Over three billion in value was erased from the stablecoin economy during the past 30 days. The trend occurred despite the number of tethers in circulation rising by 2.2% last month. On Oct. 1, 2022, tether’s market capitalization was approximately $67.95 billion, and it’s risen to $69.36 billion since then. Circle’s usd coin, on the other hand, had a valuation of around $47.20 billion 30 days ago and today, the market cap is $42.54 billion, after the stablecoin project’s number of tokens in circulation dropped by 10.3%.

Stablecoin Economy’s Supply Tightens

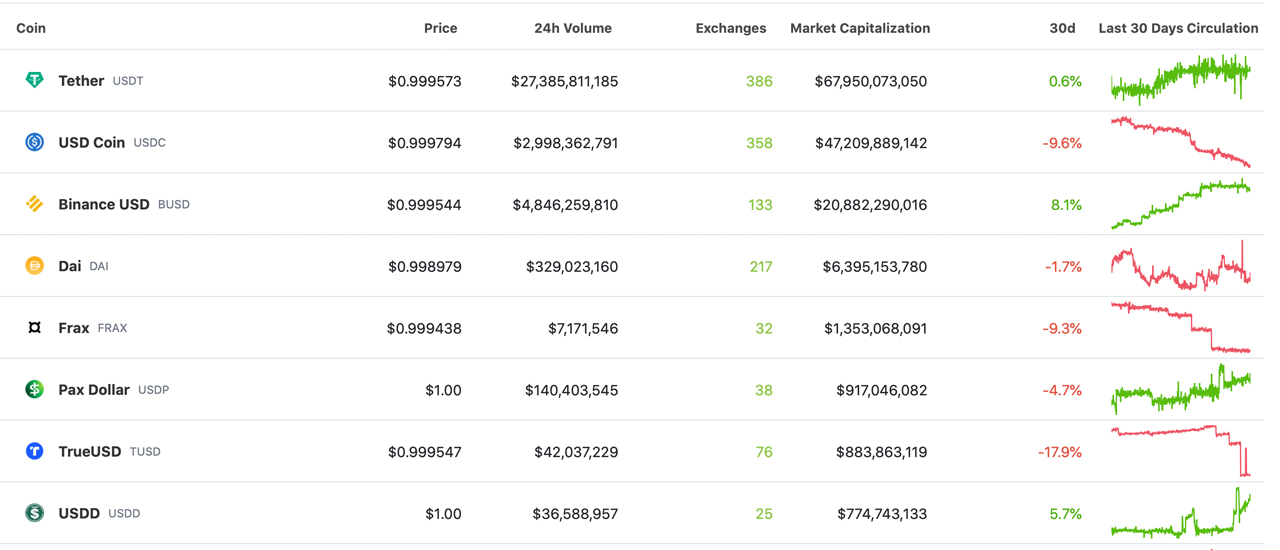

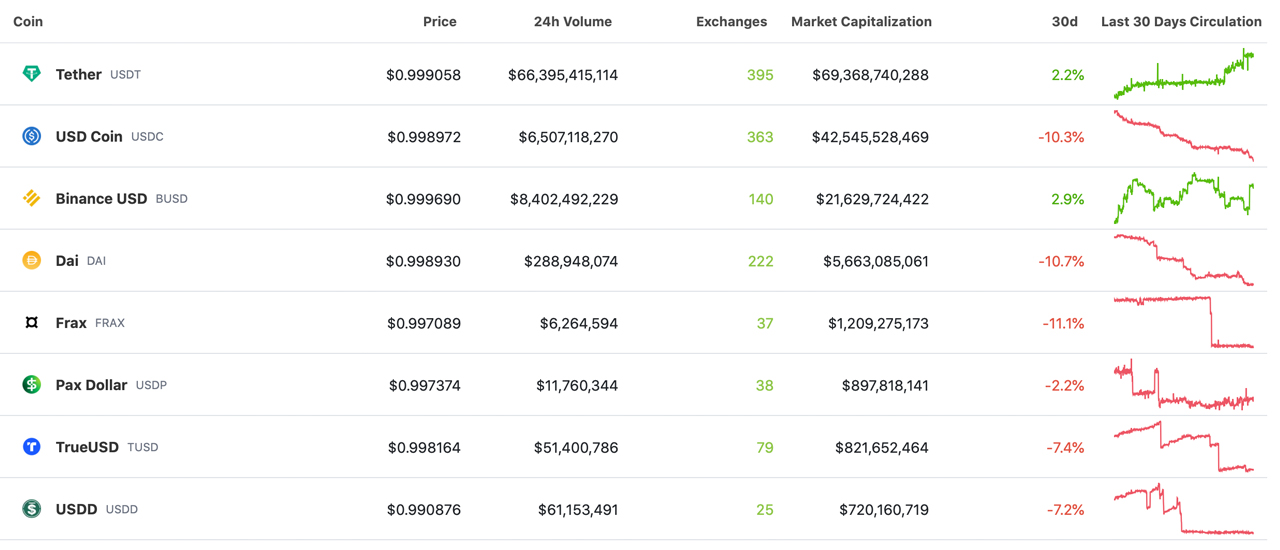

The stablecoin economy has lost approximately 3.32 billion in nominal U.S. dollar value during the past 30 days, according to statistics recorded on Nov. 2, 2022. Most of the action derived from the top two stablecoins (USDT & USDC), as usd coin’s (USDC) number of stablecoins in circulation slid 10.3% lower since last month. Archived records show, that while the stablecoin project’s supply lost 9.6% the month before, USDC’s market cap dropped from $47.20 billion to $42.54 billion through the month of October.

Records published on Oct. 1, 2022, further show that the month prior, tether’s (USDT) number of coins in circulation was up roughly 0.6%. Throughout the month of October, USDT’s coins in circulation, according to coingecko.com statistics, indicate the supply has risen by 2.2% since then. At the time, 30 days ago, tether’s market capitalization was roughly $67.95 billion and on Nov. 2, 2022, USDT’s market cap is currently valued at $69.36 billion. Although, USDC was not the only stablecoin that recorded 30-day supply drops since the first of October, as a myriad of stablecoins saw supply reductions.

The stablecoin DAI, issued by the Makerdao project, has seen a 10.7% reduction since last month. Frax (FRAX) saw an 11.1% slide downward and pax dollar (USDP) dipped by 2.2%. The number of trueusd (TUSD) declined by 7.4%, and Tron’s USDD stablecoin supply reduced by 7.2% during the last 30 days. While BUSD’s supply jumped 8.1% higher at the end of September, BUSD’s overall number of coins in circulation increased by 2.9% this past month.

BUSD’s market cap is now more than half of USDC’s valuation, as the number of BUSD coins in circulation represents 50.82% of the USDC supply. Another interesting factor that took place within the stablecoin economy was the recent HUSD depegging event.

Three days ago, Bitcoin.com News reported on HUSD sliding to record lows and now it’s trading well below that number today. HUSD is currently exchanging hands for $0.324 per unit on Nov. 2, 2022. HUSD slid to an all-time low at $0.283, and it’s currently 14.4% higher than that all-time low, but the token’s current value is not even close to the $1 parity it once held on Oct. 1, 2022.

What do you think about the stablecoin action during the last 30 days? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, coingecko.com stablecoin page

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.