Bitcoin news for traders and investors is showing positive signs as the cryptocurrency managed to stay above critical levels. The current trading environment remains uncertain as sideways price action persists, but new data points to potential gains.

As of this writing, Bitcoin trades at $27,700 with sideways movement in the last 24 hours. On higher timeframes, the cryptocurrency records profits; the previous week, BTC experienced a 4.4% rally, according to data from Coingecko.

Bitcoin News And Data Point To Favorable Price Action?

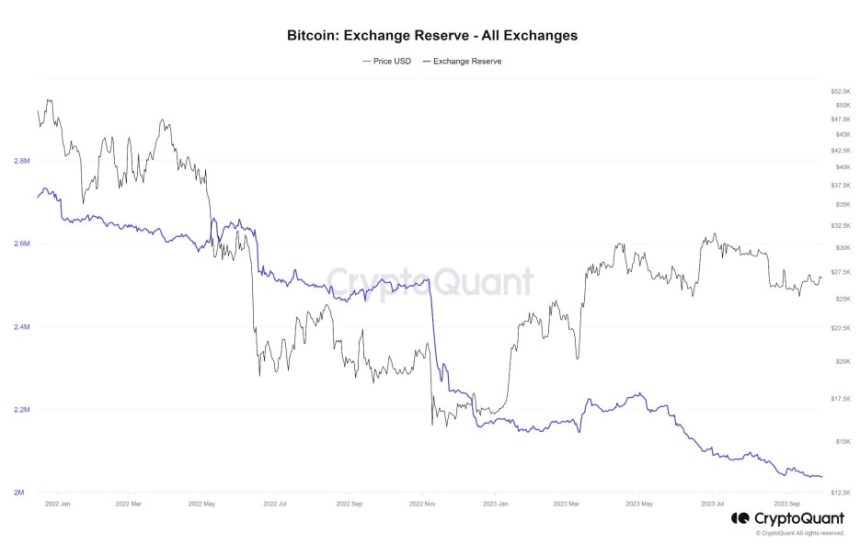

A report from Bitfinex Alpha indicates that the current Bitcoin supply on exchanges has been dropping since May 2023. This metric stands at its lowest in five years, or since 2018, when the price of Bitcoin was in the early stages of a new investment cycle.

The report indicates around 2.03 million BTC on crypto trading venues, as seen in the image below. The decline of BTC supply in the market represents good Bitcoin news due to its potential to ignite another bull market. The report claims:

As the bull market began to take off, reserves on exchanges dropped, as crypto prices soared. This seemed to imply that as investors moved their Bitcoin off exchanges, its scarcity on the platform might have driven its price up.

The chart above also shows that the cryptocurrency’s price reacts to spikes in BTC supply on crypto exchanges. Each bull market has its peculiarities, but they all need a decline in supply to enter price discovery.

Moreover, the report points out that a minority of long-term investors capitulated during this crypto winter. These investors continue to hold their coins and exert a more significant influence on the supply/demand dynamics as short-term investors get shaken off the market.

Less Selling Pressure For Bitcoin

The status quo in the Bitcoin market continues to evolve, and recent data points to a potential change in short-term holders. The Coin Days Destroyed (CDD) metric, used to measure supply/demand dynamics, indicates that both long-term and short-term holders are more inclined to hold “their Bitcoin holdings for longer periods of time.”

Furthermore, the new market dynamics hint at the formation of the early stages of a bull market. The report stated:

The 12-18 month supply holders are now in a position to make a profit on some of their holdings. While this is normal for early bull markets, it is key to note that long term holder supply remains inactive and even short-term holder supply that has been acquired mostly during the bear market at sub $20,000 price or even early 2023 at slightly higher prices remains inactive. This shows investor confidence across multiple cohorts (…).

Cover image from Unsplash, chart from Tradingview