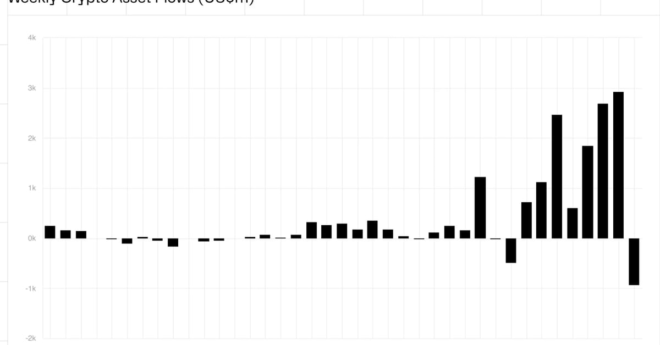

“We believe the recent price correction led to hesitancy from investors, leading to much lower inflows into new ETF issuers in the U.S., which saw $1.1 billion inflows,” said CoinShares. “Partially offsetting incumbent Grayscale’s significant $2 billion outflows last week.”

Record $1B Exited Crypto Funds Last Week: CoinShares