Key Notes

- Bitcoin accounts for $738.83 million in liquidations, double Ethereum’s losses, marking the fourth-worst day in three months.

- Long positions bore the brunt with $1.24 billion wiped out as traders faced margin calls across major exchanges.

- Analysts including Michael Burry warn Bitcoin could drop to $50,000, replicating its 2021-2022 collapse pattern.

The cryptocurrency market is in a downfall and crypto liquidations have already surpassed $1.45 billion in the last 24 hours, making it the fourth-worst day in the past three months by 24-hour liquidation size.

As of this writing, over 311,000 traders saw their positions being flushed out, with the largest single liquidation coming from the BTC/USDT pair on Hyperliquid’s competitor, Aster, for $11.36 million in nominal value. Coinspeaker retrieved this data from CoinGlass on February 5 at 5:30 p.m. UTC.

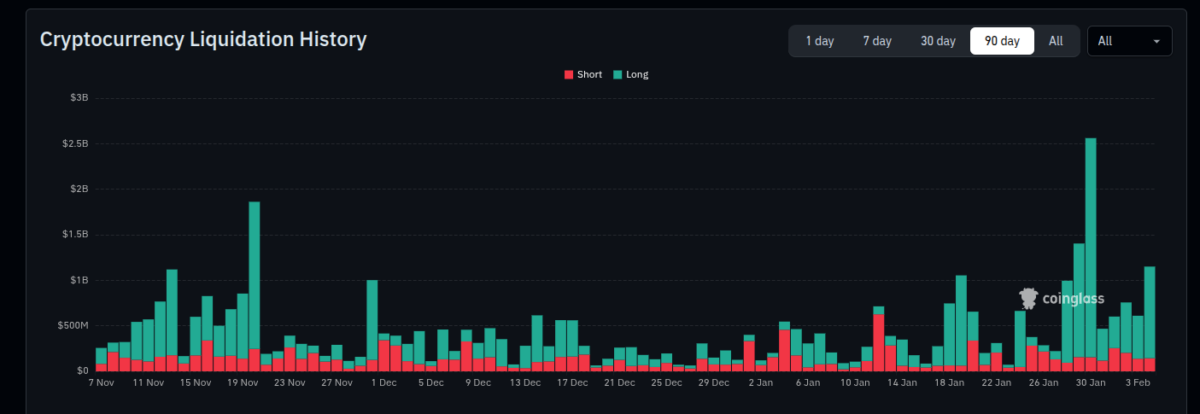

Liquidation heatmap and total liquidations as of February 5, 2026 | Source: CoinGlass

Long positions were the most affected ones, accounting for $1.24 billion out of the $1.45 billion recorded so far. Bitcoin

BTC

$65 464

24h volatility:

10.7%

Market cap:

$1.31 T

Vol. 24h:

$116.43 B

leads the liquidations by a large margin, totaling $738.83 million—two times more than Ethereum

ETH

$1 925

24h volatility:

9.1%

Market cap:

$233.45 B

Vol. 24h:

$55.96 B

at $337.45 million in second place. Solana

SOL

$81.66

24h volatility:

10.2%

Market cap:

$46.38 B

Vol. 24h:

$9.89 B

has the third-largest liquidations at $77.28 million.

Notably, most of the liquidation events happened in the last 12 hours as this data approaches $1 billion. $646 million were liquidated in the last 4 hours alone and $85 million in the past hour of this data collection.

A historical chart from CoinGlass shows this as the fourth-largest daily liquidation event in the last 90 days, only losing to data from January 29, November 20 (2025), and January 30, in order.

Cryptocurrency liquidation history (90D), as of Feb. 5, 2026 | Source: CoinGlass

Analysts Warn of Further Downside as BTC, ETH, SOL Plunge

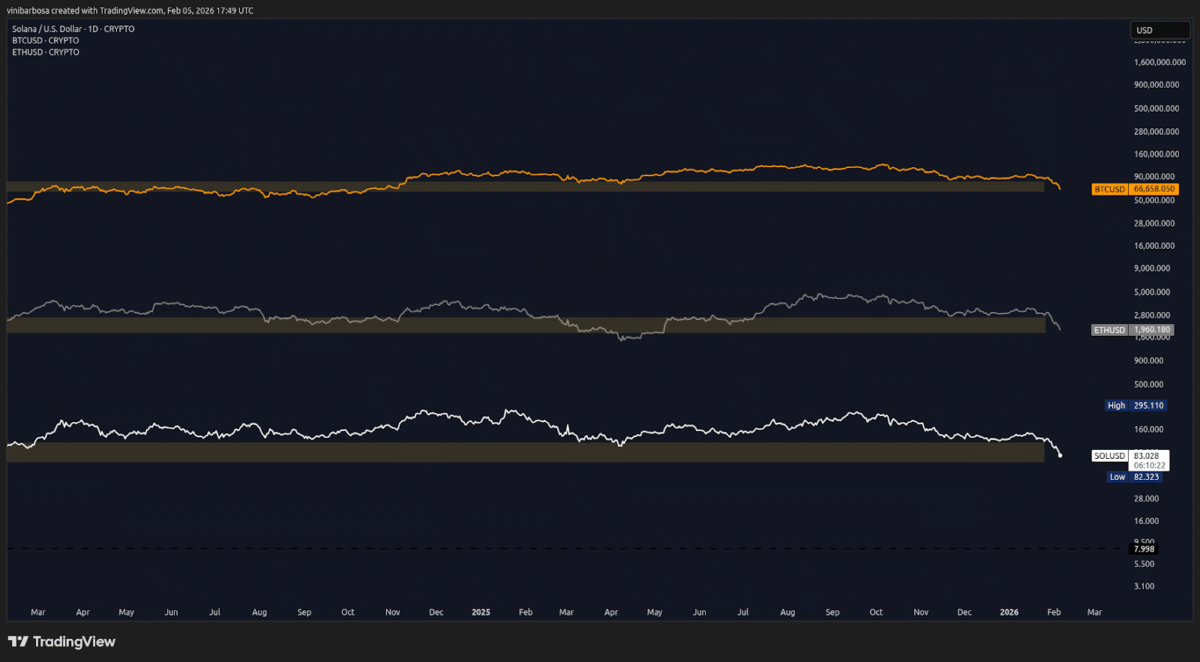

All three cryptocurrencies with the largest recorded liquidations today have lost important price support levels during this crash caused by a long squeeze. They have now entered bear market territory and could visit lower levels in the following days and weeks if they do not recover from this fall. A recovery would mark a chart deviation and invalidate the bearish landscape.

Precisely, BTC was trading at $66,650, ETH at $1,960, and SOL at $83 per coin and tokens.

Bitcoin, Ethereum, and Solana 1D price charts, as of February 5, 2026 | Source: TradingView

Michael Burry, known for predicting the 2008 crisis, warns Bitcoin could replicate its 2021-2022 collapse pattern, potentially dropping to $50,000 or lower, as Coinspeaker reported. Meanwhile, the Bitcoin analyst known as PlanB highlighted four possible bear market scenarios that could play out in the following days.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.