The approval of Bitcoin ETFs by the US Securities and Exchange Commission (SEC) in January 2023 has opened the floodgates for significant institutional investment in the newly approved market. However, US states are also rushing to capitalize on the success of these ETFs by allocating a portion of their pension funds to reap profits and diversify their investments. Wisconsin, Jersey City, Michigan Allocate Millions To Bitcoin ETFs The first state to take the plunge was Wisconsin, which in May 2023 allocated approximately $98.6 million, or 2% of its pension fund, to…

Tag: Million

VacEck Places $52.4 Million Price Tag On Bitcoin, But How Is This Possible?

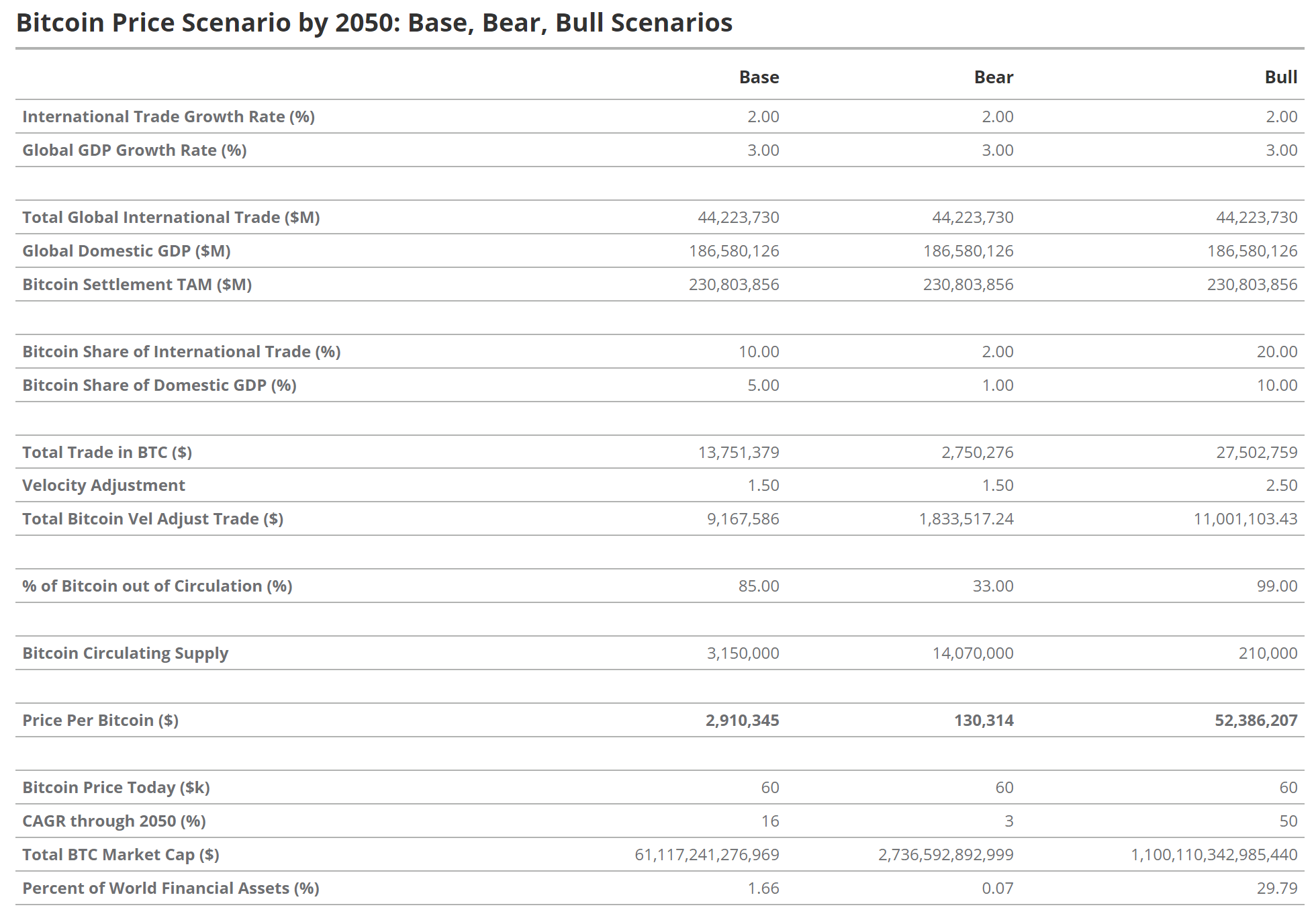

American investment management firm VanEck has set an astonishing price target for Bitcoin (BTC), the world’s largest cryptocurrency. This forecast, which seems almost inconceivably high compared to most market predictions, has garnered significant attention. Despite the ambitious forecast, VanEck’s research team has presented a comprehensive rationale explaining why they believe such a substantial price increase is attainable. VanEck Predicts Bitcoin Valuation For 2050 On July 24, VanEck published a report, outlining the teams’ assumptions for a bull scenario in which BTC could potentially rise to $52.38 million by 2050. Notably,…

$4 Million War Chest In Bitcoin, XRP For Re-election

Former President Donald Trump is set to deliver a keynote address at the 2024 Bitcoin Conference in Nashville, Tennessee, this weekend, amid growing speculation that Trump may announce Bitcoin as a strategic reserve asset for the United States. This move could have a significant impact on the entire cryptocurrency industry. Bitcoin Contributions Support Trump and Vance’s Platform According to a CNBC report, Trump has raised over $4 million in campaign contributions from a variety of digital assets, including Bitcoin, Ethereum (ETH), XRP, Circle’s USDC stablecoin, and various memecoins, ahead of…

VanEck Predicts Bitcoin Price May Hit $52.38 Million, Here’s When

In a new report dated July 24, 2024, from VanEck, the investment firm’s digital assets research team, headed by Matthew Sigel and Patrick Bush, sets forth an exceptional prediction: Bitcoin could soar to a value of $52.38 million per coin by 2050 in their most bullish scenario. The analysis, titled “Bitcoin 2050 Valuation Scenarios: Global Medium of Exchange and Reserve Asset,” paints a picture of Bitcoin transforming into a cornerstone of the global monetary framework, functioning as both a major international medium of exchange and a reserve currency. How Bitcoin…

Proton Launches Self-Custodial Bitcoin Wallet: 100 Million Proton Mail Users Can Now Receive BTC via Email

Proton, known for its privacy-focused services including the popular Proton Mail with over 100 million users, has launched Proton Wallet, a new self-custodial bitcoin wallet. “If you are one of the millions of people who have a Proton Mail email address, you can now automatically receive bitcoins with your email address,” said Proton’s CEO, adding […] Original

Caldera's Rollup-in-a-Box Platform Raises $15 Million From Peter Thiel's Venture Fund

As Ethereum’s Layer-2 ecosystem booms, Caldera’s “Metalayer” aims to help developers quickly launch applications across multiple networks. Source

$4 Million US Bitcoin Movement Raises Questions

With a huge sell-off of Bitcoin, the Germany has fundamentally changed the bitcoin scene. Germany has recently offloaded an astounding 49,850 BTC within a few weeks. Executed across many exchanges including Coinbase, Kraken, and Bitstamp, the transactions helped to reduce possible value loss. Related Reading Apparently, the German government started these sales because of worries about a notable drop in the value of Bitcoin. With the average price for a Bitcoin about $57,000, the total earnings came to a little over $2.8 billion. Fascinatingly, Germany lost out on an extra…

XRP Whales Go On $84 Million Buying Spree: Rally To Continue?

On-chain data shows the XRP whales have participated in a large accumulation in the past week, which could be bullish for the asset’s price. XRP Whales Bought More Than 140 Million Tokens Over The Past Week As explained by analyst Ali Martinez in a new post on X, the XRP whales have increased their supply share recently. The on-chain indicator of relevance here is the “Supply Distribution” from the analytics firm Santiment, which tells us about the total amount of tokens a given wallet group holds. The addresses or investors…

Telegram Reaches 950 Million Monthly Active Users

Telegram, the popular messaging app, has reached 950 million monthly active users worldwide, according to its founder Pavel Durov. The app has served as a platform for the popularization and growth of several cryptocurrency projects featuring tap-to-earn mechanics, such as Notcoin and the recently popular Hamster Kombat. Durov stated that the number of users has […] Source CryptoX Portal

Hong Kong’s Boyaa Interactive Announces Strategic Bitcoin Ecosystem Cooperation, Plans to Purchase $100 Million in BTC

Boyaa Interactive, a public gaming company based in Hong Kong, has announced a strategic investment in the UTXO Bitcoin Ecosystem Fund. The company plans to allocate $1,000,000 to this initiative, aimed at promoting the Group’s business development and expansion in the Web3 industry. Boyaa aims to ‘deepen its presence in the Web3 industry, leverage the […] Original