Grant Butler, an attorney at the K&L Gates law firm, told CoinDesk the SVB receivership is structured differently from the Signature Bank receivership. SVB has been structured to try and liquidate its assets, while Signature was set up with the apparent expectation of a buyer, which allowed for operations to remain uninterrupted. Source

Day: March 13, 2023

DeFi Privacy Bridge Aztec Connect Sunsets After Less Than a Year

“The immense research invested into Aztec Connect will be usable and indeed critical to the development of our next-gen product,” wrote the Aztec team in a Medium post. “Having an encrypted rollup live and in production gives us confidence in our shift to focusing on a fully programmable version.” Source

Bitcoin surges past $24,000 on CME launch of BTC event contracts

On Mar. 13, American derivatives marketplace CME announced the launch of Bitcoin (BTC) futures event contracts. The exchange, which is fully regulated and has cleared administrative review, will henceforth facilitate cash-settled, daily expiring contracts tied to Bitcoin futures with a “lower-cost way for investors to trade their views on the up or down price moves of bitcoin.” Tim McCourt, global head of equity and FX products at CME Group, commented: Our new event contracts on Bitcoin futures provide a limited-risk, highly transparent way for a wide range of investors to access…

U.S. Fed’s Supervision Chief Investigating What Happened with Silicon Valley Bank

Barr, a former Treasury Department official who briefly became an adviser for Ripple before returning to a government role in the Biden administration, didn’t mention Silvergate Bank in the statement, though that smaller institution was also supervised by the Fed. Source

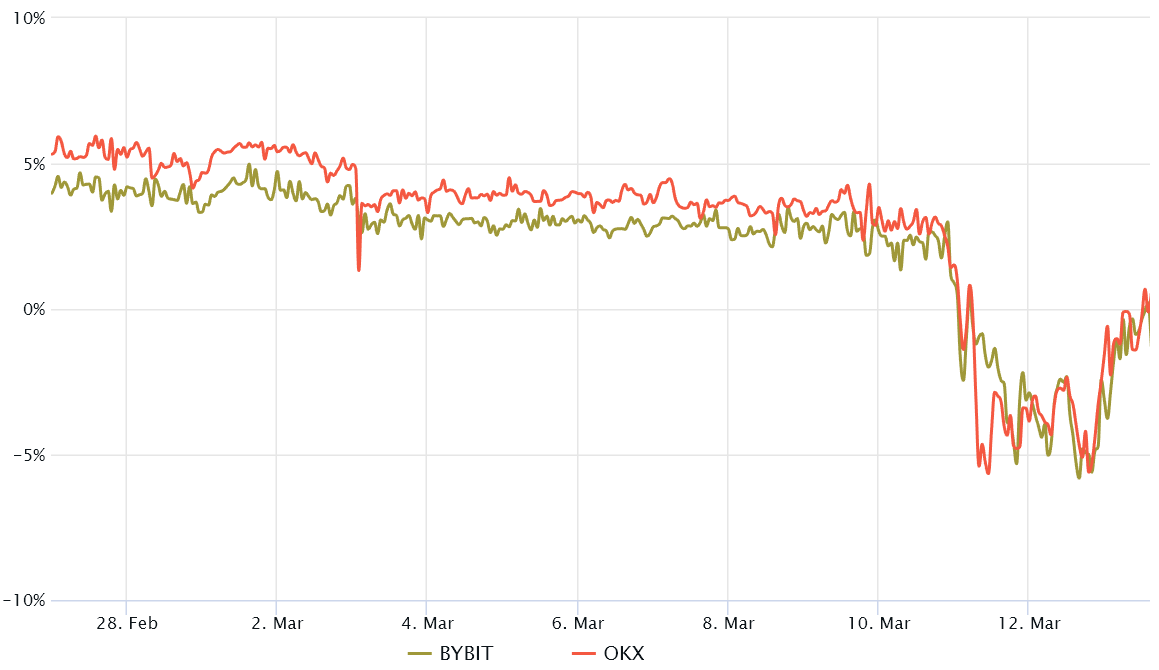

Bitcoin futures premium falls to lowest level in a year, triggering traders’ alerts

The price of Bitcoin (BTC) increased by 14.4% between March 12-13 after it was confirmed that financial regulators had rescued depositors in the failing Silicon Valley Bank (SVB). The intraday high of $24,610 may not have lasted long, but $24,000 represents a 45% increase year-to-date. On March 12, U.S. Treasury Secretary Janet Yellen, Federal Reserve Chairman Jerome Powell, and Federal Deposit Insurance Corporation (FDIC) Chair Martin Gruenberg issued a joint statement to reassure SVB depositors. Regulators also announced a systemic risk exception for Signature Bank (SBNY), an intervention designed to…

Silvergate and SVB bite the dust: Law Decoded, March 6–13.

Last week, another major quake shook crypto markets. Silvergate Bank — a crypto-fiat gateway network for financial institutions and a significant on-ramp for cryptocurrencies in the United States — shut down operations due to liquidity problems. A couple of days later, another Federal Deposit Insurance Corporation-insured institution, Silicon Valley Bank (SVB), was shut down by California’s financial watchdog. The bank provided financial services to several crypto-focused venture firms, including Andreessen Horowitz and Sequoia Capital, with USD Coin (USDC) issuer Circle holding around 20% of its reserves with the bank. Following…

🚨 URGENT Crypto Market Update! 140,000 BITCOIN SELLOFF! | Is It Over For Bulls?

▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io A massive Bitcoin sell order may be flooding the crypto market over the coming months, and investors are hitting the market sell … ▶ Coinbase Website: Coinbase.com ▶ CEX Website: cex.io Youtube version

US banks experience volatility and trading halts amid bank failures and presidential assurances

Banks saw their share prices take a rollercoaster ride over the weekend and into March 13. Trading was temporarily halted for dozens of United States regional banks amid volatility and falling prices. The Wall Street Journal reported early in the morning that trading was halted for First Republic Bank, which led bank losses when its price fell 65% by the time trading was stopped. Trading in PacWest Bancorp, down 25%; Zions Bancorp, down 25%; and Regions Financial, down 9%, was also halted. Those banks saw uneven recovery when trading resumed,…

Silicon Valley Bank and Signature Bank Reignite ‘Moral Hazard’ Dilemma Bitcoin Was Designed to End

A debate from the 2008 financial crisis resurfaces as the FDIC intervenes to help two troubled institutions with crypto connections, says CoinDesk’s David Z. Morris. Source

Stablecoin Trading Dominates Monday’s Crypto Market, Tether and BUSD Sell at Premiums – Market Updates Bitcoin News

On Monday, the crypto economy experienced significant market activity with $183.85 billion in global trade volume over 24 hours, with a large portion of those trades involving stablecoins. USDC traded near parity with the U.S. dollar, and several stablecoins, including tether and BUSD, sold at premiums. Tether reached a high of $1.04 per unit and BUSD rose to $1.03 per coin during the morning trading sessions (ET). Small Handful of Stablecoin Assets Trade for Premiums as USDC Closes $1 Parity Gap On Monday, stablecoins experienced significant trade volumes after USDC…