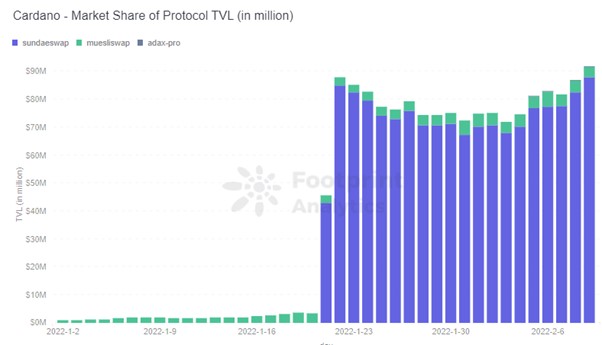

After years of fine-tuning its technology, Cardano has finally launched its first DEX on Jan. 20, called SundaeSwap. On the day of its launch, its TVL reached $4.3 million. Cardano’s token, ADA, rose 10% the previous week in anticipation.

Has Cardano’s time finally arrived?

What is Cardano

Founded in 2015, Cardano calls itself Blockchain 3.0. It aims to combine the best of Bitcoin and Ethereum to solve problems related to scalability, interoperability and sustainability.

Cardano’s strength lies in its academic and scientific philosophical foundation.

IOHK is one of Cardano’s development foundations and is responsible for working with teams of academics around the world to research and review updates to the protocol to ensure it is scalable.

Cardano has a great long-term vision for cryptocurrencies. It believes that the new technology of blockchain should be at the service of businesses or financial systems. It wants to create a chain that can support thousands of transactions per second, a platform that allows governments and businesses to track information about the system, and even enable democratic governance.

Controversy Surrounding Cardano

ADA is currently ranked 7th in terms of market cap and 15th in terms of 24h trading volume.

Footprint Analytics – ADA Price and Volume

Despite its high market cap, Cardano is a polarizing project. Here’s why some people it is grossly overrated.

1. The development of Cardano has been slow. Cardano only launched its first smart contracts in September, 2021, about six years after the mainnet went live.

While there are over 170 projects on the Cardano chain that say they are under construction, only five so far are live. One of those is SundaeSwap.

Footprint Analytics – Protocols on Cardano

2. ADA tokens lack application scenarios. ADA’s current role is only for staking and the price is influenced by FOMO. Compared to other chains with strong ecosystem development, ADA’s token price growth has grown slowly over the past year.

Footprint Analytics – Top Chain Token Price Thrend

3. Concerns about its technical design and implementation. A number of issues have been raised in the community which may indicate that Cardano’s TPS, transaction fees, and scalability are not as perfect as they should be. SundaeSwap, the first Dex on Cardano, experienced network congestion and was unable to trade when it went live.

The main premise of Cardano is that its super-slow development will be justified by best-in-class performance and security. Whether it can accomplish this remains to be seen.

The Case for Cardano

In the face of questions about the DApp launch and technical implementation, proponents argue that Cardano is future-proof. Cardano aims to work with governments and financial institutions, so it takes longer to prepare a more secure solution.

Here are the main arguments for Cardano:

- Advanced technical concepts: Cardano’s unique consensus algorithm, Ouroboros, holds the possibility of achieving millions of TPS through a two-tier network architecture.

- Professional review: Cardano was the first peer-reviewed blockchain project, meaning that Cardano’s code was subject to professional peer review to ensure the viability of the technology before it was launched.

- Strong community: Cardano has a strong and enthusiastic community, bringing together many professionals, researchers, professors, developers, and investors.

- Financial strength: Cardano currently has a fund of $160 million, which will provide strong support for subsequent ecosystem-building.

Proponents also believe that the Alonzo upgrade as the starting point for Cardano’s ecosystem to explode. As the the ecosystem expands, ADA will have richer application scenarios and prices will see an increase.

Will Cardano explode in 2022?

There is no denying that Cardano’s vision is aspirational and comes at the perfect time, with congestion and high costs plaguing Ethereum.

However, there are more strong competitors on the market than anyone likely imagined 5 years ago.

After the DeFi Summer, DApps have exploded. Other chains are also competing extremely hard to carve out a slice of the DeFi market. If anyone can survive, it will be the products that meet users’ needs as they evolve.

Big whales don’t care about gas fees, they care about liquidity. They need to get money in and out quickly with as little price impact and slippage as possible.

And liquidity is something that needs to be provided by a large number of users. This is an important advantage for Ethereum, which is firmly in the lead among public chains thanks to its first-mover advantage in liquidity.

In other words, for all of its aspirations, Cardano needs to put its advanced concepts and technologies into practice.

Cardano will be a safe bet only when more DApps are implemented to ensure the proper operation of on-chain applications and users can participate in ecosystem construction, not just token trading.

What is Footprint Analytics

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.