All crypto exchanges must register with IIROC if they want to operate in Canada, and there is currently a backlog of applications. Coinsquare, Canada’s longest-operating crypto asset trading platform, announced on Oct. 12 that the Investment Industry Regulatory Organization of Canada (IIROC) had approved its dealer registration and IIROC membership. This regulatory status will now position Coinsquare as the first crypto-only IIROC-registered investment dealer and marketplace member in Canada. The Coinsquare team wrote: “In dealing with an IIROC registrant, Coinsquare clients now have the added comfort and security of knowing…

Day: October 12, 2022

Canadian Self-Regulatory Agency Approves First Crypto-Native Investment Dealer

“Becoming an IIROC dealer and member of IIROC, it gives clients the security that they’re dealing with an intermediary, a securities dealer, with all the sorts of protections and oversight that they’re familiar with when they trade traditional assets,” Prokopy said. “And, heretofore, that has not been the case.” Source

Damien Hirst burns $10M in art: Nifty Newsletter, Oct 5–11

Racing league Formula One is positioning its brand in Web3 as it files trademark applications for “F1” covering crypto and NFTs. In this week’s newsletter, read about how the racing brand Formula One is planning to position itself in Web3 and how nonfungible tokens (NFTs) will transform betting on upcoming athletes. Check out how GameFi can provide the unemployed with a new means to earn and find out how the wealthiest British artist alive burned $10 million in artworks to complete his NFT project. And, don’t forget this week’s Nifty…

U.S. Securities and Exchange Commission Opening Investigation Into Bored Ape Yacht Club NFT Creators: Report

Federal regulators are reportedly investigating the creator of the Bored Ape Yacht Club (BAYC) non-fungible token (NFT) collection for potential violations of federal laws during the sale of digital assets. Citing an unnamed source familiar with the matter, Bloomberg reports that the U.S. Securities and Exchange Commission (SEC) is investigating Yuga Labs to determine if some of its NFTs are comparable to stocks, which would require compliance with disclosure rules. In a statement, the Miami-based company says it will cooperate with any investigation. “It’s well-known that policymakers and regulators have…

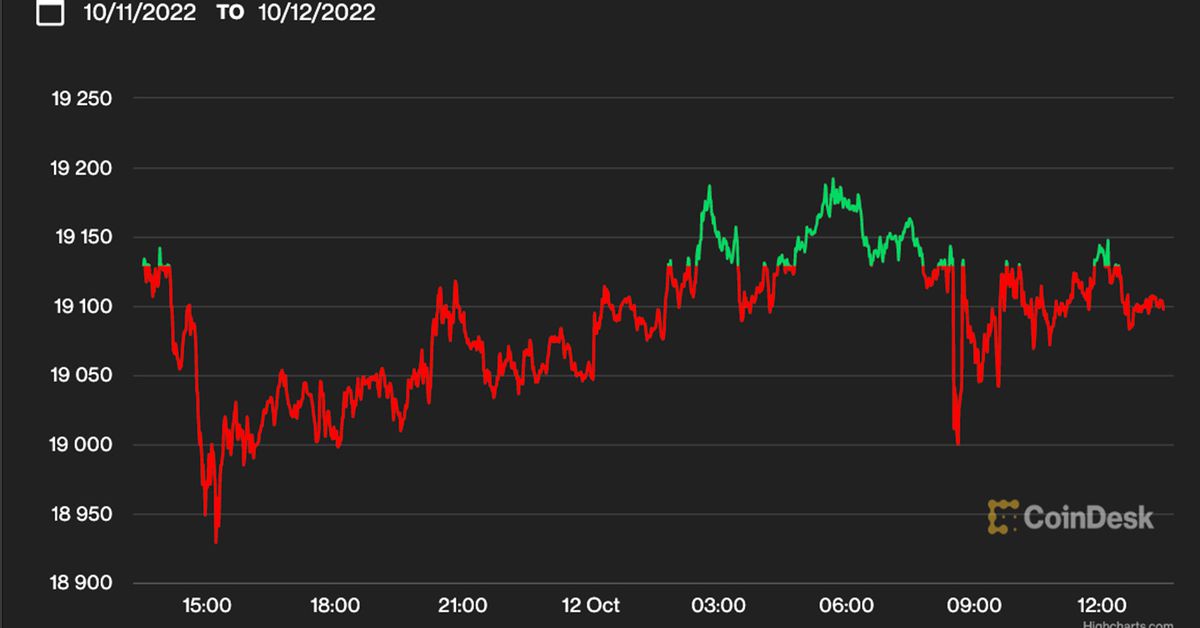

Bitcoin se aferra a los US$19K y los traders hacen sus apuestas antes de la publicación de inflación

Los inversores permanecieron con una actitud de “esperar y ver” tras conocer el miércoles a la mañana que las cifras del Índice de Precios al Productor (PPI, por sus siglas en inglés) de Estados Unidos fueron más elevadas que las previstas. El PPI es una herramienta que mide los precios de los bienes vendidos por los productores. A pesar de la lucha de la Reserva Federal de Estados Unidos (Fed) contra la inflación, los precios al por mayor subieron 0,4% en septiembre, frente a la estimación del Dow Jones de…

Key US Lawmaker Says Talks Continue Over ‘Ugly Baby’ Bill to Oversee Stablecoins

The three-way talks with Rep. Maxine Waters (D-Calif.), the chairwoman of the House Financial Services Committee, and the Treasury Department have run into a number of sticking points, according to McHenry, the committee’s senior Republican. But he said Wednesday he’s hopeful the talks will end with a law that would establish rules for how stablecoins – tokens such as Tether’s USDT and Circle Internet Financial’s USDC that are tied to steady assets such as the dollar – can operate in the U.S. Source

Crypto Custodian Copper Raises $196M in Series C Funding Round

The U.K.-based company also reported a loss of $16 million last year, up from $4.1 million in 2020. Source

Crypto Hacks Fuel Memes of North Korea: Blockchain’s Biggest Baddie

Ascribing such high-falutin’ themes to, well, s**tposting, isn’t accepted by all. One of the most prolific of these posters, the Twitter account for investor CMS Holdings, thinks the spate of North Korea memes is a function of people having literally nothing better to do. Source link

Regulators Should Use ‘Range of Options’ in Fintech, Fed’s Barr Says

“Crypto assets have grown rapidly in the last several years, both in market capitalization and in reach,” said Barr. “But recent fissures in these markets have shown that some crypto assets are rife with risks, including fraud, theft, manipulation and even exposure to money-laundering activities … Crypto asset-related activity, both outside and inside supervised banks, requires oversight that includes safeguards to ensure that crypto service providers are subject to similar regulations as other financial services providers.” Source

Google’s Partnership With Coinbase Is ‘Validation’ for the Crypto Industry: Oppenheimer

Owen Lau, senior analyst at investment bank Oppenheimer, joined “All About Bitcoin” to discuss what Google’s partnership with crypto exchange Coinbase could mean for other crypto-native companies. Source