Summary: Bitcoin has gained value from roughly $21.3k during the weekly close to a local high of $22.5k. Bitcoin is trading directly below the critical 200-week moving average, which has marked market bottoms in past bear markets. BTC gaining in the crypto markets comes at a time when the United States posted its highest inflation in 40 years at 9.1%. New Zealand has also announced record-breaking inflation, with the EU, UK, Canada, and Japan expected to announce their CPI this week. Bitcoin has had an eventful 24 hours, having broken…

Day: July 18, 2022

Borrowing USDC with LDO: A Guide

Fringe Finance, an all-new and inclusive DeFi lending platform, saw the integration of $LDO as a collateral type into its Primary Lending Platform (PLP). With Fringe’s PLP, borrowers can take out $USDC loans against their altcoins. Now $LDO holders will get access to stablecoin loans and will be able to unlock part of the value of their positions without selling their tokens. Below, we’ve prepared a short tutorial on borrowing $USDC with LDO tokens. How do $USDC Loans work? Through Fringe Finance, you can take out instant $USDC overcollateralized…

Christie’s launches venture fund aimed at Web3 and blockchain investments

Christie’s, the auction house known for its sales of art and luxury items, has launched an investment fund to support emerging companies with technology enabling “seamless consumption of art.” In a Monday announcement, the auction company said the fund, Christie’s Ventures, will financially support firms in Web3, “art related financial products and solutions,” and technology related to art and luxury goods. According to Christie’s, its first investment will be in LayerZero Labs, a company developing solutions for enabling omnichain decentralized applications, allowing a more seamless transfer of assets between blockchains.…

Mining Bitcoin⚙️

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

MATIC Climbs 20% to Hit 2-Month High, as AVAX Nears 6-Week Peak – Market Updates Bitcoin News

Polygon was up by nearly 20% to start the week, as the token rallied to its highest level since May. Today’s surge comes as crypto markets were mostly in the green, with avalanche also hitting multi-week highs, and as of writing, is up by over 10% on the day. Polygon (MATIC) Polygon (MATIC) was one of the most notable gainers in crypto markets on Monday, as prices rose by nearly 20%. Following a low of $0.7464 on Sunday, MATIC/USD raced to an intraday high of $0.9269 to start the week.…

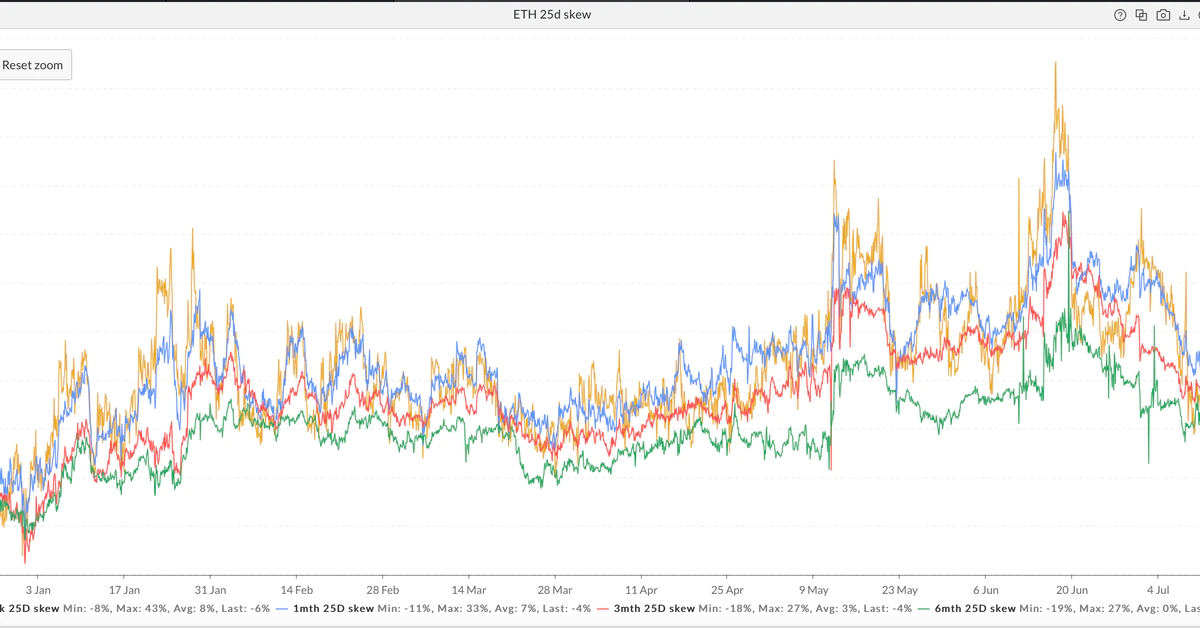

Options Signal Ether Strength for First Time in 6 Months

Some traders are buying large amounts of call options, one market observer said. Source

Polygon, ApeCoin Tokens See Outsized Gains Amid Recovery in Digital Assets

Crypto market capitalization regained the $1 trillion mark early on Monday, a recovery from June’s $800 billion level. Source

‘Token will defeat cryptocurrency’: Russia debuts palladium-backed stablecoin

The Russian government-backed tokenization platform Atomyze has issued its first digital asset backed by palladium in collaboration with the local bank Rosbank. Rosbank officially announced on July 18 that it became the first partner of the Russian blockchain firm Atomyze, acting as an investor in Russia’s first digital asset deal with palladium. According to the announcement, the newly issued digital asset is the first digital financial asset (DFA) issued through Atomyze. The platform obtained registration from the Bank of Russia in February 2022, becoming the country’s first legal digital asset manager.…

Bitcoin price nears critical 200-week moving average as Ethereum touches $1.5K

Bitcoin (BTC) hovered at $22,000 at the July 18 Wall Street open as analysts warned that bulls would not break resistance in one go. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Can Bitcoin win back bear market support? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD returning to consolidate after hitting highs of $22,500 on Bitstamp. That level represented the start of sell-side positions on exchanges clustered around the 200-week moving average (WMA), a key area which commentators argued would be hard to crack. “Not expecting continuation on Bitcoin, at…

Crypto-Related Stocks Bounce as Bitcoin Retakes $22K

Bitcoin (BTC) is up more than 5% since Friday, and – at this point on Monday morning – holding above $22,000 for a sustained period for the first time since the mid-June price crash. Ether (ETH) is performing even better, up nearly 20% since Friday to $1,479 as anticipation over the “merge” builds. Checking traditional markets, the Nasdaq is higher by about 1% and the S&P 500 is up 0.6%. Original