On May 5, 2022, at block height 735,000, the bitcoin mining pool Poolin mined the 105,000th block reward since the last halving. The mined block also represents the halfway point to the next halving that is estimated to take place on or around April 27, 2024. Block 735,000 follows the network issuing over 19 million bitcoin and the hashrate reaching an all-time high three days ago on May 2.

Block 735,000: Halfway to the Next Halving

The Bitcoin network is getting closer to the next halving which is estimated to happen on or around April 27, 2024, or 723 days from now. At block height 735,000, the 105,000th block was mined and there’s now 105,000 left to go until the next halving. At the time of writing, data shows that there’s 104,928 block subsidy rewards left to mine.

Presently, bitcoin miners get 6.25 BTC for a block reward and the fees associated with the confirmed transactions. Poolin earned the 6.25 BTC and 0.16215354 BTC worth of network fees associated with the block reward’s 1,487 transactions. The halfway point to the halving follows Bitcoin’s hashrate all-time high (ATH) recorded on May 2, 2022, at block height 734,577.

On that day, BTC’s hashrate reached an ATH at 275.01 exahash per second (EH/s). At the time of writing, the network has 767 blocks left until the next difficulty retarget which is expected to happen on or around May 10, 2022. A difficulty increase of around 5.29% is estimated to happen after the last difficulty change of around 5.56%.

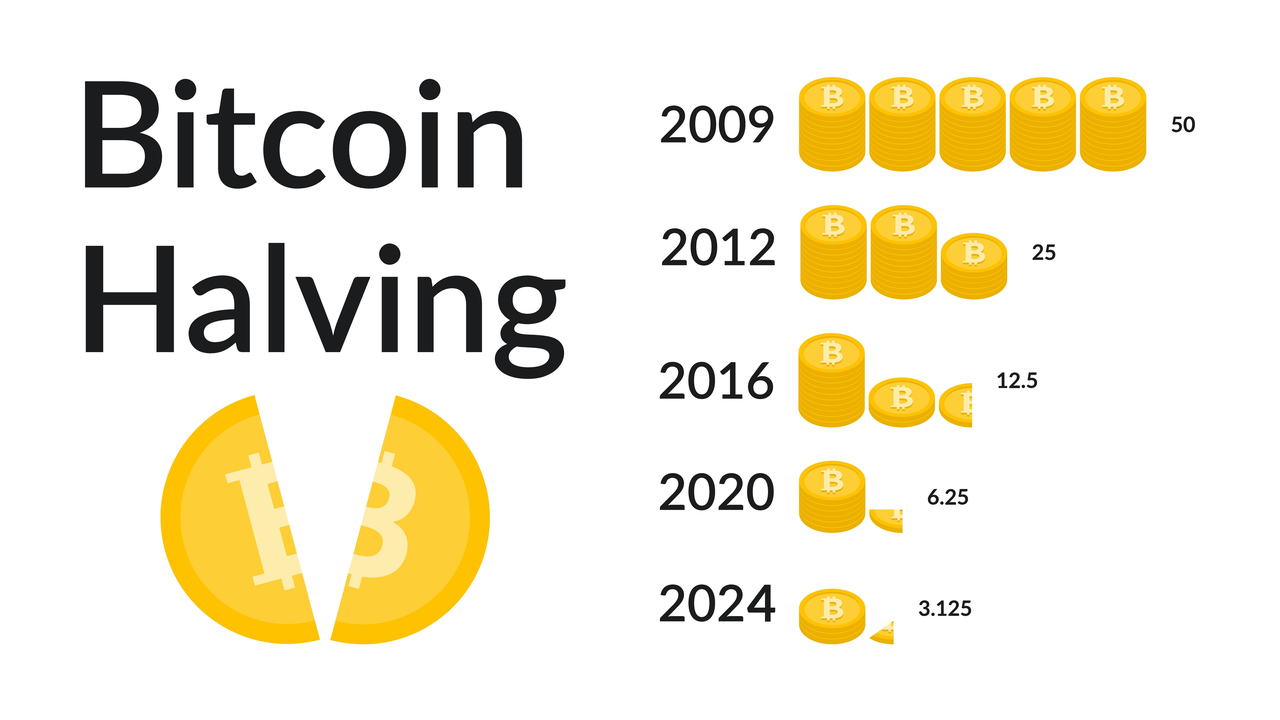

When the next halving occurs, bitcoin miners will see their revenues shaved in half as the block subsidy reward will change from the current 6.25 BTC reward to 3.125 BTC. The current Bitcoin network issuance has an inflation rate of around 1.74% per annum. So far, throughout Bitcoin’s entire lifetime, only three halvings have occurred.

Next Bitcoin Halving to Occur at Block Height 840,000 in 2024

The first Bitcoin block reward halving took place on November 28, 2012, at block height 210,000. The second halving occurred on July 9, 2016, at block height 420,000, and the third halving event took place on May 11, 2020, at block height 630,000. The next halving that’s expected to happen on or around April 27, 2024, will occur at block height 840,000.

The U.S. Federal Reserve and other central banks worldwide like to target a 2% inflation rate per annum, but that has changed a great deal since the Covid-19 pandemic and the monetary supply expansions that took place globally. Bitcoin’s current inflation rate of 1.74% per annum is much better than the central bank’s long lost target rate.

When the next halving occurs 105,000 blocks from now, Bitcoin’s inflation rate will be an estimated 1.1% per annum. Because Bitcoin has a predictable monetary supply, we can also estimate that by the 2028 block subsidy halving, Bitcoin’s inflation rate will be an estimated 0.5% per annum.

What do you think about reaching the halfway point until the next Bitcoin network halving? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.