This analysis delves into the Ripple (XRP) price prediction, offering insights into its potential growth and the factors that could shape its journey in the coming years.

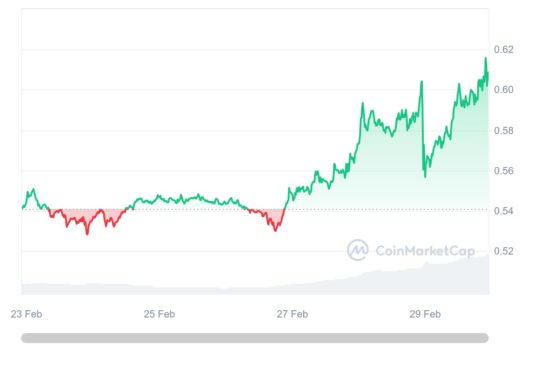

Recently, Ripple (XRP) has seen a significant resurgence, with a 10% rally over the past week pushing its price close to over $0.61.

Over the past year, XRP has seen an impressive gain of more than 70%, from $0.35 levels in Mar. 2023 to $0.59 as of March 1. However, it still trades far below its all-time high of $3.84, achieved in Jan. 2018.

Adding to Ripple’s momentum was a partial legal victory against the U.S. Securities and Exchange Commission (SEC). The ruling in Jul. 2023 found that Ripple did not violate federal securities laws by selling its XRP token on public exchanges.

Ripple Labs has also been expanding its global partnerships and has made strides in the United Kingdom, Australia, and Africa, aiming to facilitate cross-border payment channels for numerous countries.

Amid this, the potential for a Ripple IPO in 2024, while not confirmed, adds an interesting dimension to the narrative. A successful IPO could serve as a major catalyst for XRP’s price.

Let’s explore what these developments could mean for Ripple’s future and how they might impact Ripple’s price prediction in the future.

Latest developments affecting Ripple coin price prediction

Ripple vs. SEC

The legal battle between Ripple Labs and the SEC has seen significant developments and is poised for key moments in 2024.

Initiated in Dec. 2020, the SEC accused Ripple of conducting a $1.3 billion unregistered securities offering through the sale of XRP, a digital asset created by Ripple’s founders in 2012.

The core of the dispute lies in whether XRP sales should be classified as securities transactions, which would require registration with the SEC.

A turn in the case came in Jul. 2023, when U.S. District Judge Analisa Torres ruled that retail sales of the XRP token were not securities transactions, although institutional sales did qualify as such, leading to a partial victory for Ripple Labs.

Furthermore, the case has seen Ripple pushing back against the SEC’s allegations, emphasizing the need for regulatory clarity in the crypto industry.

Ripple argued that the SEC’s broad application of securities law to XRP was unfair, especially considering the commission’s previous stance on other cryptocurrencies like Ethereum (ETH), which was deemed decentralized and thus not a security.

As of early 2024, the case has moved into the remedies phase, with critical deadlines set from Feb. to Apr. 2024 for both parties to present their arguments and evidence regarding the appropriate remedies for any violations that might be determined.

Amid all these developments, the SEC has sought an alteration to the deadlines for remedies briefing, suggesting further twists and turns.

Ripple’s potential IPO

The potential for a Ripple IPO has been a topic of significant interest within the crypto circles, especially following Ripple CEO Brad Garlinghouse’s past statements about the possibility of going public once the company’s legal battles with the SEC conclude.

Despite these aspirations, Ripple’s plans for the U.S. IPO have been put on hold due to ongoing legal issues with the SEC, with Garlinghouse highlighting the regulatory body’s “hostile” stance as a major impediment.

The CEO has criticized SEC chair Gary Gensler for acting as a “political liability” and not in the economy’s interest, pointing out the challenges of going public under such regulatory scrutiny.

However, there remains optimism within the company and among analysts about Ripple’s future prospects for an IPO.

Ray Fuentes, Community Director at Linqto, a private equity platform, expressed optimism during an interview, suggesting 2024 as a favorable year for Ripple to consider going public, owing to expected improved market conditions and liquidity.

Ripple’s potential ETF

The anticipation around a Ripple ETF has been growing, with various industry insiders and experts weighing in on the possibility and timing of such a launch.

A former Ripple director hinted at the potential for an XRP ETF to emerge in either 2024 or 2025, alongside predictions for a Ripple IPO outside the U.S. by 2025.

Recently, Ripple CEO Brad Garlinghouse’s interview with Bloomberg on Feb. 20 reignited discussions surrounding an XRP ETF.

Garlinghouse cautiously expressed openness to the concept while refraining from divulging concrete plans, leaving room for speculation.

Speculation further intensified following rumors suggesting potential collaborations between Ripple and major asset management firms like BlackRock.

Notably, in Nov. 2023, a leaked filing hinted at BlackRock’s interest in an XRP ETF, fueling market excitement. However, subsequent clarifications debunked these rumors, leaving the possibility of such partnerships uncertain.

Ripple’s technologies adoption

Ripple’s unique technology and its adoption by financial institutions play a crucial role in its price potential. The more Ripple’s technology is adopted for cross-border payments, the higher the likelihood of an increase in its value. This adoption rate is a key component of the ripple XRP forecast.

Here are just a few core partnerships Ripple concluded in 2023. In November, Ripple revealed an enhanced version of its cross-border payment solution, now known as Ripple Payments. This revamped platform aims to facilitate the integration of blockchain technology into the services of web2 companies.

Another notable collaboration is with African payments company Onafriq, using Ripple’s technology to enable faster and cheaper remittances into Africa. Ripple also unveiled an upgraded version of its cross-border payment solution, Ripple Payments, to help web2 companies integrate blockchain into their services.

Adding to Ripple’s momentum, the Dubai Financial Services Authority granted XRP the distinction of being the first virtual asset authorized for use within the Dubai International Financial Center on November 2. This approval places XRP alongside other established cryptocurrencies like Bitcoin, Ethereum, and Litecoin, enabling licensed firms in the DIFC to provide services using XRP.

Furthermore, Ripple made headlines on the same day with the announcement of its collaboration with the National Bank of Georgia. The partnership will see Ripple’s Central Bank Digital Currency (CBDC) platform being employed in a pilot program to explore the potential applications and advantages of a digital version of the Georgian Lari. This initiative marks a significant step in Ripple’s expansion and adoption in global financial systems.

Ripple crypto price prediction: short-term view

Several platforms have offered XRP price predictions for the short term, based on their analysis of the crypto market.

According to data provided by Changelly, on Mar. 11, the price of XRP is expected to reach $0.77, suggesting a potential increase of over 36% from the current levels. However, by Mar. 29, the forecasted price stands at $0.600370, suggesting a decline.

Meanwhile, Coincodex has also offered Ripple price forecasts, with almost similar predictions. They suggest that on Mar. 12, the price of XRP could hit $0.802223, signaling a potential increase of over 32%. By Mar. 30, they anticipate the price to reach $0.61, indicating a decline.

Approach these predictions with caution, understanding that the crypto market is highly volatile and subject to rapid changes. While such forecasts can provide insights, they should not be considered guarantees of future performance.

Ripple price prediction: long-term view

According to DigitalCoinPrice, Ripple price prediction for 2024 stands at $1.27, marking a notable increase from its current valuation.

Looking further into the future, DCP anticipates a gradual rise, forecasting Ripple price prediction for 2025 to reach $1.47.

The long-term outlook extends to 2030, where DCP suggests a significant surge, with Ripple potentially hitting $4.41.

In contrast, CoinCodex offers a slightly different perspective. For 2025, the platform’s projections range from a low of $0.414752 to a high of $1.694221.

Looking even further ahead to Ripple price prediction for 2030, CoinCodex provides a wider range, with estimates ranging from $0.497556 to $2.03.

Cryptocurrency markets are notoriously volatile, subject to sudden shifts and external influences that can defy even the most well-informed predictions.

Exercise prudence, conduct thorough research, and diversify your portfolios to mitigate risks associated with cryptocurrency investments. Always remember the golden rule of investing: never invest more than you can afford to lose.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

FAQs

Is XRP a good investment?

Whether XRP is a good investment depends on various factors, including individual risk tolerance, investment goals, and market dynamics. XRP has shown potential due to its unique technology and partnerships in the financial sector. However, like any cryptocurrency, it comes with risks, especially considering its ongoing legal challenges and market volatility.

Will Ripple price rise?

The potential for Ripple’s price to rise is subject to several influencing factors, including the outcome of its legal battles, adoption rate by financial institutions, and overall market trends. Positive developments in these areas could lead to a price rise. However, investors should remain aware of the inherent uncertainties and risks in the cryptocurrency market.

How high can Ripple go?

Predicting how high Ripple can go is challenging due to the volatile nature of the cryptocurrency market. Increased adoption, technological advancements, and favorable regulatory outcomes could significantly boost Ripple’s value. Historical data, expert analyses, and market trends can offer some guidance, but absolute certainty is impossible in crypto.

How to buy Ripple (XRP)?

To buy Ripple XRP, follow these steps:

— Choose a cryptocurrency exchange that lists XRP.

— Create an account on the exchange.

— Complete any required verification processes.

— Deposit funds into your account, either with fiat currency or another cryptocurrency.

— Purchase XRP using the deposited funds.

— Store your XRP in a secure wallet, either provided by the exchange or a personal digital wallet for added security.