Other investors in the round included Seed Club Ventures, North Island Ventures, Balaji Srinivasan, Zeneca, Mischief Ventures, Sfermion, CMT Digital, Patricio Worthalter, Spice Capital and Sublime Venture, among others. Lore has now raised $7.15 million to date. Source

Day: April 6, 2023

Magic Eden Rolls Out Bitcoin Ordinals NFT Creator Launchpad

“Bitcoin is the grandfather of all blockchains, and we believe it can be the home to pure digital artifacts,” said Yin. “With Ordinals, content can be preserved forever, and we’re proud to be helping creators and the Ordinals community grow together.” Original

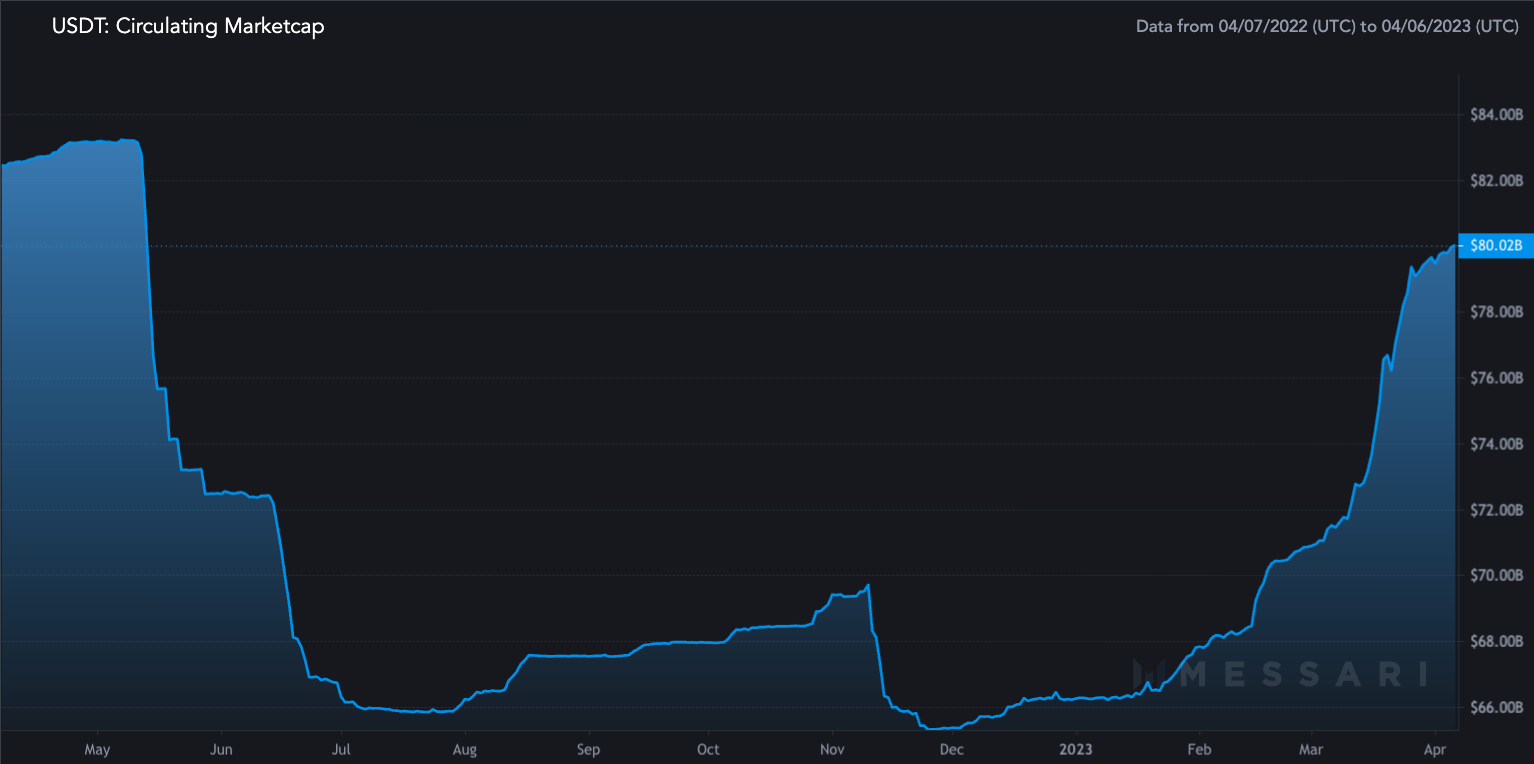

Tether supply hits $80B for the first time since May 2022 — stablecoin rivals stumble

Tether (USDT) continues to benefit from the ongoing turmoil in the U.S. dollar-backed stablecoin industry with its market capitalization growing significantly in Q1 2023 at other stablecoins’ expense. Tether market cap reaches $80 billion On April 6, the circulating market cap of USDT surpassed $80 billion for the first time since May 2022 with a gain of $15 billion so far in 2023. USDT circulating market cap 12-month performance. Source: Messari On the other hand, the market caps of its chief rivals, namely USD Coin (USDC) and Binance USD (BUSD),…

DOGE Extends Declines on Thursday, Falling by Nearly 9% – Market Updates Bitcoin News

Dogecoin was one of Thursday’s biggest movers, as the meme coin fell by as much as 9%. The decline comes as market sentiment begins to shift, following huge gains to start the week. Litecoin was also in the red today, with prices hovering near the $90.00 level. Dogecoin (DOGE) Dogecoin (DOGE) fell for a third consecutive session on Thursday, as market sentiment shifted bearish, following strong gains to start the week. DOGE/USD dropped to a low of $0.08857 earlier in the day, which comes less than 24-hours after trading at…

North Korea and criminals are using DeFi services for money laundering — US Treasury

A new report from the United States Treasury Department analyzing decentralized finance concluded that actors from the Democratic People’s Republic of Korea as well as other scammers are able to exploit vulnerabilities to facilitate money laundering. In its ‘Illicit Finance Risk Assessment of Decentralized Finance’ report released on April 6, the U.S. Treasury said many groups engaged in illicit activity from North Korea benefited from some DeFi platforms’ non-compliance with certain anti-money laundering (AML) and countering the financing of terrorism (CFT) regulations. According to the report, insufficient AML/CFT controls and…

15 ways crypto companies can manage costs in the current economy

Crypto winter has been challenging enough for the industry; it doesn’t help that the broader macroeconomic environment is uncertain as well. With ongoing talk of a potential recession, tightening access to investor capital and rising interest rates, some crypto and blockchain companies are joining their peers in other industries in exploring cost-cutting measures. While trimming the budget may be a necessary effort, it’s important to do so judiciously. Further, leveraging smart strategies can help companies avoid deep cuts and boost productivity and efficiency. Here, 15 members of Cointelegraph Innovation Circle…

Avalanche introduces ‘Evergreen’ subnets to connect institutions on blockchain

Ava Labs, the developer of the Avalanche layer-1 blockchain platform, is introducing new institutional deployments to improve the blockchain environment. On April 6, Ava Labs introduced Avalanche Evergreen Subnets, a suite of institutional blockchain tooling and customizations designed to address company-specific requirements for financial services. The new product aims to allow institutions to maintain control over their blockchain environment while enabling intercompany communication, Ava Labs’ institutional business development director, Morgan Krupetsky, told Cointelegraph. “Currently, many institutions are building use cases on enterprise blockchains such as Corda, Hyperledger, Quorum or R3, which…

Avalanche’s New Subnet to Offer Blockchain Customization for Financial Institutions

“Institutions can pursue their blockchain strategies in private, permissioned chains with known and approved counterparties, while retaining the ability to communicate with other subnets through Avalanche’s native communication protocol Avalanche Warp Messaging (AWM),” according to the statement. The AWM allows users to data transfer, communicate and asset swap without relying on a third party intermediary, the statement added. Source

Lido Stakers Can Expect Ether Withdrawals ‘No Sooner Than Early May’

CryptoX – Cryptocurrency Analysis and News Portal Lido is the largest decentralized finance protocol with $11.2 billion in total value locked, according to crypto stats website DefiLlama. The price of LDO, Lido’s governance token, currently sits at $2.50, down 6% in the past 24 hours, per CoinGecko. Original Source The post Lido Stakers Can Expect Ether Withdrawals ‘No Sooner Than Early May’ appeared first on CryptoX. CryptoX Portal

Lido Stakers Can Expect Ether Withdrawals 'No Sooner Than Early May'

Lido needs to prepare the launch of its V2 testnet and finalize for the completion of several ongoing security audits of its V2 upgrade, before enabling withdrawals. Source