The bill is awaiting presidential approval. Source

Day: November 30, 2023

SEC solicits comments on Fidelity’s spot Ether ETF application

The United States Securities and Exchange Commission (SEC) called on the public to comment on a proposed rule change that could allow asset management firm Fidelity to offer shares of its spot Ether exchange-traded fund, or ETF. In a Nov. 30 notice, the SEC said “interested persons” may comment on the Fidelity offering, proposing the Cboe BZX Exchange list and trade shares of its Fidelity Ethereum Fund. Fidelity first filed for approval of the fund on Nov. 17, becoming one of many firms looking to throw their hats into the…

Shiba Inu L2 Shibarium Crosses 4 Million Transactions As Burn Rate Explodes

Shibarium, the Shiba Inu layer-2 solution, recently reached a new milestone in the past few days, crossing the 4 million total transaction threshold. The launch of Shibarium, Shiba Inu’s layer-2 solution, has been a huge catalyst for the meme coin. At the same time, SHIB’s burn rate has exploded in the last two days, as investors look to push the price of SHIB in a positive direction. Shibarium’s Rapid Growth, Burn Rate Skyrockets In just the past few months, over 4 million transactions have taken place on the Shibarium network.…

Microsoft to invest $3.2B in UK artificial intelligence infrastructure

Microsoft is set to launch a $3.2-billion investment in the United Kingdom for artificial intelligence (AI) infrastructure and training. This marks the company’s largest U.K. investment since it started doing business in the area 40 years ago. .@Microsoft is committed as a company to ensuring that the UK as a country has world-leading #AI infrastructure, easy access to the skills people need, and broad protections for the safety and security.https://t.co/qtTrjH9IS9 — Brad Smith (@BradSmi) November 30, 2023 Artificial intelligence infrastructure Brad Smith, vice chair and president of Microsoft, described the…

MicroStrategy apes $593m into Bitcoin

Michael Saylor’s digital software giant bought 16,130 BTC, increasing the worth of the company’s total Bitcoin holdings to over $6 billion at current prices. MicroStrategy, one of the largest corporate holders of Bitcoin (BTC), bought more of crypto’s leading token by market cap according to founder Michael Saylor and a Nov. 29 filing with the Securities and Exchange Commission (SEC). Saylor’s firm purchased an additional 16,130 BTC at an average price of $36,785 per Bitcoin. This scoop raised MicroStrategy’s total Bitcoin portfolio to some 174,530 coins acquired for $30,252 on…

UK Won’t Excuse Ignorance in the Hunt for Unpaid Crypto Taxes, Experts Say

The government could use a number of different ways to track down crypto tax evaders, CoinDesk was told. Source

Crypto for Advisors: Investing in Web3

Alex Tapscott, author of the recently published book Web3: Charting the Internet’s Next Economic and Cultural Frontier, takes us through Web3 investment opportunities in today’s Advisors. Source

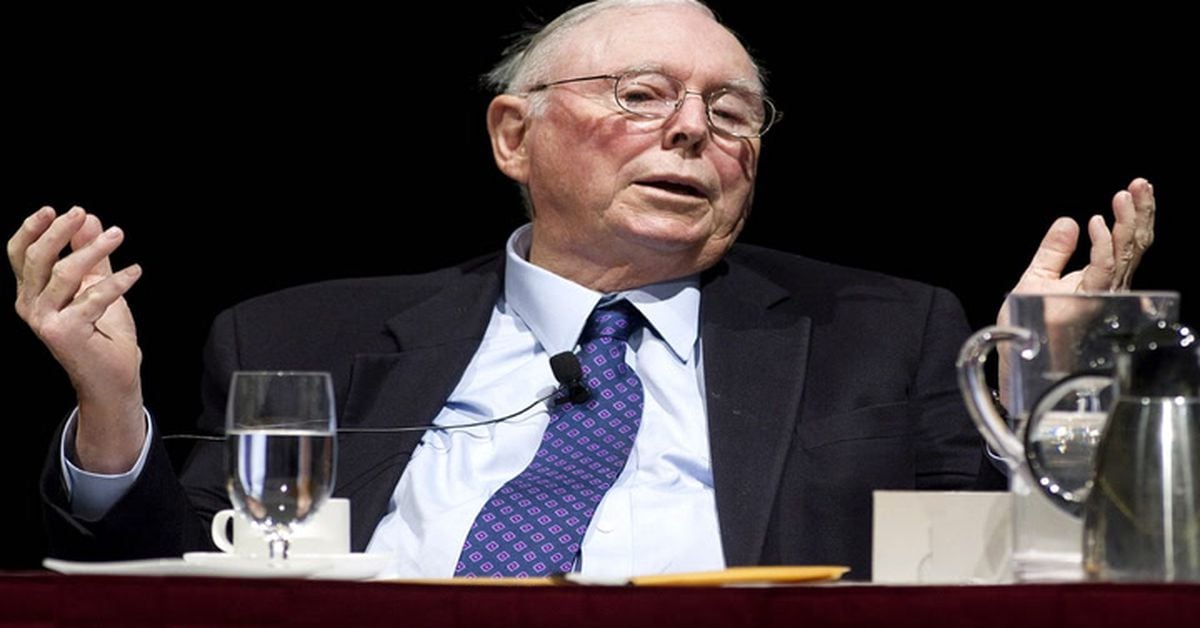

A Suspicious 'Munger' Coin Soars Then Crashes After Billionaire Charlie Munger's Death

A memecoin that was minted 15 minutes after Charlie Munger’s death soared by more than 31,000% before losing 98% of its value over the subsequent 24-hours. Source

Capital flight from Binance subsides: Report

It appears that withdrawals from crypto exchange Binance have largely subsided after its $4.3-billion settlement with the United States Department of Justice last week. Data from blockchain analytics firm Nansen shows that Binance witnessed a net inflow of $87.4 million in Ethereum token deposits in the past seven days. Meanwhile, the net withdrawal of multichain tokens, which includes Ether (ETH), BNB (BNB), Avalanche’s AVAX (AVAX) and Polygon’s MATIC (MATIC), totaled $59.2 million during the same period. In the initial aftermath of the $4.3-billion settlement, Binance users withdrew more than $1…

DeFi, NFT Markets Are Showing Signs of Revival, JPMorgan Says

The Ethereum blockchain does not appear to have profited from this recent revival in DeFi and NFT activity, and faces issues related to its “network scalability, low transaction speeds and higher fees,” and increased competition from other layer-1 chains, the report said. Source