It’s not easy being a dev. In recent days, a young Solana-based DEX, OptiFi, faced an unexpected downfall after a simple coding error. The platform released an announcement that their mainnet program is now unrecoverable yesterday. The move has resulted in an unexpected shutdown for the DEX. Let’s review what we know from the announcement and how something like this could be avoided in the future. OptiFi’s Unexpected Shutdown OptiFi was an options and derivatives focused decentralized exchange (DEX) built on Solana that was less than a year in the…

Month: August 2022

Amid crypto winter, Nexo commits additional $50M to buyback program

Crypto lending platform Nexo has increased the size of its buyback program, giving the company more discretionary ability to repurchase its native token to boost interest payments or make strategic investments in the future. On Tuesday, Nexo disclosed that its board of directors had committed an additional $50 million to buybacks, building off the company’s initial $100 million repurchase program launched in November 2021. The approval green lights the discretionary repurchase of up to $50 million worth of NEXO tokens on the open market. NEXO is the platform’s native cryptocurrency,…

Betting Platform BetDEX Labs Likes the Odds for Its Decentralized Sports Exchange

The decentralized sports betting exchange based on Solana is looking to build a global clearinghouse “where people can put up the bets they will take … and the bets they will meet…,” BetDEX Co-Founder Nigel Eccles said, on CoinDesk TV’s “First Mover.” Source

Crypto.com Mistakenly Sent $10.5 Million to Client Instead of a $100 Refund

Crypto.com According to 7News, two Melbourne women, Manivel Thevamanogari and her sister Gangadory Thevamanogari got a AUD$10.5 million deposit from Singaporean cryptocurrency exchange Crypto.com after the latter made an error in giving a AUD$100 refund. An employee reportedly inserted an account number in the payment box instead of the return amount, resulting in an incorrect transfer to their bank account. According to court filings, the beneficiary utilized a portion of the monies to purchase a lavish property shortly after receiving them. The event happened in May 2021 but was not…

Blockchain – The Engine of the Next Financial Revolution | Mauro Casellini | TEDxVaduz

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io What will be the engine of the next financial revolution? Mauro Casellini speaks in his TEDx talk about the potential that he sees in blockchain technology. He explains how complicated today’s financial infrastructure is based on the use case of payments and talks about the opportunity which this newer technology will deliver. In his talk he simplifies the functionality of the blockchain technology which clearly highlight its benefits compared to the traditional, heavily centralized financial infrastructure. Thanks to the distributed ledger technology,…

New free-to-own GameFi model is ‘high risk,’ according to CZ

Changpeng “CZ” Zhao, CEO of Binance, criticized the creation of a novel “free-to-own” business model in the GameFi space on Tuesday, writing: “If everything will be free in the world, why do we have to work so hard…” The Binance CEO then explained that nothing is absolutely free, pointing to how the exchange can offer zero trading fees for Bitcoin (BTC) and Ether (ETH) pairs because of the adequate revenue generated from other trading pairs. He added that new projects that allow players to sign up for free can be…

3 reasons why Ethereum PoW hard fork tokens won’t gain traction

Ether (ETH) is the second largest crypto by market capitalization and the absolute leader in decentralized applications by deposits. Becoming a victim of its own success, the network experienced a fee hike in November 2021 when the average transaction costs surpassed $50. That’s precisely why the Merge is a critical step to implementing a fully functional scaling solution. The confirmation of a transition to a proof-ofstake (PoS) consensus was the main driver for the rally toward $2,000 on Aug. 15. Investors were partially excited about the reduced issuing schedule and…

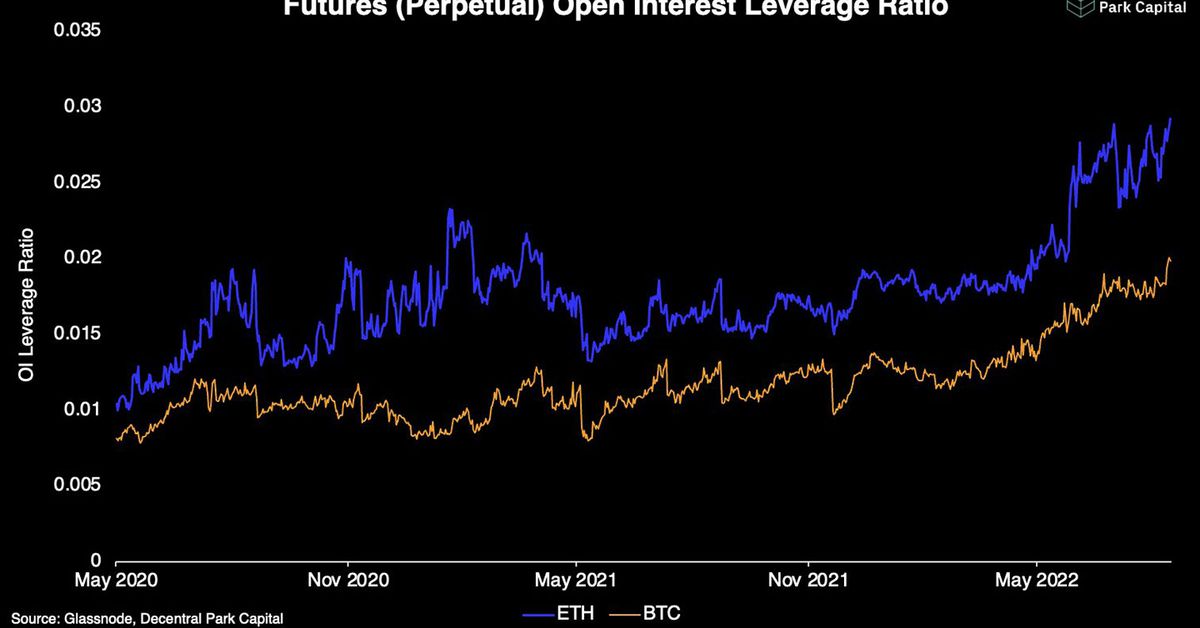

ETH y BTC podrían registrar inestabilidad a medida que aumenta el índice de apalancamiento de interés abierto

Andrew Krohn, analista de la firma de investigación cripto Delphi Digital, expresó una opinión similar en una nota a los clientes el lunes, diciendo que la relación sugiere que el interés abierto es grande en relación con el tamaño del mercado e “implica un mayor riesgo de contracción del mercado, cascadas de liquidación o eventos de desapalancamiento”. Source

OpenSea Turns Into NFT Ghost-Town After Volume Downs 99% In 3 Months

A continuing debt issue at lending platform BendDAO raises the prospect of the NFT bubble imploding. As concerns about a potential market bubble mount, daily volumes on OpenSea, the world’s most significant nonfungible token (NFT) marketplace, have dropped significantly. OpenSea Volume Plummets to Yearly Lows Notably, the marketplace executed about $5 million in NFT transactions on August 28 — roughly 99% less than its record high of $405.75 million on May 1. The precipitous decreases in daily quantities coincided with equally sharp drops in OpenSea users and transactions, implying that…

What to Make of the Avalanche Whistleblower Report

The report, if true, is damning and shows that anti-competitive behavior is alive and well in crypto. There are, however, several reasons to remain skeptical about the allegations. Right now, the pursuit of truth has reached a he-said-she-said stage – where it seems like all parties are withholding some facts – that only tarnishes crypto’s reputation. Source