According to United States Treasury Secretary Janet Yellen, the stablecoin market is not at the scale at which the drop in the price of TerraUSD (UST) and Tether (USDT) below $1 would present a threat to the country’s financial stability. In a Thursday hearing of the House Financial Services Committee on the Financial Stability Oversight Council’s Annual Report to Congress, Yellen hinted that the stablecoin market was not yet at a size in which UST dropping to under $0.40 and USDT — the largest stablecoin by market capitalization — briefly…

Day: May 12, 2022

BiFarms Network Announced the Launch of the Decentralized Multichain Yield Optimizer Platform and Tier-less Launchpad Ecosystem

BiFARMS has announced the launch of the all in one decentralized finance yield optimizer platform that’s focused on providing high yields on crypto assets. BiFARMS aims to simplify this process by creating a seamless and streamlined process for users to earn a rewardingly high yet modest APR in the easiest and safest way while ensuring sustainable growth within the BiFARMS platform across multiple farming ecosystems. According to the research, the Decentralized Finance (DeFi) crypto market cap is estimated at $122.40B, at the time of writing. Statistically, it’s crystal clear that…

Bill Miller says he sold some bitcoin to meet margin calls, but remains a long-term crypto bull

Bill Miller revealed Thursday that he sold some of his bitcoin holdings as the recent losses in the cryptocurrency triggered margin calls. Source link

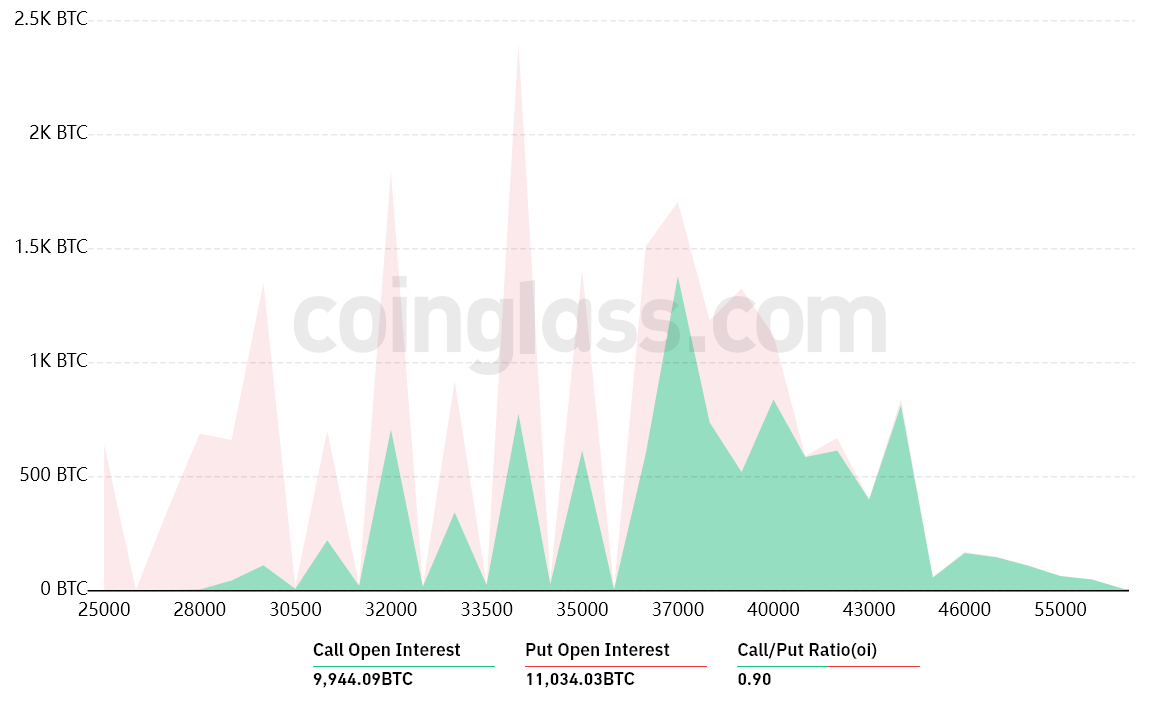

3 reasons why bears aim to pin Bitcoin below $30K for this week’s BTC options expiry

Investors were surprised by Bitcoin (BTC) price falling to $25,500 on May 12, and this shock extended to options traders. The strong correction was not restricted to cryptocurrencies and some large-cap stocks faced 25% or heavier weekly losses in the same period. Growing economic uncertainty impacted S&P 500 index members like Illumina (ILMN), which declined by 27% over the past seven days and Caesars Entertainment (CZR) faced a 25% drop. Shopify (SHOP), one of the largest Canadian e-commerce companies also saw its stock plunge by 28%. Traders are scratching their…

Mangata Finance’s Polkadot-based Efficient, MEV-Free DEX Coming June 6th

Mangata Finance, the Polkadot-based DEX, is all set for launch on June 6th. Recently, it had a successful crowdloan that was closed in just under an hour that secured it a slot on Polkadot’s innovation network Kusama. Over $2 million in value was bonded through the crowdloan, a process of staking Polkadot (DOT) tokens to support a specific project in the Polkadot Slot Auction, in return for which participants receive rewards from the projects. The project also raised $4.2 million in equity, which came shortly after the launch of its…

TopGoal Brings Football to Klaytn Blockchain

The metaverse isn’t merely tech jargon. It’s a whole new virtual reality, evolving rapidly to change lives and industries. Beginning as a sci-fi fantasy two decades ago, the metaverse has now become intertwined with modern life. The estimations of it being a $1 trillion revenue opportunity is thus no surprise. The excitement also gripped corporates recently, with the Facebook rebranding to Meta and launching metaverse-focused initiatives in 2021. But above all, the metaverse is Web3’s poster child. It’s critical to the internet’s new era, leveraging technologies like blockchain, crypto, NFTs,…

MAKING BILLION DOLLARS WITH BITCOIN MINING | INTERNET CAFE SIMULATOR 2 | HINDI #8

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io MAKING BILLION DOLLARS WITH BITCOIN MINING | INTERNET CAFE SIMULATOR 2 | HINDI #8 Second Channel – Subscribe Or I Will Take Your Minecraft Diamonds 😂 Social Media ► Instagram ► Business Email ► workforvebv@gmail.com ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Crypto Risk Monitoring Firm Solidus Labs Raises $45M

Liberty City Ventures led the round for the market surveillance and risk monitoring startup, which has several ex-regulators as backers or advisors. Source

Crypto Exchanges Are Trading Against Their Customers Often – Regulation Bitcoin News

The chairman of the U.S. Securities and Exchange Commission (SEC), Gary Gensler, says cryptocurrency exchanges are “trading against their customers often because they’re market-marking against their customers.” He has raised concerns over crypto trading platforms “commingling” services. SEC Chair Gensler on Crypto Exchanges Trading Against Customers SEC Chairman Gary Gensler said in an interview with Bloomberg News Tuesday that some cryptocurrency exchange platforms may be betting against their own customers. Gensler expressed concerns that crypto exchanges are not segregating different parts of their businesses, such as trading, custody, and market-making.…

How long will the crypto bear market last? Raoul Pal’s macro analysis

Macro investor Raoul Pal is convinced that the current crypto bear market will end only once the Fed eases its hawkish monetary policy by halting interest rate hikes. That could happen in the next couple of months, according to Pal’s predictions. “The Fed are unlikely to raise rates as far and as fast as people expect. My guess is they probably stop raising rates sometime in the summer and that will be it,” he said in an exclusive interview with Cointelegraph. Pal sees the combination of high interest rates and…