Wall Street’s demand for Bitcoin products surged last week, with $1.1 billion in new cash captured by BlackRock’s spot Bitcoin exchange-traded fund. Bitcoin (BTC) has become a major focus for U.S. wealth management heavyweight BlackRock as its spot Bitcoin ETF outpaced several traditional finance offerings. Investors have injected $26 billion into BlackRock’s IBIT, 10 months after spot Bitcoin ETFs debuted in mid-January. The fund has broken into the top 2% of all ETFs in the U.S., and last week’s inflows marked another milestone for BlackRock’s Bitcoin ETF. BlackRock’s IBIT accounted…

Tag: ETF

Bitcoin ETF Holdings Push Steadily Toward the 1 Million BTC Threshold

Following Friday’s spot bitcoin exchange-traded fund (ETF) activity, the numbers reveal that the 12 ETFs are on the brink of reaching the impressive milestone of 1 million bitcoins. As of this weekend, the funds are just shy of 42,000 BTC from hitting that target. Massive Bitcoin Inflows Drive ETFs Closer to 1 Million Bitcoin Milestone […] Original

NYSE, CBOE to list Bitcoin ETF options after SEC approval

The U.S. Securities and Exchange Commission has granted “accelerated approval” for listing Bitcoin options exchange-traded funds on the New York Stock Exchange and the Chicago Board Options Exchange. According to Oct. 18 filings, the SEC has greenlighted the NYSE and CBOE to list and trade options for Bitcoin ETFs. Options give investors the right to buy or sell an asset—referred to as “call” or “put” options—at a specific price before an agreed date. This move is expected to open up new opportunities for investors seeking to manage risk or capitalize…

NYSE, Cboe Win SEC Approval for Bitcoin (BTC) ETF Options

In its NYSE approval, the SEC wrote that it believes options on the bitcoin ETFs “would permit hedging, and allow for more liquidity, better price efficiency, and less volatility with respect to the underlying Funds,” as well as “enhance the transparency and efficiency of markets in these and correlated products.” Original

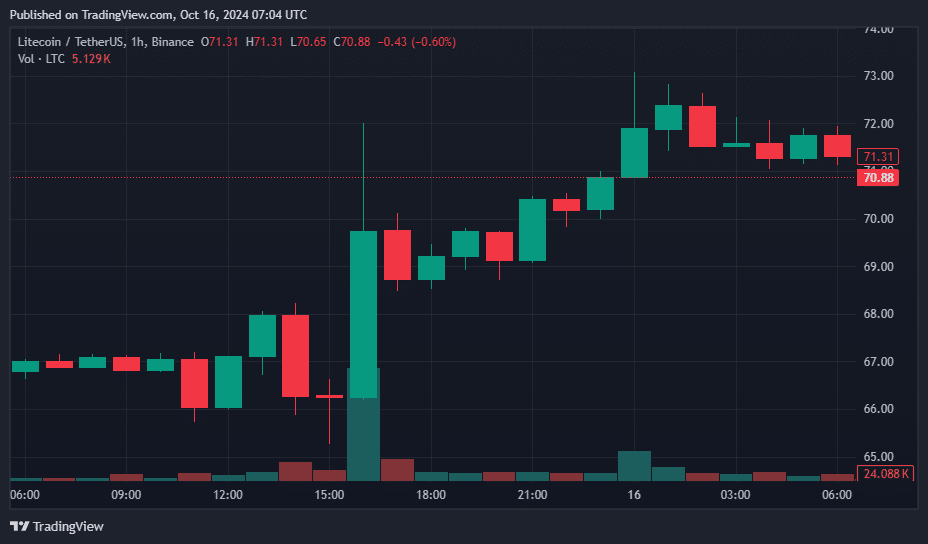

ETF Hopes Propel Litecoin 12% Higher, Bullish Predictions On The Cards

Following its price increase of more than 12% in the past week to roughly $71.50 on October 16, Litecoin (LTC) is attracting more and more interest. The action followed growing buzz about a planned Litecoin exchange-traded fund (ETF) proposal by Canary Capital Group. Investors are excited, since this ETF may provide a more direct method for investing in Litecoin, allowing both individual and institutional participants to access the market. The S-1 registration statement for the proposed ETF was filed on October 15, requesting permission from US regulators. Numerous individuals regard…

BTC Flirts With $68K Amid ETF Inflows

Bitcoin made another attempt to establish a foothold above $68,000 early in the European morning before pulling back and trading around $67,800. BTC has gained about 1.35% in the last 24 hours, outperforming the broader digital asset market, as measured by the CoinDesk 20 Index, which is just under 0.8% higher. Bitcoin has also risen nearly 9% this week, according to CoinDesk Indices, amidst strong uptake for spot BTC ETFs. The U.S.-listed funds have seen inflows of $1.86 billion since Monday, which, even with one day remaining, is their highest…

New Grayscale ETF Aims To Include Major Cryptos: Bitcoin, Ether, Solana, And XRP

Crypto asset manager Grayscale is in the process of converting its Grayscale Digital Large Cap Fund (GDLC) into an exchange-traded fund (ETF), according to Bloomberg ETF expert Eric Balchunas. The strategic move aims to provide investors with a diversified portfolio that includes major digital assets such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP and Avalanche (AVAX). Diversified Exposure To Bitcoin, Ethereum, And More The proposed ETF comes at a time when investor interest in regulated cryptocurrency products is on the rise. Grayscale’s Digital Large Cap Fund currently holds approximately…

Bitcoin ETF Inflows Climb While Ethereum Funds Face a Day of Losses

Based on the latest figures from Tuesday’s exchange-traded fund (ETF) trading sessions, the 12 spot bitcoin ETFs experienced another day of positive inflows, totaling $371.02 million. In contrast, the nine ethereum-based ETFs recorded outflows, with $12.7 million exiting the ether funds. Bitcoin ETFs Pull in $371M While Ethereum Funds Drop by $12.7M On Tuesday, Blackrock’s […] Original

Litecoin rallies 11% amid spot ETF application and improving market sentiment

Litecoin surged to its two-month highs following the news of a spot Litecoin ETF filing with the U.S. Securities and Exchange Commission. Litecoin (LTC) rose 7.2% over the last day, exchanging hands at $71.52 on Wednesday, Oct. 16, its highest price seen since the end of July. LTC 24-hour price chart – Oct. 16 | Source: crypto.news This recent rally reflects a 15% increase from its monthly low, with Litecoin’s market capitalization growing from $4.6 billion on Oct. 3 to over $5.36 billion at the time of writing. The upward…

Bitcoin holding strong at $67k amid solid ETF inflows

Bitcoin’s surge above the $67,000 mark came along with solid spot exchange-traded fund inflows and increased short liquidations. Bitcoin (BTC) is up 2% in the past 24 hours and is trading around $67,000 at the time of writing. Yesterday, Oct. 15, the flagship crypto asset surpassed $67,500 and even got close to the $68,000 zone, marking a two-month-high. BTC price – Oct. 16 | Source: crypto.news BTC’s market cap is currently hovering at $1.32 trillion with a daily trading volume of almost $50 billion. It’s rising trading volume shows increased…