State Street is partnering with digital asset custodian Taurus for its tokenization plans with the intention of extending to crypto custody once the U.S. regulatory environment improves. State Street, which has $44.3 trillion in assets under management, plans to go live with tokenized versions of traditional assets. The bank has been “very vocal” about the need to change SAB 121, which could force banks seeking to hold crypto to maintain an onerous amount of capital to compensate for the risk, Donna Milrod, chief product officer and head of Digital Asset Solutions, said in an interview. “While we’re starting with tokenization, that’s not where we’re ending. As soon as the U.S. regulations help us out, we will be providing digital custody services as well.”

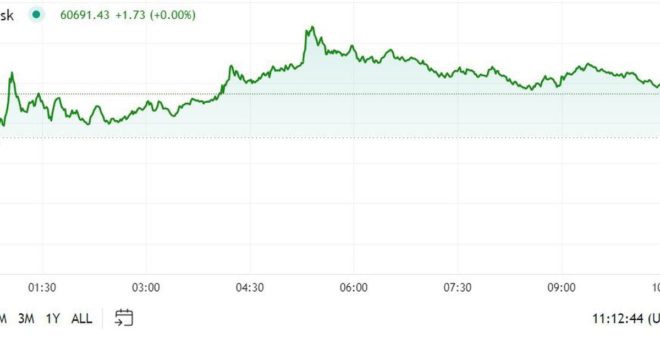

Bitcoin Returns to $61K, Outperforms Broader Crypto Market