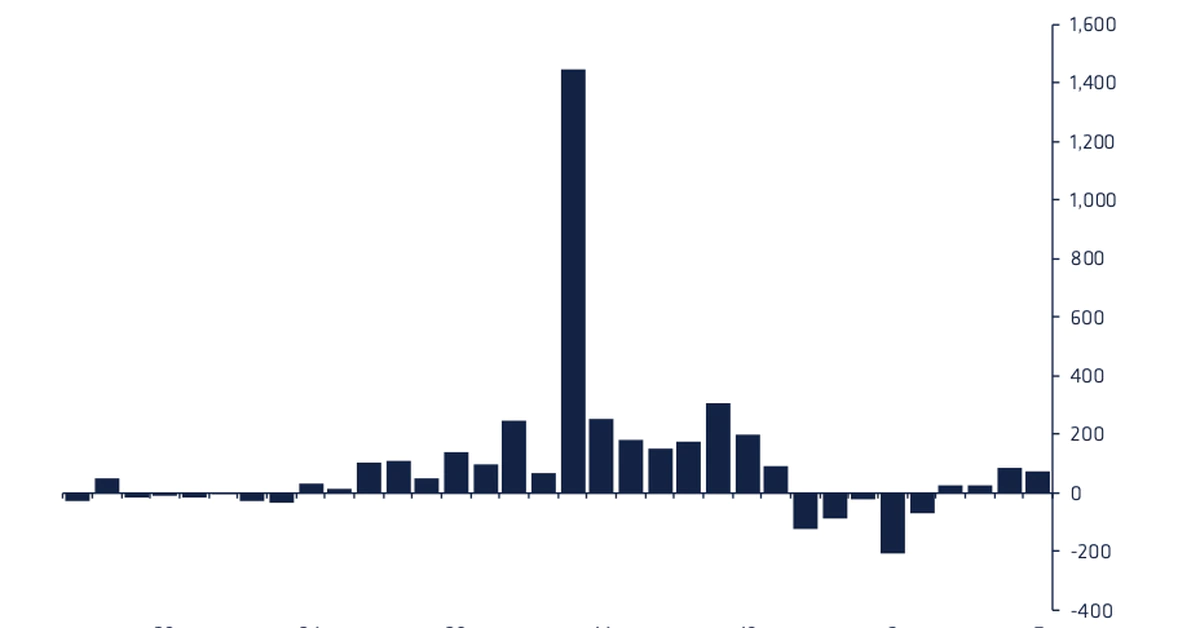

Some $75 million went into digital-asset funds last week as ether funds saw their first inflows in 10 weeks. Source

Day: February 14, 2022

Are we misguided about Bitcoin mining’s environmental impacts? Slush Pool’s CMO Kristian Csepcsar explains

It’s a controversial topic in the blockchain community that comes up from time to time — just how much impact Bitcoin (BTC) mining has on the environment. Last year, Tesla’s CEO Elon Musk brought forth a sharp correction in the cryptocurrency market by tweeting that his namesake car company would abandon plans to accept BTC, citing “rapidly increasing use of fossil fuels for Bitcoin mining and transactions.” However, a recent report published by CoinShares notes that despite the widespread use of coal, oil, and gas for Bitcoin mining, the network…

*URGENT* IF YOU HOLD BITCOIN, WATCH THIS VIDEO RIGHT NOW!!!!!!!!!!! BTC Price Prediction Analysis

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io This Bitcoin and Cryptocurrency trading analysis applies to various exchanges, including Bybit and Binance. Tackling questions like if Bitcoin can reach all time highs again or how low BTC will crash. Things like the lightning network have provided huge improvements for BTC and while it is true that others like Roger Ver with Bitcoin Cash (bcash) may disagree, I do see these blockchain technology innovations to be very bullish fundamental signs for the space. ⚡️𝗢𝗙𝗙𝗜𝗖𝗜𝗔𝗟 𝗙𝗢𝗥𝗙𝗟𝗜𝗘𝗦 𝗖𝗛𝗔𝗡𝗡𝗘𝗟𝗦 (𝗧𝗘𝗟𝗘𝗚𝗥𝗔𝗠/𝗪𝗘𝗕𝗦𝗜𝗧𝗘)⚡️ 🚀 Forflies GOLD: 🚀…

Exchange Whale Ratio Spikes Up

On-chain data shows the Bitcoin exchange whale ratio has spiked up recently, a signal that shows dumping may be going on in the market. Bitcoin Exchange Whale Ratio Surges Up As Price Declines As pointed out by an analyst in a CryptoQuant post, the BTC exchange whale ratio has risen to very high values recently. The “exchange whale ratio” is an indicator that measures the ratio between the sum of the top 10 transactions to exchanges and the total amount of Bitcoin moving into exchanges. In simpler terms, this metric…

Ether investment products register first weekly inflows in 10 weeks

Inflows into cryptocurrency investment funds rose sharply last week, with Ether (ETH) products breaking a nine-week spell of outflows in the latest sign that institutional managers were re-accumulating assets. Digital asset investment products registered $75.3 million worth of cumulative inflows last week, data from CoinShares revealed Monday. Bitcoin (BTC) investment products saw $25.1 million worth of inflows, while Ether products attracted $20.9 million worth of capital. Positive inflows were also reported for multi-asset funds with exposure to several cryptocurrencies. Solana (SOL), Polkadot (DOT) and Ripple (XRP) products were also net…

Price analysis 2/14: BTC, ETH, BNB, XRP, ADA, SOL, LUNA, DOGE, AVAX, DOT

BTC price continues to consolidate, a process that gives altcoin traders the opportunity to range trade and secure short-term gains. Bitcoin (BTC) is attempting to form a higher low as investors take advantage of lower levels to accumulate. Twitter user PlanC recently highlighted that the balance of addresses having at least two significant incoming transactions but no outgoing transactions has soared to a 57-month high. However, not everyone is bullish on the future prospects of Bitcoin. Popular analyst Ari Rudd presented three long-term technical setups, which point to further downside…

Why You Should Curb Your Enthusiasm About the 'Crypto Bowl'

CoinDesk culture reporter Will Gottsegen ranks the Super Bowl crypto ads from worst to best. Source

MINA Monday’s Big Gainer, CRO Lower Despite Crypto.com’s LeBron Ad – Market Updates Bitcoin News

In what has been a volatile day of trading, MINA is one of the biggest gainers in crypto to start the week. In addition to this, crypto.com coin (CRO) was in the red, despite pulling out all the stops in a Super Bowl ad that featured LeBron James. Biggest gainers A week to the day, SHIB was the biggest gainer in the crypto top 100, climbing by as much as 50% in the process, although, today’s bull has risen by less than 10%. Crypto markets have been lower in recent…

States’ crypto rights and the influx of digital money into analog politics, Feb. 7–14.

Several storylines that had been long in the making dominated last week’s news cycle in the cryptocurrency policy and enforcement department. The Russian government has made another huge step on the path toward creating a tailored regulatory framework for digital assets, unveiling its consolidated view that crypto is to be treated as currency rather than swept under the rug of a blanket ban. While this movement in the direction of crypto’s formal legitimization is a welcomed development, a host of questions persists related to both the exact shape of the…

68% of investment execs think clients shouldn’t own cryptocurrency

A Bitcoin ATM is seen inside a gas station in Los Angeles on June 24, 2021. CHRIS DELMAS | AFP | Getty Images Roughly 2 out of 3 “fund selectors” don’t think individual investors should own cryptocurrency in their portfolios, largely for reasons related to transparency and regulation, according to a Natixis Investment Managers survey. Fund selectors at brokerage houses, financial advisory shops, private banks and other institutions analyze and choose the investments their firms offer customers. Sixty-eight percent don’t think individuals should have access to crypto, according to the…