Cardano (ADA) is currently trading at a pivotal $0.291. The question is: Will ADA experience a 28% upswing or is a 23% drop on the horizon? Remarkably, the ADA price still remains in bearish territory, but the potential for a trend reversal is palpable.

Price Analysis: 4-Hour Chart

The 4-hour chart paints a picture of ADA trading just a smidge above the 23.6% Fibonacci retracement level, which stands at $0.286. Notably, on Monday, ADA briefly dipped below this level but was buoyed by the ascending trend line (black line) that was established in mid-June. This trend line is the bulls’ last stand; a breach could see a bearish descent to the year’s low of $0.22.

Adding another layer of complexity, the 200-EMA (blue line) on the 4-hour chart is converging towards the 23.6% Fibonacci level. ADA’s recent inability to surpass the 20-EMA (red line) is concerning. With the moving averages trending downward, a compression between $0.28 and $0.30 seems inevitable.

However, if ADA remains resilient above the 23.6% Fibonacci retracement level and the trendline, and manages to break the moving averages, especially the 200-EMA, then the bulls might just have a fighting chance.

In this scenario, the 38.2% Fibonacci at $0.319, the 50% Fibonacci at $0.346, and the 61.8% Fibonacci at $0.378 become the next logical targets. A daily close above $0.38 (July’s high) would be a clarion call for the bulls, marking a 28% rallye from the recent price.

Bullish Arguments for Cardano

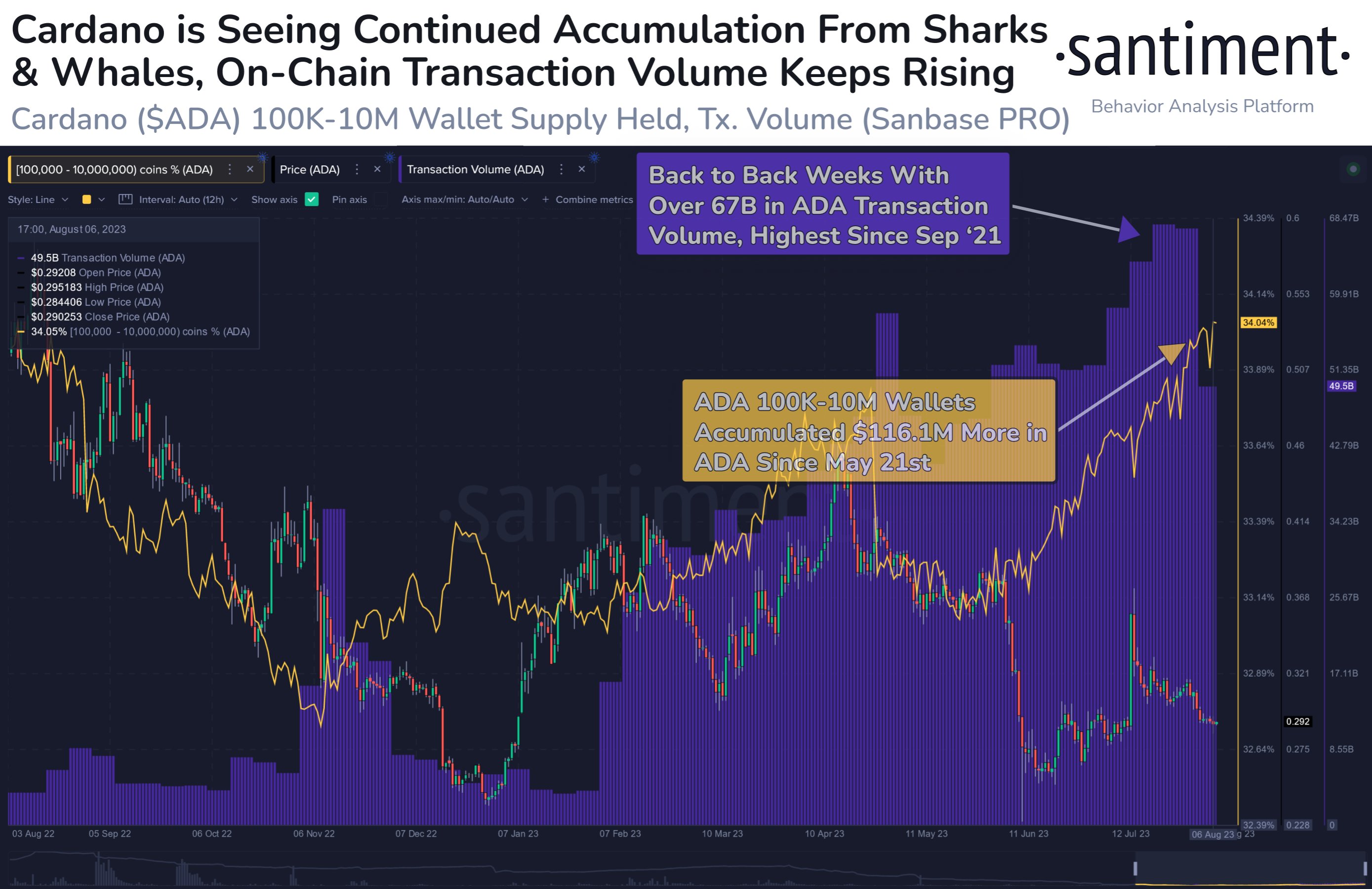

The recent price movements by Cardano might be bearish, but there are compelling arguments in favor of ADA’s potential resurgence. Santiment, a renowned analytics platform, recently tweeted:

As Cardano sits just above $0.29, whales and sharks holding between 100K-10M ADA have accumulated back to their highest level since September, 2022. Additionally, on-chain transaction volume has been rising nearly every week for the past 6 months.

This statement is supported by data indicating ADA’s transaction volume surged above a staggering 67 billion ADA in consecutive weeks, a peak not seen since September 2021. Such heightened network activity is often interpreted as a bullish sign, indicative of increased user engagement and interest.

Furthermore, ADA wallets holding between 100K-10M ADA now account for a significant 34.04% of all circulating tokens, suggesting strong confidence among larger investors.

Also, Messari’s recent report on Cardano offers more reasons for optimism. The report delves deep into Cardano’s ecosystem, financial trends, and network performance. One of the standout revelations is the surge in decentralized app (dapp) activities. For the third consecutive quarter, Cardano has seen a remarkable uptick in dapp transactions, boasting a 49.0% quarter-over-quarter increase in Q2, averaging 57,900 daily transactions.

State of @Cardano Q2 2023

With a dedicated community of users and developers, Cardano has demonstrated staying power.

In Q2, average daily dapp transactions were up 49%, TVL up 10%, and 199% YTD.@redvelvetzip dives in. https://t.co/MNhyNJvIPq

— Messari (@MessariCrypto) August 4, 2023

Featured image from Coinbase, chart from TradingView.com