Avalanche, the fourth-generation proof-of-stake (PoS) blockchain, incurs significant costs to incentivize its validators. Token Terminal data on December 7 shows that in the past year, the smart contract platform paid over $275 million in AVAX to compensate its validators despite generating only $11.5 million in user fees.

Avalanche Is Paying A Premium To Incentivize Validators

Although it appears that Avalanche is paying a premium for validators, this is critical in securing the network and ensuring all transactions are confirmed. Overall, and being a proof-of-stake network reliant on node operators for security and decentralization, Avalanche’s decision to pay validators a premium is, as its users demand, to maintain a robust network of nodes.

According to CoinMarketCap data, the network has a market cap of over $9.8 billion. It is currently in the top 10 by liquidity, surpassing Polygon and Polkadot, competing low-fee alternatives. As it is, by incentivizing validators with generous rewards, Avalanche ensures that there is a strong pool of nodes available to maintain the network’s operation.

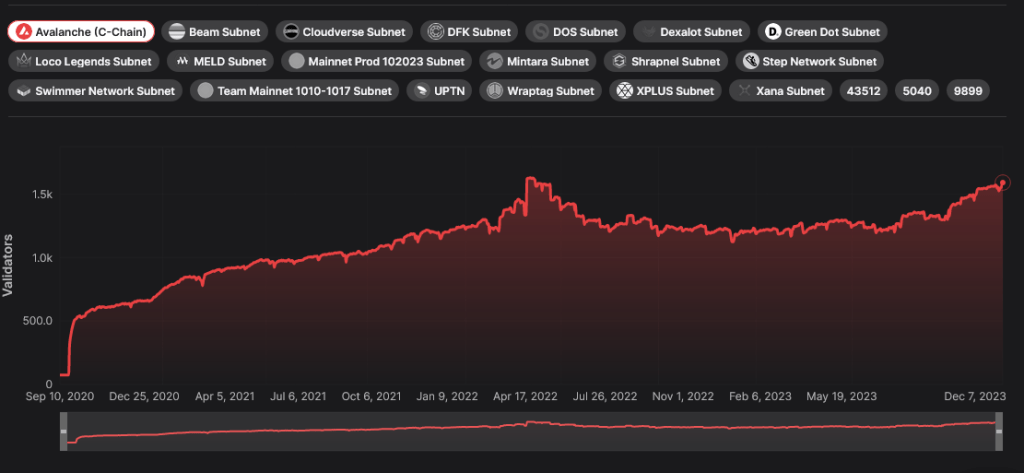

Through these validators, AVAX holders can stake and receive rewards. As of December 7, there are over 1,539 validators currently staking over 248 million AVAX and earning 7.84% APY. At the same time, statistics show that Avalanche has a staking ratio of 57.11%. Most AVAX in circulation are used to secure the network at this level.

While AVAX incentivization might draw more validators, Avalanche documentation also states that the network doesn’t require complex hardware to operate a node. At the same time, the blockchain, unlike Ethereum, states that staked AVAX is not at risk of being slashed–or penalized by the network–provided all network requirements are met. This feature could explain the steady rise in validator count over the past three years.

AVAX Is Up By 200%, Trading At 2023 High

While Avalanche grows its validator count, AVAX prices have also been expanding steadily, mirroring the general market. Thus far, AVAX is changing hands above $26, up over 200% in the last three months. At spot rates, AVAX is trading at new 2023 highs and in a bullish breakout formation, looking at price action in the daily chart.

Related Reading: Apollo Crypto Predicts Bitcoin Price Of $200,000 This Cycle, Here’s Why

Looking at how AVAX is, bulls might break above $30. If the accompanying surge is with expanding trading volume, it might be the base for another leg up that might lift the coin toward $90 or higher in the sessions ahead. When AVAX peaked in 2021, it rose to as high as $145.

Feature image from Canva, chart from TradingView