Este artículo también está disponible en español. Solana (SOL) has long been regarded as one of the top-performing cryptocurrencies in the market, boasting incredible growth in the past 11 months. However, with the recent emergence of Mpeppe (MPEPE), a new AI-powered gambling memecoin, Solana (SOL) investors are beginning to diversify their portfolios. Despite Solana’s (SOL) success, many of its investors are choosing to double down on Mpeppe (MPEPE) in anticipation of its massive growth potential. Solana’s (SOL) Recent Performance and Concerns Solana (SOL) has recently experienced two consecutive red candles,…

Tag: Investors

Binance CEO Richard Teng: Exchange Sees 40% Rise in Institutional Investors This Year

CoinspeakerBinance CEO Richard Teng: Exchange Sees 40% Rise in Institutional Investors This Year Binance CEO Richard Teng announced a 40% rise in institutional and corporate investors on the platform this year. He shared this achievement during an interview with CNBC on September 18, 2024. Teng noted that this jump in institutional interest is “just the beginning,” as many firms are still conducting research before fully entering the crypto market. Even with ongoing regulatory challenges, Binance has managed to attract major investors, highlighting the company’s strategic shift under Teng’s leadership. Since…

Family Offices Investors Summit: The $100M Club Bets on Liquid Token, AI, and Gaming in Pivot to Alternative Investments

The Asia-Pacific region is expected to lead global growth in family office wealth, Manana Samuseva, founder of FOIS, told CoinDesk. Source

Cant FET Keep Up With Investors Demands, GoodEGG (GEGG) Rallies 191%

Este artículo también está disponible en español. As the crypto market evolves, new trends and opportunities continue to captivate investors. One of the most talked-about coins in the Artificial Intelligence (AI) and blockchain space is the Artificial Superintelligence Alliance (FET). However, the spotlight is slowly shifting towards GoodEgg (GEGG), a meme AI-powered dating cryptocurrency, which has rallied by a staggering 191% within days of its presale launch. This article explores the recent surge in GEGG’s popularity and whether FET can keep up with investor demand. Artificial Superintelligence Alliance: A Steady…

Key Reasons Why Sui Investors Are Buying New Casino ICO Mpeppe (MPEPE)

Este artículo también está disponible en español. The cryptocurrency market is always on the lookout for new opportunities, and Sui (SUI) has been a standout in recent months, attracting a large number of investors with its strong performance and technological advancements. However, despite Sui’s stellar growth, many of its investors are now looking at another promising token — Mpeppe (MPEPE), a new casino-focused ICO. There are several reasons why Sui investors are jumping on the Mpeppe bandwagon, and in this article, we’ll explore those factors and why Mpeppe might be…

SHIB Shark Says Early Investors at $0.00015 Can Double Their Fortune, Market Responds Positively

Este artículo también está disponible en español. The cryptocurrency market is no stranger to volatility, especially when it comes to memecoins like Shiba Inu (SHIB). Once dubbed the “Dogecoin Killer,” SHIB enjoyed its time in the spotlight, gaining millions of loyal supporters and a significant market cap. However, despite these successes, Shiba Inu (SHIB) now faces increasing pressure from new tokens, particularly those with more utility and real-world applications. A key example is GoodEgg (GEGG), a new AI-powered social dating platform that is turning heads in the crypto space. Recently,…

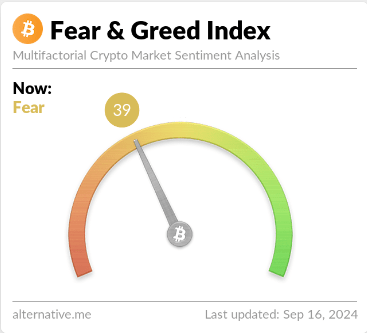

Bitcoin Investors Succumb To Fear As BTC Erases $60,000 Weekend Recovery

Este artículo también está disponible en español. Data shows that the sentiment of the Bitcoin market has switched to fear after the retrace. BTC has seen a $58,000 level during the past day. Bitcoin Fear & Greed Index Is Pointing At ‘Fear’ Now The “Fear & Greed Index” is an indicator created by Alternative that tells us about the general sentiment among the investors in the Bitcoin and the wider cryptocurrency market. Related Reading Market sentiment can be helpful to follow as it can reflect the cryptocurrency’s price. It sometimes…

Analyst Sounds Warning For Bullish Investors, Says Solana Will Crash 42% To $80

Solana has gotten a bearish warning despite being one of the best performers over the last year. This prediction goes against the grain of current speculation where a rise to as high as $1,000 has been forecasted for the price. But it seems not everyone shares this sentiment as one crypto analyst has predicted that the auction’s price could suffer a massive 42% crash from here. Solana Price Turns Bearish In an analysis on the TradingView website, crypto analyst Alan Santana has warned that the Solana price is turning bearish.…

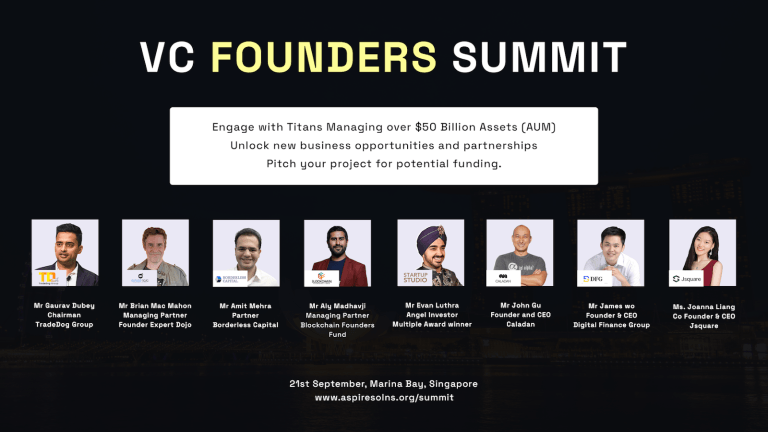

VC Founders Summit: The Largest Convergence of Investors and Founders Set to Take Place in Singapore

PRESS RELEASE. [Singapore, 2024] – The much-anticipated VC Founders Summit is set to take place on September 21st, bringing together venture capitalists, industry leaders, and innovators to shape the future of investment and entrepreneurship. As a dynamic side event of the renowned Token2049 conference, and coinciding with the excitement of Singapore Formula One Week, this […] Source CryptoX Portal

3 Reasons Why Solana Investors Are Adding GoodEgg To Their Long-Term Investment Strategy

Este artículo también está disponible en español. Solana (SOL) has been a dominant force in the cryptocurrency world for years, and its investors are known for making smart, long-term decisions. Recently, a growing number of Solana (SOL) investors have been adding GoodEgg (GEGG) to their portfolios, recognizing the potential for significant gains in the coming months and years. Here are three key reasons why Solana (SOL) investors are making the switch to GoodEgg (GEGG). 1. Diversification with High Growth Potential One of the primary reasons Solana (SOL) investors are turning…