A proposal to fund the Arbitrum Foundation with 750 million ARB tokens — nearly $1 billion — raised controversy in the ARB community over the weekend, as the Foundation announced that it was only ratifying a decision that had already been made. The conflict comes after a few days the layer-2 protocol airdropped its governance token. According to the AIP-1 proposal on Arbitrum’s DAO, the 750 million tokens would be used to cover “Special Grants, reimbursing applicable service providers […] and covering ongoing administrative and operational costs of The Arbitrum…

Day: April 2, 2023

US CFTC sues Binance, crypto markets contract, ex-FTX boss faces fresh allegations

This week, like it has been the trend, regulators in the United States didn’t slow down. The Commodity Futures Trading Commission (CFTC) formally brought charges against Binance, alleging breaches of the Commodity Exchange Act. Despite the markets contracting, gains posted in the preceding week remained intact. Meanwhile, fresh revelations emerged on the ongoing FTX case. A deluge of regulatory actions The global trend of strengthening regulatory oversight for cryptocurrency has been gaining momentum. Financial regulatory bodies around the globe aim to offer clear guidance to the fledgling industry and protect…

Value Locked in Defi Holds the Line at $50B, After Temporarily Shedding $8B in Mid-March – Defi Bitcoin News

The total value locked (TVL) in decentralized finance (defi) during the first week of April is about $50 billion, roughly the same as on March 1. The value locked dropped to $42 billion on March 12 but has since rebounded as protocols such as Lido Finance, Aave, and Justlend recorded double-digit monthly gains. After the March 12 Dip, the Value Locked in Decentralized Finance Rebounds to $50B According to statistics, the value locked in defi on April 2, 2023, is $50.22 billion, up 0.91% in the past 24 hours. The…

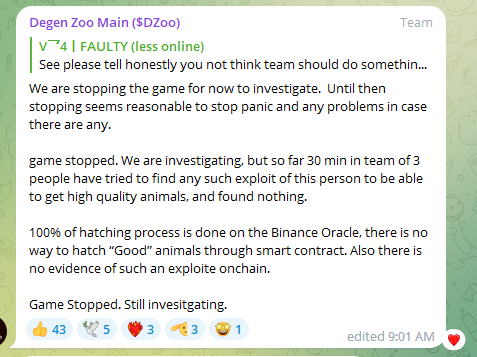

DAOMaker game, Degen Zoo, temporarily halted on hacking fears

The DAOMaker game project, Degen Zoo, has been halted as the team investigates a possible exploit on Binance Oracle. Degen Zoo suspended Reports from the Degen Zoo Telegram group indicate that the team agreed to briefly stop and launch an investigation into possible manipulation. Degen Zoo game halted: Telegram The team agreed that this intervention was the best option to manage anxiety and mitigate risks that might arise if there is an exploit. Prior investigations conducted 30 minutes before the announcement has not yielded any results confirming an exploit. However, the investigating…

Bitcoin copying ‘familiar’ price trend in 2023, two more metrics show

Bitcoin (BTC) is on the road to a new bull market and should deliver serious returns in the process, fresh analysis reveals In a tweet on April 2, Charles Edwards, founder of Bitcoin and digital asset hedge fund Capriole Investments, flagged a “familiar” bull signal on the SLRV Ribbons metric. Edwards: SLRV beginning “new trend” SLRV Ribbons is a tool for measuring potential Bitcoin profitability. Put forward by Capriole in 2022, it is based on the Short-to-Long-term Realized Value (SLRV) Ratio from well-known analyst David Puell. The SLRV Ratio takes…

USDC’s Depeg Laid Bare the Risks Traditional Finance Poses to Stablecoins

Other, smaller-circulation stablecoins lost their pegs, too, including BUSD, issued by Paxos, and crypto-backed stablecoin DAI, issued by MakerDAO. Only USDT seemed to benefit from the turmoil, briefly exceeding $1, most likely because of investors shifting out of the depegged stablecoins. Source

Stress test? What Biden’s bank bailout means for stablecoins

The collapse of Silicon Valley Bank (SVB), which suffered a bank run after revealing a hole in its finances over the sale of part of its inflation-hit bond portfolio, led to a depegging event for major stablecoins in the crypto sector, leaving many to wonder whether it was a simple stress test or a sign of weakness in the system. The second-largest stablecoin by market capitalization, the Centre Consortium’s USD Coin (USDC), saw its value plunge to $0.87 after it was revealed that $3.3 billion of its over $40 billion…

Former Treasury Official Issues Dire Warning, Bill Ackman Fears Economic ‘Train Wreck,’ US Gov. Remains Top BTC Holder, and More — Week in Review – The Weekly Bitcoin News

Warnings continue to pervade market and financial news this week, with Monica Crowley, former assistant secretary for public affairs for the U.S. Department of the Treasury, indicating “catastrophic” consequences if the U.S. dollar loses its status as the world’s reserve currency. In related news, billionaire Bill Ackman warned that the U.S. economy is “heading for a train wreck.” Meanwhile, First Citizens Bank has acquired SVB, and the U.S. government remains a top bitcoin holder with its seized stash. All this and more, just below. Former Treasury Official Warns of Complete…

Over 66,000 new validators joined Ethereum in Q1 2023

In Q1 2023, the Ethereum proof-of-stake network added 66,000 new validators, with the total count growing from 495,270 in early January to 562,236 by the end of March. Validator count rising Validators are critical in Ethereum, especially in network security and decentralization. They validate transactions, ensuring no invalid transactions are added to a block. The increasing number of validators signifies that more individuals and entities are willing to participate, helping make the platform more robust and secure. This could have a bullish effect on the ethereum (ETH) price ahead of the Shanghai…

Contentious Arbitrum Vote Over $1B in Tokens ‘Ratification Not Request,’ Says Foundation

McCorry said there’s a “chicken and egg problem” in setting up decentralized governance structures. In the case of Arbitrum, “certain parameters need to be decided” ahead of time, including the structure of a “security council” that wields emergency powers, deciding voting mechanics, and of course, the funding. Source