The Democratic Party of Korea, which holds 167 out of 300 seats in the National Assembly, has made it mandatory for prospective candidates to disclose their digital asset holdings before the 2024 general election. According to the local outlet, News1, the disclosure will be a part of the party’s effort to show the “high moral standards” of its candidates. The chairman of the Democratic Party’s strategic planning committee, Han Byung-do, reportedly stated in a closed-door meeting with journalists: “We have decided to verify whether candidates have conflicts of interest in…

Day: November 14, 2023

Goldman Sachs leads $95M funding round for blockchain payment firm Fnality — Report

Global investment bank Goldman Sachs and French universal bank BNP Paribas have reportedly led a new funding round for Fnality, a blockchain-based wholesale payments firm backed by Nomura Group. Fnality has raised 77.7 million British pounds ($95.09 million) in a second round of funding, Reuters reported on Nov. 13. In addition to Goldman and BNP Paribas, the fund raise involved participation by settlement houses like Euroclear and Depository Trust and Clearing Corporation. Other investors included the global exchange-traded fund firm WisdomTree and Fnality’s existing investor Nomura. There was also additional…

Google sues scammers over creation of fake Bard AI chatbot

Google has filed a lawsuit against three scammers for creating fake advertisements for updates to Google’s artificial intelligence (AI) chatbot Bard, among other things, which, when downloaded, installs malware. The lawsuit was filed on Nov. 13 and names the defendants as “DOES 1-3,” as they remain anonymous. Google says that the scammers have used its trademarks specifically relating to its AI products, such as “Google, Google AI, and Bard,” to “lure unsuspecting victims into downloading malware onto their computers.” It gave an example of deceptive social media pages and trademarked…

Spot BTC ETF Approval Would Bring RIAs, Retirement Funds, More Institutions to Crypto: Coinbase

“The opportunity is potentially much greater than just enabling new capital to access the crypto market,” as ETFs “will ease the restrictions for large money managers and institutions to buy and hold bitcoin, which will improve liquidity and price discovery for all market participants,” wrote David Duong, head of institutional research at Coinbase. Source

Bitcoin ETF optimism sparks bullish run, GFOX and LINK gain momentum

Bitcoin recently surged past $37,000, reaching levels not seen since May 2022. The spike was attributed mainly to a short squeeze, as short investors were liquidated. Market enthusiasm is fueled by growing optimism about U.S. regulators’ potential approval of the first spot Bitcoin ETFs. Amid this optimism, altcoins like Galaxy Fox (GFOX) and Chainlink (LINK) appear to be gaining traction. Examining GFOX Bitcoin plays a critical role in crypto, and the expectation of the first batch of spot Bitcoin ETFs appear to be driving the markets higher. With Bitcoin halving…

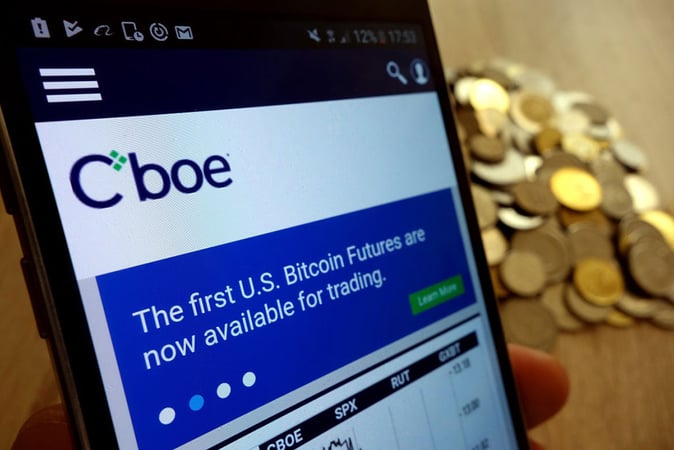

Cboe Digital Set Sight for Bitcoin and Ether Futures Trading in 2024

Cboe Digital’s planned launch of margin Bitcoin and Ethereum futures is set to complement its existing spot crypto market, which includes trading pairs for Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and USDC Cboe Global Markets’ digital asset exchange recently revealed its ambitious plans to revolutionize crypto trading by launching margin futures on Bitcoin (BTC) and Ethereum (ETH) starting January 11, 2024. Cboe Digital to Pioneer Crypto Futures Trading This move positions Cboe Digital as the first US-regulated crypto-native exchange and clearinghouse to facilitate both spot and leveraged derivatives trading on a…

SSV.Network Partners with P2P.org to Roll Out Distributed Validator Technology for Staking

SSV.Network is on the verge of completing its mainnet launch. Once achieved, it will pave the way for a wider rollout of its DVT implementation. Ethereum staking infrastructure protocol SSV.Network has unveiled a major partnership with P2P.org, the non-custodial provider of institutional staking. The deal will see P2P.org integrate the DVT Staking API, bringing Distributed Validator Technology to institutions, who will benefit from a stronger and more distributed validator set. DVT Enters the Market The partnership between SSV.Network and P2P.org will mark one of the largest demonstrations to date of…

Crypto is second most popular investment asset in France: Survey

Cryptocurrencies are the second most popular type of investment asset among the adult French population, according to a survey by the Organisation for Economic Co-operation and Development (OECD) published by France’s principal financial regulator, the Financial Markets Authority (AMF), on Nov. 13. According to the survey, 9.4% of the French population holds crypto assets, which is only marginally lower than those holding the most popular type of investment asset, real estate funds (10.7%). A further 2.8% of respondents possess nonfungible tokens (NFTs). The survey also measured the group of “new investors”…

Terraform Labs Announces Acquisition of Cross-Chain Protocol Pulsar Finance

As part of the deal, Pulsar Finance’s flagship product Portfolio, will undergo integration into Terraform’s Station, a cross-chain wallet. Terra blockchain’s leading developer Terraform Labs announced the acquisition of the cross-chain portfolio management and analytics startup Pulsar Finance. This development arises as Terraform grapples with ongoing legal challenges arising from the demise of the algorithmic stablecoin TerraUSD in May of 2022. A notable legal conflict involves a lawsuit from the United States Securities and Exchange Commission (SEC), filed against Terraform in February. The SEC alleges the sale of unregistered crypto…

Australia to impose capital gains tax on wrapped cryptocurrency tokens

The Australian Taxation Office (ATO) has issued guidance on capital gains tax (CGT) treatment of decentralized finance (DeFi) and wrapping crypto tokens for individuals, clarifying its intent to continue taxing Australians on capital gains when wrapping and unwrapping tokens. In May 2022, the ATO outlined crypto capital gains as one of four key focus areas. Building on the initiative, the Australian taxman recently clarified a raft of actions considered taxable in its jurisdiction. The transfer of crypto assets to an address that the sender does not control or that already holds…