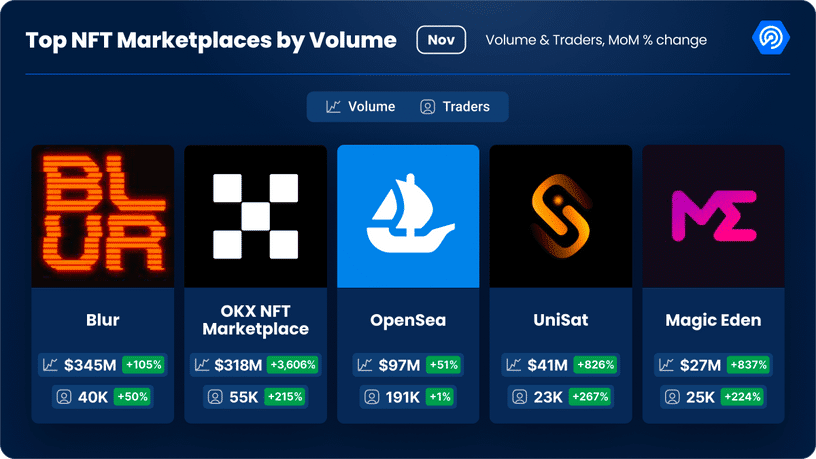

According to data from DappRadar, OKX NFT marketplace secured 32% dominance in the NFT sector, surpassing OpenSea in trading volume. In a blog post on Dec. 7, 202, DappRadar gathered top marketplaces for trading digital collectibles, which allocated the most liquidity in November 2023. According to the data, the Blur marketplace was ranked the top platform, controlling a 35% share of the NFT trading volume and generating $345 million in trades in November 2023. Top NFT trading platforms by volume | Source: DappRadar OKX NFT, a digital marketplace powered by…

Day: December 9, 2023

Swiss arm of BBVA bank taps Ripple-owned Metaco for crypto custody

BBVA Switzerland has migrated its crypto custody services to Ripple-owned infrastructure provider Metaco. Under the collaboration agreement, BBVA Switzerland will be using Metaco‘s Harmonize platform to connect between multiple blockchain networks, according to a press release published on Dec. 7, 2023. With Metaco, the Swiss branch of the BBVA banking group wants to expand its services beyond Bitcoin and Ethereum networks for fund managers and large companies, that need to “explore new business opportunities and opportunities to exchange value in a digital environment,” BBVA Switzerland says. In addition to custodian…

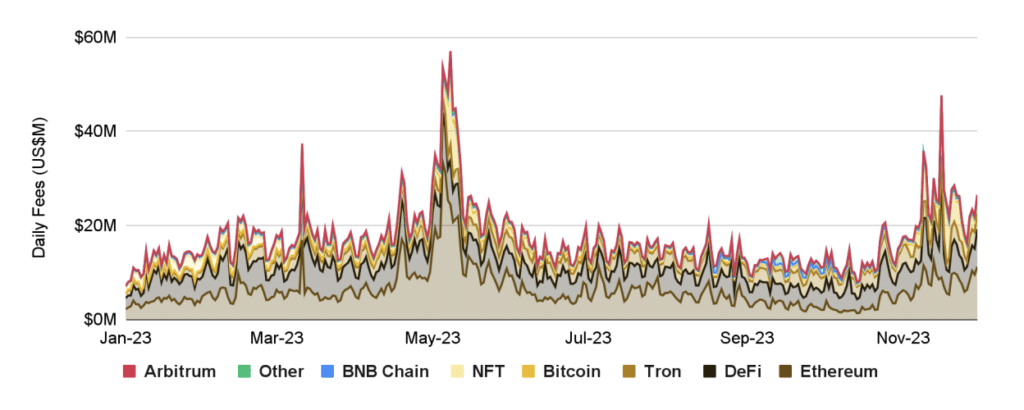

DeFi share in crypto market increases by 18% in November

In November, the decentralized finance (DeFi) sector’s share of the cryptocurrency market increased by 18% compared to last month. November also turned green for non-fungible tokens (NFTs). Trading volumes recently jumped 200%, according to the latest report from Binance Research. Analysts noted that the rate remained from 3.8% to 4.1% throughout the year. However, in November, it began to overgrow. Over the month, the share of the DeFi sector increased by 18% and ended at 4.44%. The main drivers of significant growth were THORChain, PancakeSwap, Uniswap, and Synthetix. Additionally, since…

Fidelity and SEC meet to discuss spot Bitcoin ETF application

The United States Securities and Exchange Commission (SEC) recently met with Fidelity to seek additional clarity on its spot Bitcoin (BTC) exchange-traded fund (ETF) application. According to a filing published on December 7, two Cboe BZX Exchange representatives, along with six personnel from the SEC and nine individuals from Fidelity, discussed the workings of the Wise Origin Bitcoin Trust in a meeting. “The discussion concerned Cboe BZX’s proposed rule change to list and trade shares of the Wise Origin Bitcoin Trust under Cboe BZX Rule 14.11(e)(4). Fidelity also provided the…

Chainlink Staking Program Exceeds Expectations, Drives LINK Price Up By 12%

In a significant development for the blockchain data-oracle project, Chainlink (LINK) has witnessed a significant response to its enhanced crypto-staking program, amassing over $632 million worth of its LINK tokens within a remarkably short period. The company announced a recent press release highlighting the “overwhelming demand” during the early-access period, which filled the staking limit in just six hours. Chainlink Unveils Staking v0.2 Chainlink, recognized as the industry-standard decentralized computing platform, unveiled Chainlink Staking v0.2, the latest upgrade to the protocol’s native staking mechanism. The Early Access phase has commenced, inviting…

YieldMax files for ETF focused on MicroStrategy derivatives

YieldMax, a firm specializing in exchange-traded funds (ETFs), has filed to launch a novel yield-bearing ETF based on shares of Michael Saylor’s Bitcoin (BTC) holding company, MicroStrategy. According to a Dec. 7 filing with the U. S. Securities and Exchange Commission (SEC), the proposed ETF, named Option Income Strategy ETF, is scheduled for a 2024 release and will trade under the ticker MSTY. This ETF employs a “synthetic covered call” strategy, which involves a combination of buying call options and selling put options to generate income. This income is then…

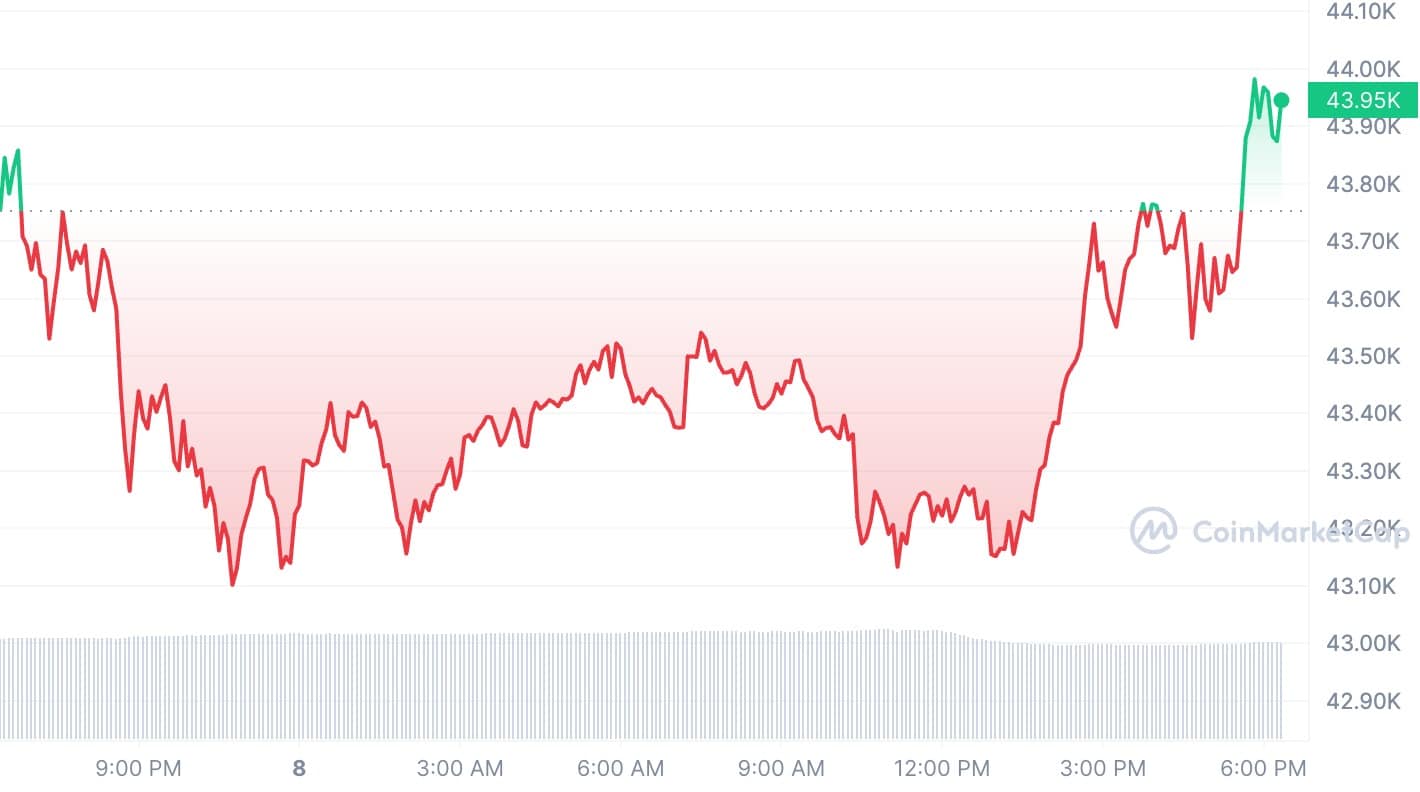

Bitcoin and Ethereum Fees Rise By Over 50%: Will BTC Conquer $69k?

There is a spike in crypto on-chain activity if transaction fees lead. According to IntoTheBlock data on December 8, Bitcoin transaction fees are up by over 60%, while “gas” in Ethereum has climbed by nearly 50% in the past week. Bitcoin And Ethereum Transaction Fees Rise By Double-Digits This surge in activity can be pinned to multiple factors, mainly growing user interest and the ongoing crypto bull market. To illustrate, Bitcoin and Ethereum prices are trending at 2023 highs above $43,500 and $2,300 when writing. Even so, the crypto community expects…

Tether treasury’s $60m transfer to whale sparks scrutiny

Lookonchain, a web3 data analysis tool that tracks whale activity, shared a post on X that one fund or institution had secured $60 million in USDT from the Tether Treasury. This brings the total to $1.76 billion USDT received from Tether Treasury and subsequently funneled into exchanges since Oct. 20. As part of the post, Lookonchain puts these numbers into perspective, highlighting the sum is enough to acquire 44,000 Bitcoin (BTC) at an average price of $40,000. On Nov. 22, Lookonchain also reported significant Tether treasury transactions, revealing that Tether…

SEC’s “Crypto Asset Securities” Alert Boosts Spot Bitcoin ETF Prospects

As anticipation builds for the long-awaited approval of a spot Bitcoin ETF by the US Securities and Exchange Commission (SEC), an encouraging sign has emerged, further increasing the likelihood of approval. The SEC issued an investor alert regarding “crypto asset securities,” prompting speculation that the spot Bitcoin ETF may be closer than ever. Spot Bitcoin ETF Approval On The Horizon? The recent investor alert issued by the SEC has garnered significant attention in the cryptocurrency community. While the alert does not explicitly mention the spot Bitcoin ETF, many market participants…