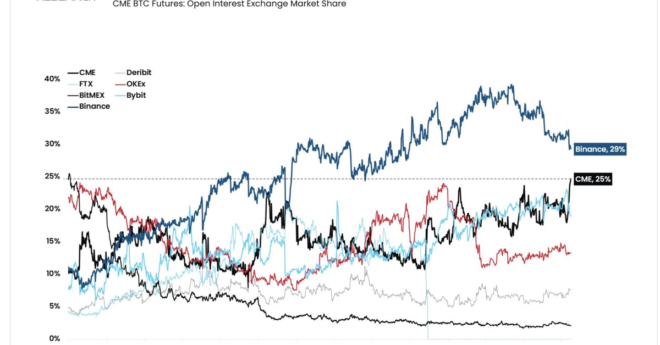

The breakout above the $31,800 resistance level coincided with a drop in open interest, a metric that assesses the notional value of all derivatives positions, across crypto exchanges, according to Coinalyze data. The decline, which reflects retail investor interest, contrasts with open interest on the Chicago Mercantile Exchange (CME), a venue favored by institutions, topping 100,000 bitcoin ($3.4 billion) for the first time.

BTC Drive by Institutions Sends Open Interest on Chicago Mercantile Exchange to Record High