Litecoin market cap crashes as triggered by the bearish movement of the crypto market. Litecoin’s market cap was down by more than 30% compared to its performance in the first week of May wherein the digital asset was in top shape. Litecoin market valuation closed the previous month at $4.82 billion; a disappointing number to say the least.

LTC was one of the cryptocurrencies that felt the blow on the eve of the crypto crash in May. The coin was down by 11.04% on Monday, dubbed the token’s most significant percentage loss by far.

Its market cap spiraled down to $3.012 billion. For comparison, note that the LTC’s highest market cap by far is at $25.609 billion.

Suggested Reading | Dogecoin Shed 91% Of Its Value Since 2021 High – A Musk Tweet To Pump DOGE?

Litecoin Shaved Off 33.59% In TCV

Meanwhile, LTC traded between $41.200 to $48.300 in the past 24 hours. Litecoin has also declined in value, losing as much as 33.59% and traded 0.75% or around $1.135B of the total crypto volume.

The coin plunged by 89.83% compared to its all-time high, wherein it peaked at $420 on December 12, 2017.

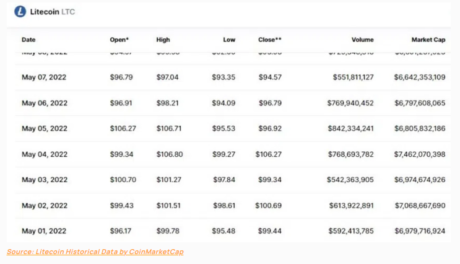

Evidently, it started May with a bang at $96.17. May 1 had LTC soaring at a trading volume of $592.41 million, equivalent to a market cap of $6.98 billion. The crypto asset also reached a monthly high that peaked at $106.80 or on May 4.

LTC total market cap at $3.1 billion on the daily chart | Source: TradingView.com

It also tested and dipped to a monthly low on May 12 at $55.32; and consequently ended May at a trading price burrowed at $68.41. The figures reveal that LTC has dropped immensely when you look at its opening and closing prices in May.

LTC Hurt By Crypto Market Crash In May

LTC resorted to an aggressive sell-off due to the market cap disequilibrium. Like other cryptocurrencies, it is toughing it out in rough times. Many factors have triggered this rupture, such as inflation, stock market crisis, economic and political events, and increased interest in precious metals like gold, silver, and the like.

Huge transactions with LTC peaked on May 18 at 12,910, equivalent to roughly 84.31 million worth of transactions priced at $70. This generally translates to a total transaction volume amounting to $5.9 billion.

LTC opened May 18 at $72.97, which capsized at an intraday low of $66.42. The trading volume shows a remarkable decline of 33% in the market value of the coin since May 1.

Suggested Reading | Ether Drops Below $1,400, Pummeled By US Inflation And Difficulty Bomb Setback

Featured image from ITNext, chart from TradingView.com