The regulator, which has been hammering away at the crypto sector under the direction of Chair Gary Gensler, sent a loud message to the industry in May 2022 by announcing it was adding 20 people to its newly named Crypto Assets and Cyber Unit. That nearly doubled the size of the 50-person operation, and an SEC spokesperson told CoinDesk that the added slots “are nearly filled.” Source

Day: March 1, 2023

DeFi Protocol StaFi Nearly Halves Commission Fees for Staking

StaFi’s move to slash commission fees comes in the runup to the Ethereum Shanghai Upgrade, a network upgrade that encompasses a collection of improvement proposals, including one to allow investors to collect their staked, or locked-up, ether. The upgrade, which is slated for March, is expected to boost the number of stakers within the DeFi ecosystem, offering StaFi an opportunity to attract more builders to its protocol. Source

SEC, CFTC press civil charges against former FTX exec Singh parallel to criminal case

Civil charges were announced against former FTX director of engineering Nishad Singh on Feb. 28, the same day he entered a guilty plea to three counts of criminal fraud in Manhattan district court. Both the United States Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are pressing charges against Singh. Singh pleaded guilty in the U.S. District Court for the Southern District of New York to one count of wire fraud, one count of conspiracy to commit wire fraud on FTX customers and one count of…

Kraken Pulling Back From Using Signature Bank: Bloomberg

Non-corporate clients will no longer be able to make dollar deposits or withdrawals using the crypto-focused bank, according to a report. Source

Bitcoin price searches for direction ahead of this week’s $710M BTC options expiry

Bitcoin (BTC) bulls laid most of their options at $24,500 and higher for the March 3 options expiry, and given the recent bullishness seen from BTC, who can blame them? On Feb. 21, Bitcoin price briefly traded above $25,200, reflecting an 18% gain in eight days. Unfortunately, regulatory pressure on the crypto sector increased and despite no effective measures being announced, investors are still wary and reactive to remarks from policymakers. For instance, on Feb. 23, U.S. Securities and Exchange Commission Chair Gary Gensler claimed that “everything other than Bitcoin”…

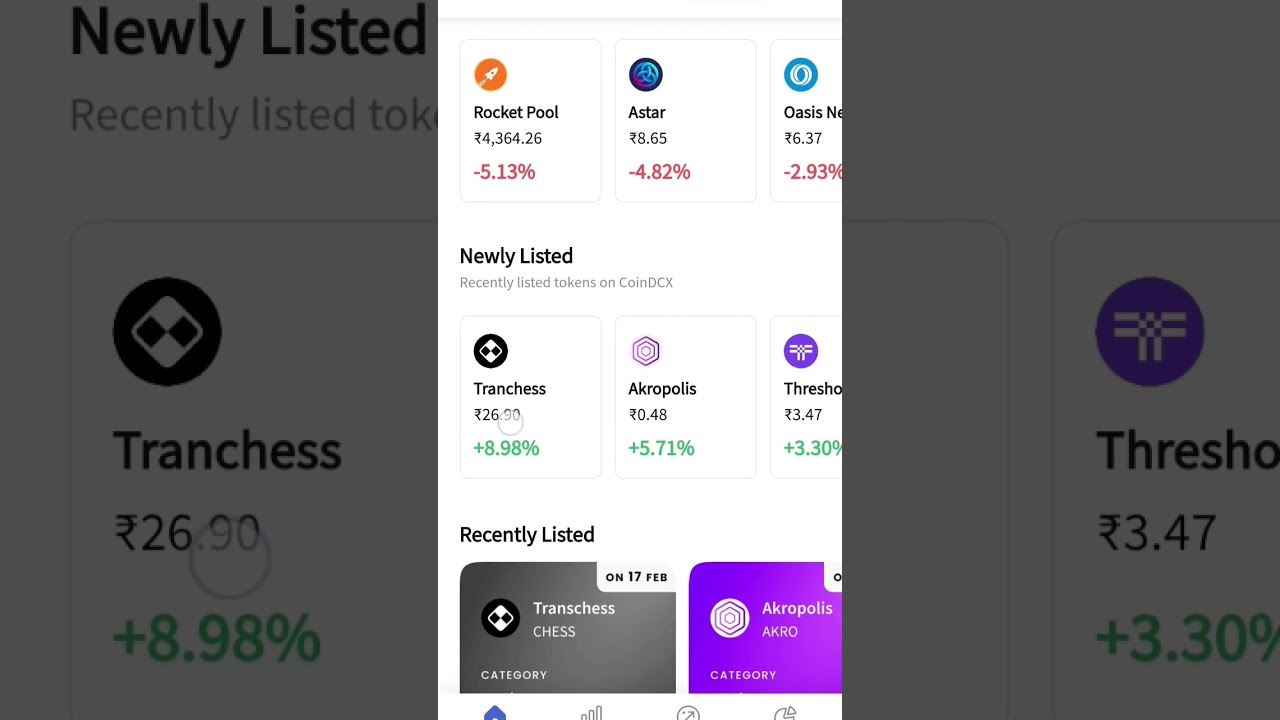

how to invest in crypto|| #polygon #viral #bitcoin #crypto #bhageshawar #shortvideo

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

Erik Yates optimistic on bitcoin as the future of banking

Eric Yakes, author of “The 7th Property,” shares his practical vision for a bitcoin native banking system in an interview, where he explores the potential for Fedimints to revolutionize free banking in the digital age. As the world becomes increasingly digitized, there is growing interest in the potential for a bitcoin native banking system. In a recent interview, Eric Yakes explores free banking and digital currency in depth on a global level. Yates noted that there are only two reasonable scenarios for bitcoin, the worst-case scenario is that it is…

CoinDesk and Art Blocks Release Microcosms to Supercharge Consensus With NFTs

Unlike with a traditional event ticket that simply gains you entrance to an event, we focused a set of on-the-ground rewards to enhance an attendee’s experience. Beyond access, all users get our DESK token airdropped to them. The token can be used at the event for food, drink, merchandise or experiences. Based on an algorithm, additional people will receive special rewards like a speaking slot at Consensus, a booth on the show floor, a comped hotel stay or meetings with key venture capitalists who are investing in Web3. If recipients…

Ethereum DeFi Altcoin Explodes 140% After Surprise Support From Crypto Exchange Binance

A decentralized Ethereum (ETH)-based lending protocol is leading the altcoin markets with explosive gains following surprise support from Binance, the world’s largest crypto trading platform by volume. In an announcement yesterday, Binance revealed it would be listing Liquity (LQTY) in its “Innovation Zone”, where newer tokens with higher volatility are designated. Liquity is a borrowing and lending protocol powered by its stablecoin LUSD, and uses ETH as collateral. LQTY, its native token, can be used for liquidity mining and staking. LQTY stakers can earn LUSD from fees on loan issuance,…

UBS Strategists Predict Minimal Impact of Upcoming Mt Gox Payouts on Bitcoin Value – Bitcoin News

A recent report published by market strategists from the investment bank and financial services company UBS says that the upcoming Mt Gox payouts won’t destabilize bitcoin’s value. While a new supply will come to the market, UBS strategists insist that “it would be less concentrated.” UBS Market Strategists Believe Mt Gox Payouts Won’t Destabilize Bitcoin’s Value UBS market strategists think that the cause for concern over the upcoming Mt Gox distribution of 142,000 bitcoin (BTC) may be a bit overhyped in regard to the “long-held fear that Mt. Gox redemptions…