Amid multiple speculations on the effects of Ripple potentially launching an initial public offering (IPO), popular crypto author Panos Mekras has come out to dispel concerns about this development, yielding a negative effect on the XRP token. Ripple IPO Will Lead To More Exposure For XRP, Mekras Says On Friday, November 3, crypto analyst and trader Mason Versluis shared a screenshot on X in which a crypto enthusiast argued that a Ripple IPO would result in the “death of XRP.” Although the enthusiast did admit that XRP may initially experience…

Day: November 4, 2023

OpenSea rolls out Pro version on Polygon, adds support for cross-chain swaps

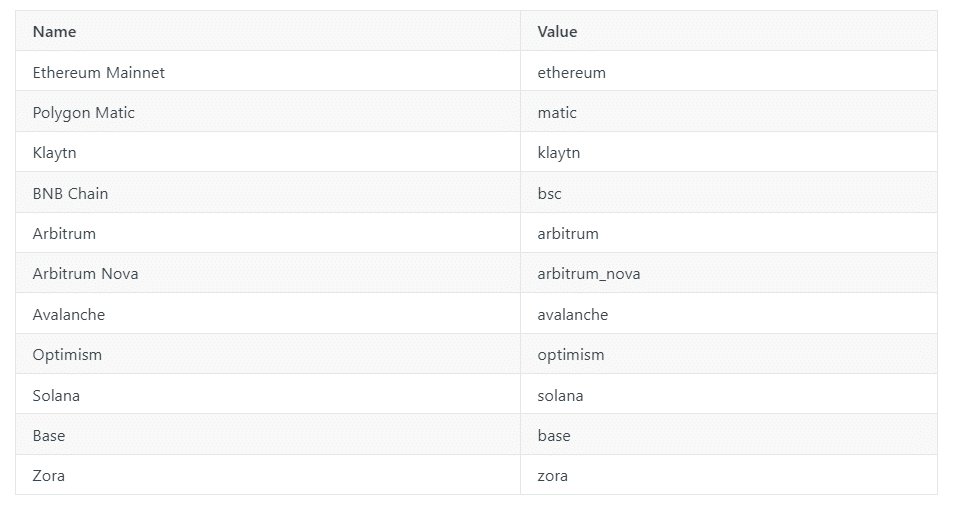

OpenSea, the digital marketplace for non-fungible tokens (NFTs), has expanded its multi-chain presence after releasing the Pro version to the Polygon sidechain. Taking to X on Nov. 2, OpenSea said users can now buy and sell NFTs on different marketplaces and blockchain networks. Moreover, OpenSea has launched a cross-chain bridge feature with Socket, a web3 infrastructure for social interactions on-chain. This feature allows users to send tokens to other chains and swap them “in a single flow.” OpenSea supports various ledgers, offering cross-blockchain compatibility across Ethereum, Polygon, BNB Chain (formerly Binance Smart Chain), Base,…

Coinbase user agreement dispute reaches US Supreme Court

The United States Supreme Court has taken up a legal dispute concerning Coinbase and its users, specifically addressing a significant procedural matter on whether a judge or an arbitrator should decide which contract governs disputes. According to a report from Bloomberg, this issue stems from conflicting agreements between the parties, with one contract advocating arbitration and another supporting courtroom litigation. Coinbase had initially applied arbitration clauses to its clients, but a complication arose with a sweepstakes agreement that directed dispute resolution to California courts. Following allegations of deceptive advertising, customers…

Crypto Pundit Says Expect A Repeat Of Massive 2019 Rally

Partner at the Venture Capital firm Placeholder Capital and prominent figure in the crypto community, Chris Burniske, has given an instance where assets like Bitcoin and Ethereum could see a repeat of what happened in mid-2019. New Highs Before A “Final Wipeout” In a post shared on his X (formerly Twitter) platform, Burniske mentioned that a repeat of mid-2019 could happen if the top two cryptocurrencies, Bitcoin and Ethereum, were to “rip” from their current levels. If that happens, the crypto founder believes that the broader crypto market could follow…

Shiba Inu’s surprise announcement, Ethereum and Everlodge are trending

In crypto, Shiba Inu (SHIB), Ethereum (ETH), and Everlodge (ELDG) have been making headlines, mainly because of their storylines. Shiba Inu recently made a surprise announcement, sparking activity in its community. Meanwhile, ETH continues to edge higher. Amid this, Everlodge is emerging as a new contender in real estate, integrating blockchain technology as it seeks to reshape property investment. Shiba Inu: what’s in store for SHIB? Shiba Inu, a meme-inspired crypto project, recently made a surprise announcement, spurring activity. Though details are scant, the Shiba Inu development team hinted that…

RUNE Rally Hits Barrier: THORChain Price Nears Resistance

THORChain’s price has been up by over 100% since the last week of October, hitting levels not seen since May 2022. This is an amazing increment in price. But caution is advised since RUNE, an altcoin, seems overbought, possibly signaling a 20% drop in the near future. At the time of writing, RUNE was trading at $3.42, climbing over 15% in the last 24 hours, and registering an impressive 37% rally in the last seven days, figures by CoinMarketCap shows. RUNE: Potential To Reverse Bearish Trajectory If RUNE closes above…

LedgerX highlights CFTC regulatory gap in customer asset rules

The U.S. Commodity Futures Trading Commission (CFTC) has focused its attention on how companies handle customer assets. Nevertheless, this fresh regulation does not fully encompass the innovative model of the crypto platform LedgerX, leaving key operational aspects subject to regulatory oversight. Regarding regulations, the recent CFTC proposal seeks to enhance the rules for futures commission merchants (FCMs) and derivative clearing organizations (DCOs). These companies are now required to invest customer funds in highly liquid assets. Nonetheless, this revision does not account for LedgerX’s unique operational model. LedgerX operates as a…

Bluzelle expands into Creator Economy, aims to empower artists

Bluzelle, a layer-1 blockchain platform, has announced its vision to empower innovators in the broader Creator Economy. In an exclusive press release shared with crypto.news, Bluzelle said the Creator Economy will be a diverse market comprising content creators, such as artists, musicians, gamers, social media influencers, and even those leveraging artificial intelligence (AI). Bluzelle aims to provide fitting solutions to safeguard and authenticate their creations. The platform estimates the Creator Economy will be a $480 billion industry by 2027. Of note, Bluzelle’s ecosystem products will play a pivotal role in…

Fraud trial of Mango Markets exploiter behind alleged $116M theft pushed to April

Lawyers representing the $116 million Mango Markets exploiter have convinced a judge to postpone the fraud trial until April 8, 2023. Avraham Eisenberg’s fraud trial was set to commence on Dec. 4 but several circumstances impacted his trial preparations, according to his lawyers, who filed a successful motion for a continuance to District Court Judge Arun Subramanian on Nov. 2. “As discussed in today’s conference, the motion for continuance is GRANTED. Trial in this case will begin on April 8, 2024,” Subramanian stated in a Nov. 3 court filing. U.S.…

Bug in Fed’s payment system prevents bank customers from getting paid

Some of the largest United States banks are not able to facilitate customers deposits after one of the Federal Reserve’s payment systems suffered an outage on Nov. 3. The Federal Reserve said the bug was caused by a “processing issue” in the Automated Clearing House — a payment processing network widely used by banks and employers to deposit wages into employee bank accounts. The ACH is operated by the Federal Reserve Banks and the Electronic Payment Network. Banks stressed customer accounts “remain secure” and the Federal Reserve claims all of…