In a blog post on November 30, Coinbase sought to clarify its bug bounty program policies in response to the recent Uber data breach verdict. The company stated that it still welcomes “responsible” disclosure of security issues, but users who abuse this process will not be awarded bug bounties: “The key word in all of this is ‘responsible’. In the wake of the recent Uber verdict, there is a lot of concern in the industry about bug bounty submissions becoming extortion attempts. At Coinbase, […] we’ve put a lot of…

Day: November 30, 2022

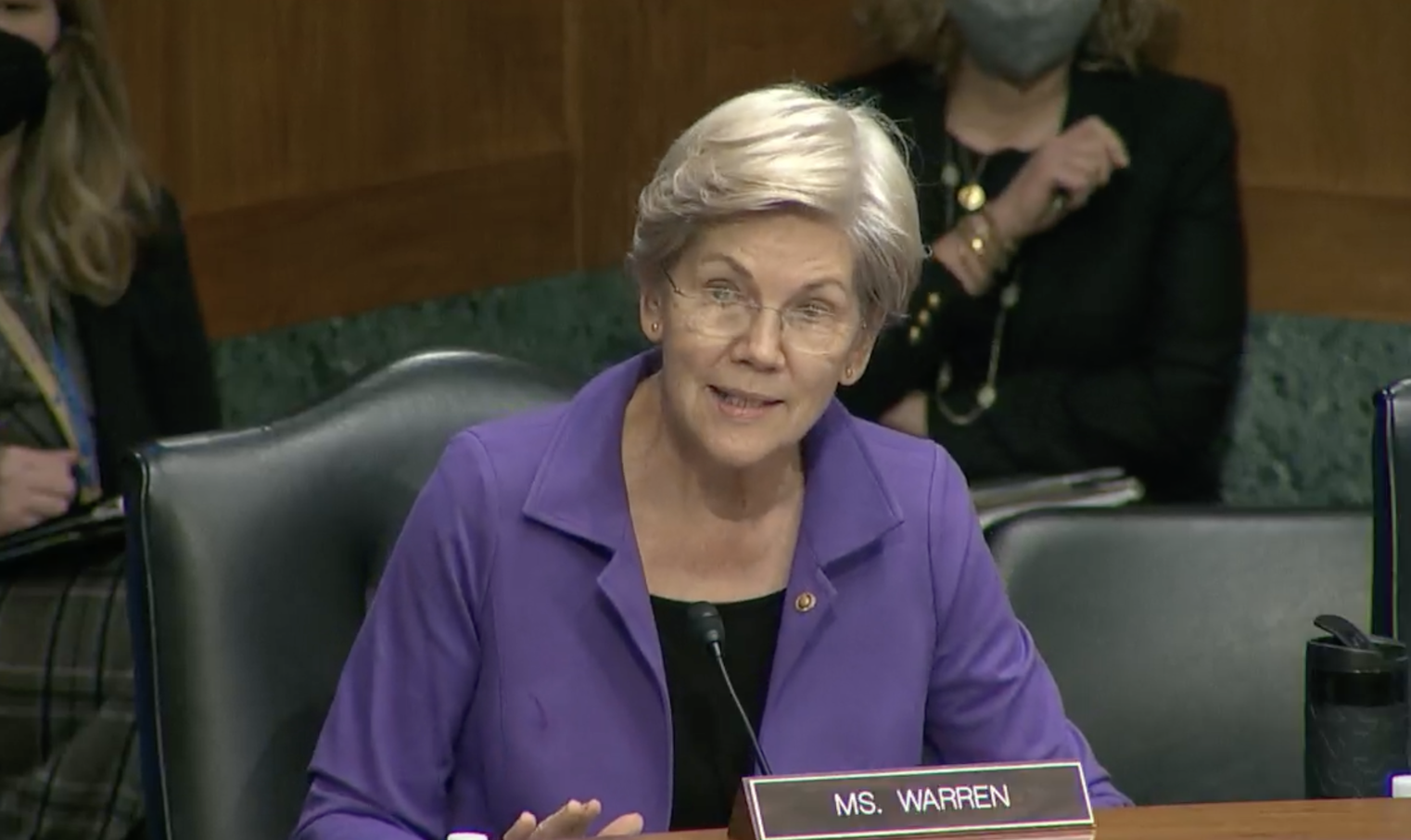

Biden administration worked to stop crypto being ‘dangerously intertwined’ with banks

Referring to the events surrounding the collapse of FTX as “a handful of magic beans”, Massachusetts Senator Elizabeth Warren seemed to frame the “contagion” spreading through the crypto space as a partisan issue. Speaking at a Senate Banking Committee nomination hearing on Nov. 30, Warren addressed committee counsel Jonathan McKernan, who confirmed that FTX’s bankruptcy had largely not affected traditional banking institutions in the United States. The Massachusetts senator, an outspoken skeptic of cryptocurrencies, used some of her time to applaud the work of Federal Deposit Insurance Corporation, or FDIC,…

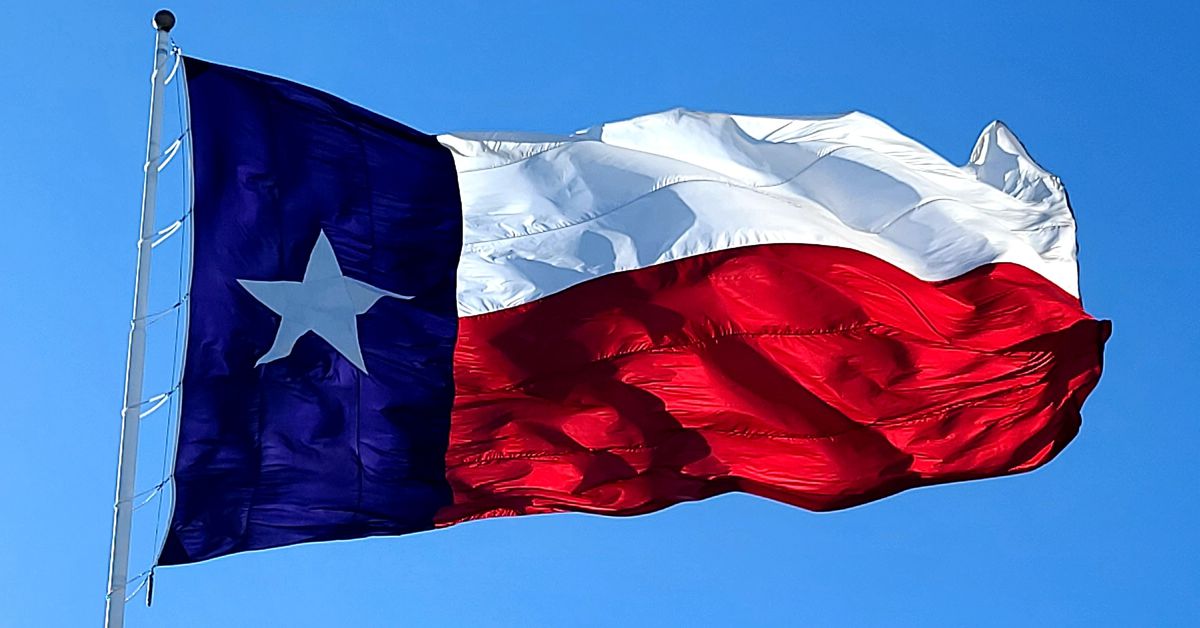

US Prosecutors Charge 21 Alleged ‘Money Mules’ With Using Crypto to Launder Proceeds of Cybercrimes

Prosecutors in Texas have slapped 21 U.S. citizens with an assortment of criminal charges for allegedly helping various transnational criminal rings launder their ill-gotten gains using cryptocurrency Source

FTX proves MiCA should be passed fast, officials tell European Parliament committee

The European Parliament Economic and Monetary Affairs Committee held a hearing on “FTX cryptocurrency exchange collapse and implications for the EU” Nov. 30. Three European monetary officials testified, talking about FTX, blockchain technology and crypto regulation in a “preliminary assessment of the events.” European Securities and Markets Authority (ESMA) Risk Analysis & Economics Department head Steffen Kern told the committee that ESMA “has neither regulated nor supervised FTX” and has no “information on the company beyond what is in the public domain.” The ESMA does not see significant risks to…

Two Bored Apes sell for $1M each: Nifty Newsletter, Nov. 23–29

In this week’s newsletter, read about how two Bored Ape nonfungible tokens (NFTs) sold for almost $1 million during the bear market and how the word “metaverse” made it into the top three finalists for Oxford Word of the Year. Check out how the metaverse can generate passive income through royalties and how NFT marketplace OpenSea has integrated BNB Chain into its platform. And, don’t forget this week’s Nifty News featuring COVID-19 protests in China being converted into a Polygon-based NFT collection. ‘Metaverse’ a top 3 contender for Oxford’s Word…

OMG!!! MAJOR ALTCOIN PUMP!!! Bitcoin & Ethereum Soar! Crypto News

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Bitcoin and Ethereum Soar Following Strong US Jobs Report! + Major Altcoin News (Gala, Stepn, Solana, IMX, ect)! Vote Altcoin … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Data Shows There’s No Profits Left for Bitcoin Miners That Can’t Obtain Cheap Electricity, Run Efficient Mining Rigs – Mining Bitcoin News

During the last few weeks bitcoin’s cost of production has been higher than the leading crypto asset’s spot market value and in turn, this has put massive pressure on bitcoin miners. On Nov. 30, 2022, statistics show if miners paying for electricity pay roughly $0.12 per kilowatt hour (kWh), only three application-specific integrated circuit (ASIC) mining rigs are profitable. At a rate of $0.07 per kWh, profits begin to increase and data shows 16 different ASIC bitcoin mining devices are profitable with electrical costs at that rate. At $0.12 per…

Don’t’ believe the hype — Bitcoin price rally to $17K reflects improving sentiment

Bitcoin (BTC) price gained 6.1% between Nov. 28 and Nov. 30 after briefly testing the $17,000 support. Favorable regulatory winds might have helped fuel the rally after the Binance exchange announced the acquisition of a regulated crypto exchange in Japan on Nov. 30. Bitcoin 12-hour price index, USD. Source: TradingView Binance shut its operations in Japan in 2018 after being warned by the Japan Financial Services Agency for operating without a license. The acquisition of Sakura Exchange BitCoin would mark the re-entry of Binance in the Japanese market. Furthermore, Gemini…

IBM and Australian Stock Market’s Blockchain Projects Failed, a Blow to Private Ledgers

The enterprise blockchain space, which doesn’t seem to experience the same bullish and bearish market cycles as public crypto, is now feeling a change in the broader economic climate, particularly in areas like shipping. This is one of the reasons TradeLens is closing shop, according to Lars Jensen, CEO of Vespucci Maritime, a consultancy firm to the container shipping industry. Source

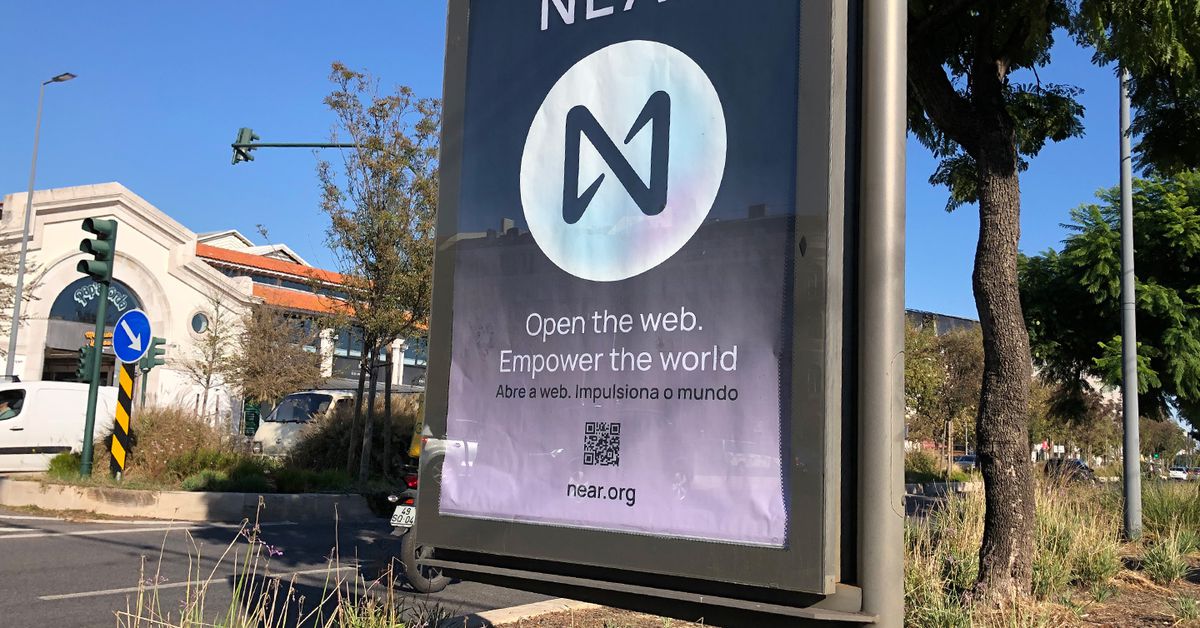

Near Foundation Joins Processed Foods Giant Grupo Nutresa to Unveil Web3 Loyalty Program in Latin America

Grupo Nutresa, which trades on the Colombia stock exchange, generated $3.1 billion in revenue in 2020 and has been expanding internationally in recent years. It sells products in 78 countries via eight business units, including meats, coffee, ice cream and pasta. Source