The governor of India’s central bank, the Reserve Bank of India (RBI), has warned that the next financial crisis will come from cryptocurrencies, like bitcoin and ether. The central bank chief added that cryptocurrencies pose “huge inherent risks” to India’s macroeconomic and financial stability.

Indian Central Bank Warns About Crypto Causing the Next Financial Crisis

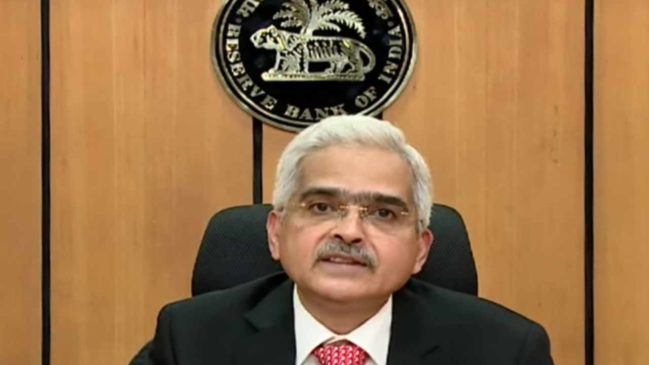

Reserve Bank of India (RBI) Governor Shaktikanta Das warned about the danger of cryptocurrency Wednesday. The central banker cautioned:

Cryptocurrencies have … huge inherent risks for our macroeconomic and financial stability.

The RBI is primarily concerned about cryptocurrencies having no underlying value, Das clarified, emphasizing that crypto is “speculative” and should be banned.

Indian authorities refer to any non-government-issued cryptocurrencies, such as bitcoin and ether, as “private” cryptocurrencies. Commenting on crypto trading, Das said:

It is a hundred percent speculative activity, and I would still hold the view that it should be prohibited … because, if it is allowed to grow — if you try to regulate it and allow it to grow — please mark my words, the next financial crisis will come from private cryptocurrencies.

Meanwhile, India is trying to launch its own central bank digital currency (CBDC). The RBI recently started both wholesale and retail digital rupee pilots.

Das explained that CBDCs can expedite international money transfers and reduce the need for logistics, including printing notes. Earlier this month, RBI Deputy Governor T. Rabi Sankar claimed that India’s central bank digital currency can do anything cryptocurrencies can do.

The Indian government is also working on the country’s crypto policy. Earlier this week, the government provided Lok Sabha, the lower house of India’s parliament, with an update on its cryptocurrency bill that was scheduled to be discussed in the winter session of parliament last year.

Meanwhile, India’s finance minister, Nirmala Sitharaman, has shared that the government plans to discuss crypto regulations with the G20 countries to establish a technology-driven framework for crypto assets. Last month, she and U.S. Treasury Secretary Janet Yellen discussed crypto regulation during the ninth India-U.S. Economic and Financial Partnership meeting.

What do you think about the warning by India’s central bank governor about crypto causing the next financial crisis? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.