New analysis published Wednesday by the Federal Reserve proposes that crypto be categorized as a distinct asset class for initial margin requirements used in “uncleared” derivatives markets, including over-the-counter trades and other transactions that do not pass through a centralized clearinghouse.

The working paper said that is because crypto is more volatile than traditional asset classes and does not fit into the risk categories outlined in the Standardized Initial Margin Model (SIMM) that classifies asset classes.

These include interest rates, equities, foreign exchange and commodities, according to authors Anna Amirdjanova, David Lynch and Anni Zheng.

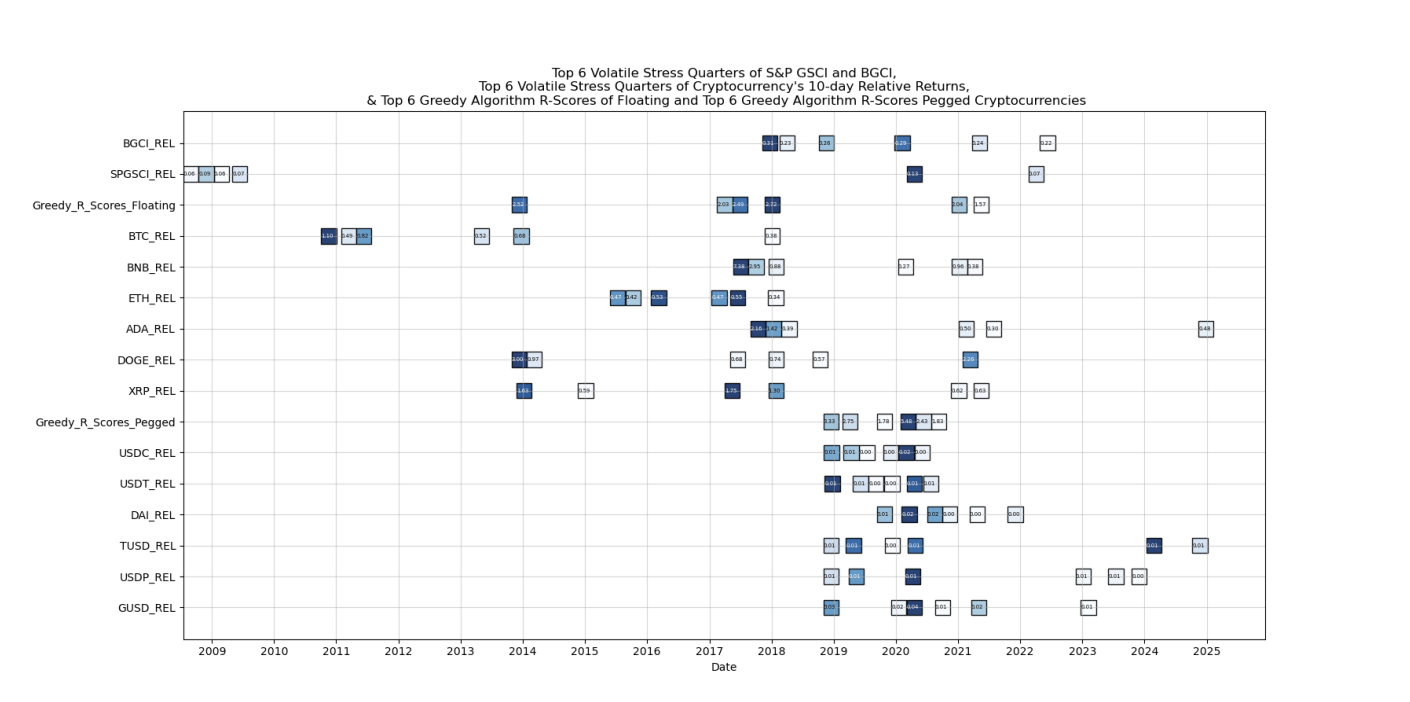

The trio propose a distinct risk weighting for “floating” cryptocurrencies, including Bitcoin (BTC), Binance (BNB), Ether (ETH), Cardano (ADA), Dogecoin (DOGE), XRP (XRP), and “pegged” cryptos like stablecoins.

A benchmark index equally divided between floating digital assets and pegged stablecoins could also be used as a proxy for crypto market volatility and behavior, they said.

The performance and behavior of the benchmark index could then be used as an input to more accurately model “calibrated” risk weights for crypto, according to the authors.

Initial margin requirements are critical for derivatives markets, where traders must post collateral to ensure against counterparty default when opening a position. Crypto’s higher volatility means traders must post more collateral as a buffer against liquidation.

The working paper proposal reflects the maturation of crypto as an asset class and how Federal authorities in the United States are prepping regulatory frameworks to accommodate the growing sector.

Related: Hong Kong greenlights crypto margin financing and perpetual trading

Fed clears the way for banks to engage with crypto

In December, the central bank reversed its previous guidance, first issued in 2023, which limited US banks’ engagement with cryptocurrencies.

“Uninsured and insured banks supervised by the Board will be subject to the same limitations on activities, including novel banking activities, such as crypto-asset-related activities,” the Fed’s 2023 guidance said.

The Federal Reserve also proposed the idea of giving crypto companies access to “skinny” master accounts, bank accounts that have direct access to the central banking system but have fewer privileges than full master accounts.

Magazine: Meet the Ethereum and Polkadot co-founder who wasn’t in Time Magazine