Cointelegraph was on the ground during the second edition of the Madeira Blockchain 2023, held between Nov. 30 and Dec. 1. The event featured regional Web3 developments, as well as how the Portuguese islands are looking for startups and tech talent to grow their economy in the digital age. During a roundtable discussion at the conference, studios working on blockchain features discussed the challenges associated with integrating the technology into games, including acceptance from game developers, players and publishers. Redcatpig is a Web3 studio engaged in developing blockchain features, but…

Day: December 6, 2023

Bitcoin ETF Seed Funding is Just One Step Forward

It’s common for ETF issuers to raise seed capital well ahead of the launch of new products, he reminded. Seyffart also noted that the $100,000 figure is a relatively small one – a more normal amount, he said, would be closer to a couple of million. Source

Investment Giants BlackRock and Fidelity Stir Interest in Spot Bitcoin ETFs Among Professionals

These prospective bitcoin ETF issues have a significant amount of assets under management (we estimate around $16 trillion), so they could have a huge impact on crypto. If only a small percentage of that amount gets invested into bitcoin, the effect would most likely be very significant because, currently, bitcoin exchange-traded products only amount to $38.8 billion of assets, based on our calculations (including Grayscale’s trust). Original

Bitcoin and the Predictability of Crypto Market Cycles

History shows there’s likely a bright year ahead for BTC’s price. Source

US Mortgage Refinance Demand Surges 14% as Interest Rates Hit Lowest Point since August

Mortgage rates are expected to continue their downward trend in December. The US mortgage market is witnessing a resurgence in refinance demand, marked by a substantial 14% increase in applications. According to a CNBC report, this surge is attributed to a recent drop in mortgage rates, bringing them down to their lowest point since August. After a robust 8% rise in October, US mortgage rates are again approaching the 7% mark. This decline is proving to be a catalyst for the refinance market, offering homeowners an opportune moment to revisit…

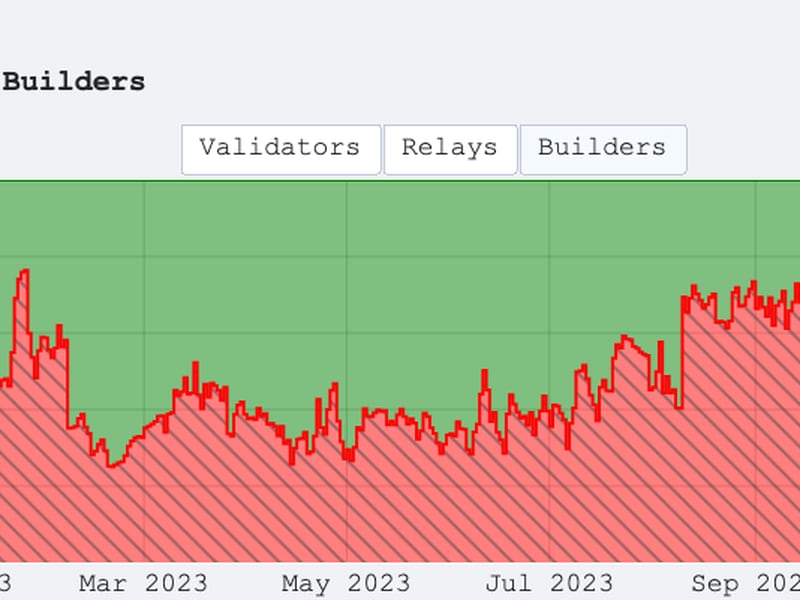

Fewer Transactions Sanctioned by U.S. Government’s OFAC Are Getting Through on Ethereum, Data Shows

This large percentage resulted, in part, from the fact that a small number of relayers were available in MEV-Boost’s early days, and the most popular ones were filtering out OFAC transactions. After a blowback from the Ethereum community, several “non-censoring” relayers entered the MEV-Boost fray, and it looked like the tide was turning back in favor of network neutrality. Today, only 30% of relayed blocks are “censored,” by Wahrstätter’s definition. Source CryptoX Portal

TikTok Parent Company ByteDance to Spend $5B Buying Back Stock

TikTok’s parent company ByteDance plans to spend $5 billion buying back stock from shareholders. This will bring its valuation to $268 billion. As per recent reports, ByteDance, the parent company of TikTok, plans to spend about $5 billion buying back stock from its shareholders. This comes as the company has faced several setbacks in its journey to becoming publicly listed, including the economy back in China and regulatory issues in the United States. ByteDance Buying Back Stock Reports suggest that ByteDance will be offering $160 per share to current holders,…

Buy XRP, not Bitcoin, analyst suggests

The JWK Show’s crypto analyst predicts XRP’s rise and anticipates short-term Bitcoin gains awaiting a possible ETF approval. The analyst revealed he invested personally in XRP, trading around $0.62 at the time of his video. He said he “bought even more XRP” on Dec. 3rd based on specific technical analysis signals. Based on the charts right now, we are expecting XRP to move up. We are expecting XRP to clear these highs at around the $0.71 mark. We’ll see if that plays out. JWK Show Beyond the analyst’s technical analysis,…

Tether (USDT) Cap Approaches $90 Billion: Why This Affects Bitcoin

Data shows that the Tether (USDT) market cap is almost $90 billion. Here’s why this growth could matter for the price of Bitcoin. Tether Market Cap Has Continued To Observe A Rise Recently Tether is a cryptocurrency pegged to the US Dollar, meaning its price remains stable around the $1 mark. The asset is the most famous such “stablecoin” in the sector, with its market cap outstripping any other stable’s. As the market intelligence platform IntoTheBlock pointed out, the largest stablecoin supply has only continued to grow recently. The chart…