku tvorcu / posudzovateľov obsahu a ich tolerancia k riziku sa môže líšiť od vašej. Crypto invest kanál nie je zodpovedný…

BC.GAME Token Hits All-Time High Following Burn of 250 Million BC Tokens

BELIZE CITY, Belize, July 18, 2025 /PRNewswire/ — BC.GAME, a global leader in Web3 entertainment, today announced that its native token BC has surged to a new all-time high following the burn of 250 million BC tokens, valued at approximately $2.8 million USD. The burn transaction is publicly verifiable on the blockchain at: https://solscan.io/account/BCBurn1111111111111111111111111111111111111. Following the announcement, BC experienced a 75.8% increase within 24 hours, breaking the $0.01 price barrier and pushing its market capitalization above $100 million USD, marking a significant milestone for the token and the ecosystem. BC is…

Bitcoin nears $120k: 3 altcoins near ATH, including an under $0.01 token poised to 10x

Bitcoin hits record highs as 3 altcoins near peak prices; under-penny token shows 10x potential this week. #partnercontent Original

Pump.fun’s PUMP Token Peaks Then Plummets—Is the Party Over?

Pump.fun’s freshly minted token, PUMP, has hit a few speed bumps since its debut on July 12. Originally offered at $0.004 during the platform’s initial coin offering (ICO), it’s barely nudged higher a week later, hovering at just $0.004246 per token. PUMP Hype Cools as Price Sinks Well Below Launch High Pump.fun’s coin blasted off […] Source CryptoX Portal

#coinbase Aktie erreicht neues Allzeithoch – Kursplus von 40 % im letzten Monat

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Die Aktie von Coinbase (Ticker: COIN) hat am Donnerstag einen neuen historischen Schlusskurs erreicht und damit die bisherige Bestmarke aus dem Jahr 2021 übertroffen. Das Papier schloss bei 375,07 US-Dollar und legte damit am Tag um 5,5 % zu. Der bisherige Rekordwert lag bei 357,39 US-Dollar und wurde im November 2021 verzeichnet. In den letzten fünf Handelstagen stieg die Aktie um nahezu 24 %, im Monatsverlauf beträgt das Plus rund 40 %. Mit diesem Kursanstieg kletterte die Marktkapitalisierung von Coinbase auf etwa…

OKX to List Pump Today: Token Tanks Another 6%

Key Notes OKX will list the PUMP/USDT pair today at 7:00 AM UTC, despite a recent 6% price drop. Over 59% of ICO participants have already sold or moved their tokens, per BitMEX data. Security firm Blockaid flagged over 2,400 fake $PUMP tokens and 6,700 scam attempts. Crypto exchange OKX announced it will list one of the most talked-about meme coins of the year, the PUMP token from Pump.fun, with trading set to begin at 7:00 AM UTC on July 18. The listing comes as the token battles heavy sell…

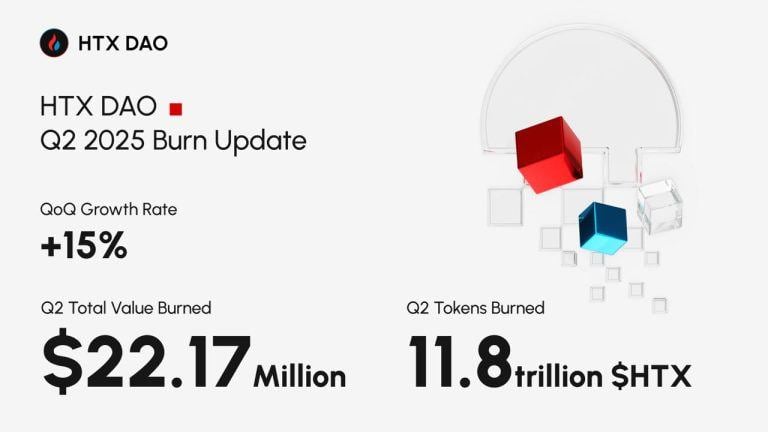

HTX DAO Completes Over $22.17 Million $HTX Token Burn in Q2 2025, Advancing Decentralized Governance

This content is provided by a sponsor. PRESS RELEASE. Panama, 17th July 2025 – HTX DAO announced the successful completion of its $HTX token burn for Q2 2025 on 15 July. This initiative is a core component of HTX DAO’s ongoing strategy to implement its deflationary mechanism, aiming to enhance the long-term value of $HTX […] Source CryptoX Portal