Ucrania comenzó a aceptar criptomonedas como medio de donación el 26 de febrero, cuando las tropas rusas entraron en territorio ucraniano en una “operación militar especial”. El país está aceptando donaciones en bitcoin, ether, USDT y los tokens DOT de Polkadot. Source

Day: March 2, 2022

Bitcoin Climbs to $45K Early Wednesday Before Quickly Retreating

Trudging about in the $43,500 area at 13:45 UTC, bitcoin quickly jumped to above $45,000 for the first time since February 10, but if you blinked you missed it. Within seconds, the price had fallen back to $44,100. At the time of writing, it’s changing hands at $44,300. Original

Lucrosus Capital CEO Piotr Barbachowski Explains the Benefits of Decentralized Venture Capital – Interview Bitcoin News

Lucrosus Capital is the first gamified Decentralized Venture Capital (DeVC) providing institutional benefits to individual investors through its own token. Tokenization allowed this project to truly make investing decentralized. Due to the application of unique blockchain features, investments will be accessible with basically no threshold as well as will be anonymous. Everyone who holds the $LUCA token will be able to take advantage of utilities like direct and indirect exposure on investments made by Lucrosus Capital. Piotr Barbachowski is the Founder and CEO of Lucrosus Capital. He recently joined the…

DCG announces $250M share repurchase for Grayscale products

Grayscale parent Digital Currency Group, better known as DCG, announced that it intends to repurchase up to $250 million in shares for various Grayscale investment products. The share repurchase program is centered around Grayscale’s Litecoin Trust, Horizon Trust, Zcash Trust and other Grayscale products, DCG confirmed on Wednesday. The pace and timing of the share repurchase are not fixed and will depend on several factors, “including the levels of cash available, price, and prevailing market conditions,” the company said. Digital Currency Group Announces $250 Million Share Repurchase Program for Grayscale®…

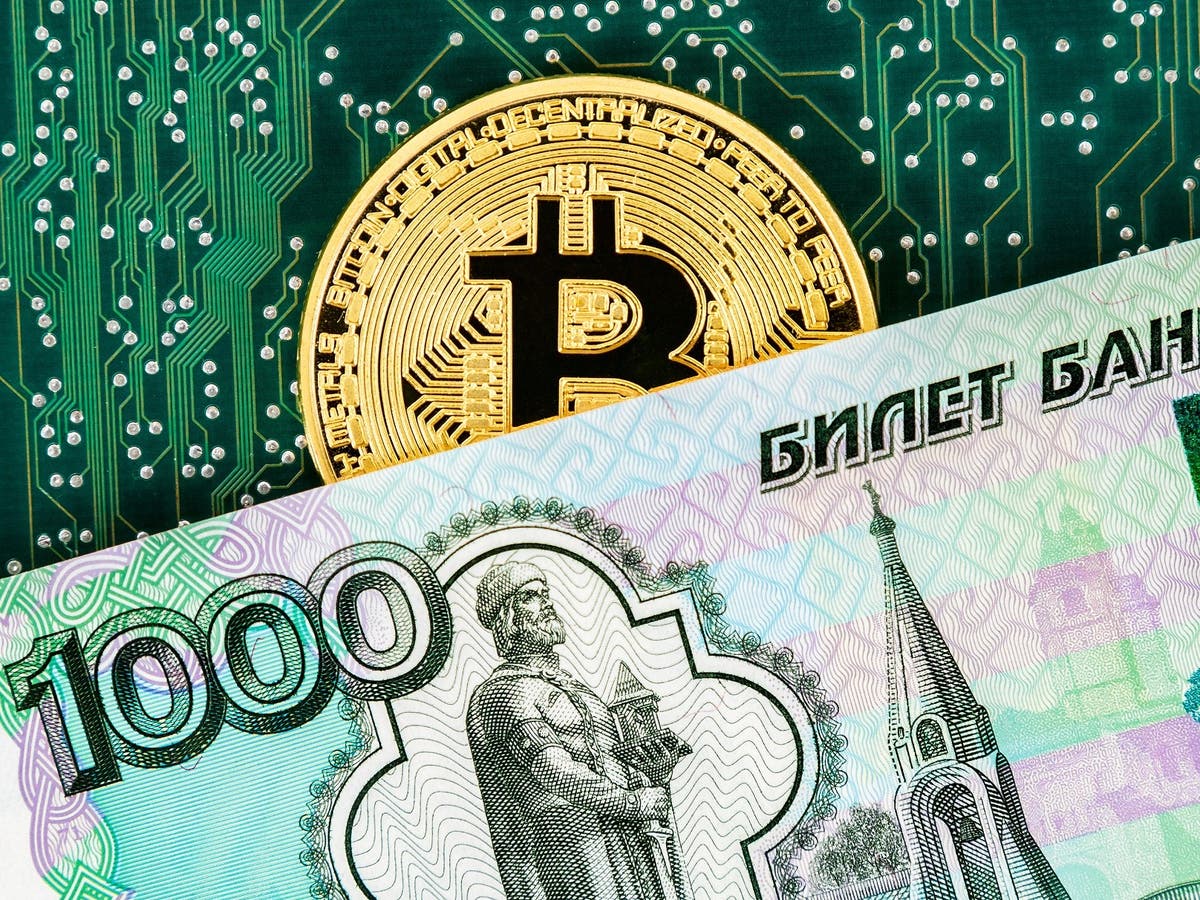

Data Show Rubble-Denominated Crypto Pairs Are Spiking

Russian rubles are now flooding into Tether, while rubble-denominated crypto pairs are on the rise on major crypto exchanges. Between February 20 and February 28, Bitcoin volume surged by 243%, from 522 to 1,792 BTC traded via Binance’s BTC/RUB combo. A Russian government study claimed Russians held 2 trillion rubles ($20 billion) in cryptocurrencies. Related Article | Bitcoin Staggers After Putin’s Nuclear Deterrence Alert Warning Rubble-Denominated Crypto Pairs Surge On February 28, a tremendous spike in the volume of the ruble pairings in Binance, especially in USDT, became apparent, with…

IMA Financial Plans to Start Selling NFT Insurance in Decentraland

IMA, which is one of the largest private and employee-owned brokers in the U.S. with predicted revenues this year of around $500 million, has connections with Lloyd’s syndicates for some of its business lines, said Jacobs. But for now, there are no insurance products directed at things like NFTs, he said. Source

Fed Chair Powell: 'War Underscores Need' for Crypto Regulation

“[The Ukraine-Russia conflict] underscored the need for congressional action on digital finance including crypto currency,” Fed Chair Jerome Powell said in Congressional testimony on Wednesday. Source

El Salvador is using volcano power to mine bitcoin

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io CNBC’s MacKenzie Sigalos joins The Exchange with more information on how El Salvador is harnessing power from volcanos to mine Bitcoin. For access to live and exclusive video from CNBC subscribe to CNBC PRO: » Subscribe to CNBC TV: » Subscribe to CNBC: » Subscribe to CNBC Classic: Turn to CNBC TV for the latest stock market news and analysis. From market futures to live price updates CNBC is the leader in business news worldwide. The News with Shepard Smith is CNBC’s daily…

Cambridge Centre for Alternative Finance Launches Digital Assets Research Project With 16 Banks – Bitcoin News

On Tuesday, Cambridge Centre for Alternative Finance (CCAF) at Cambridge Judge Business School announced a new research initiative focused on the “growing digital asset ecosystem.” According to CCAF, the newly launched collaborative effort involves 16 financial institutions such as the Bank for International Settlements (BIS), Accenture, EY, Goldman Sachs, and more. CCAF Launches 2-Year Research Effort Focused on the Digital Asset Ecosystem Since 2015, the organization CCAF has been dedicated to the study of technology-enabled and innovative instruments such as cryptocurrencies. To date, CCAF has published over 40 industry and…

Federal Reserve Chairman Powell Sees Rate Hike This Month as ‘Appropriate’

The central bank is concerned about inflation, now at its highest in four decades Powell, however, expects inflation will diminish this year as supply constraints ease and demand moderates because of the shrinking effects of fiscal stimulus and tighter monetary policy. Source