As the crypto market braces for the Federal Reserve’s decision, traders are showing caution, evidenced by a 40% drop in trading volume over the last 24 hours. Bitcoin (BTC), the world’s leading cryptocurrency, finds itself in a period of consolidation around the $41,000 price mark, as traders eagerly await the Federal Reserve‘s interest rate decision, scheduled for today. Bitcoin’s Price Movement Bitcoin’s recent journey in the market has been characterized by volatility, with the price rebounding from a low of $40,200 to $42,000 before settling at around $41,300. Despite the…

Day: December 13, 2023

Bitcoin Has Gifts This Holiday Season

This shift might ruffle some feathers, straying from crypto’s original ethos as an alternative to mainstream finance. But, hey, it’s what’s revving up excitement again. And it’s not just Wall Street driving this. Macro factors like the potential end of the U.S. interest rate hiking cycle, Middle East tensions and the specter of long-term inflation are nudging investors toward safer harbors, including crypto, as BlackRock’s Larry Fink’s “flight to quality,” comment suggested. Funny how a former crypto-skeptic like Fink is now singing Bitcoin’s praises on national TV, huh? Original

Coinbase Launches Spot Trading of Bitcoin and Ether Outside the U.S.

The move came at a time where regulators in the U.S. started to heavily crack down on crypto companies, including Coinbase itself, which was sued and is still under investigation by the Securities and Exchange Commission (SEC) for allegedly violating federal securities laws. The exchange has moved to dismiss those allegations. Source

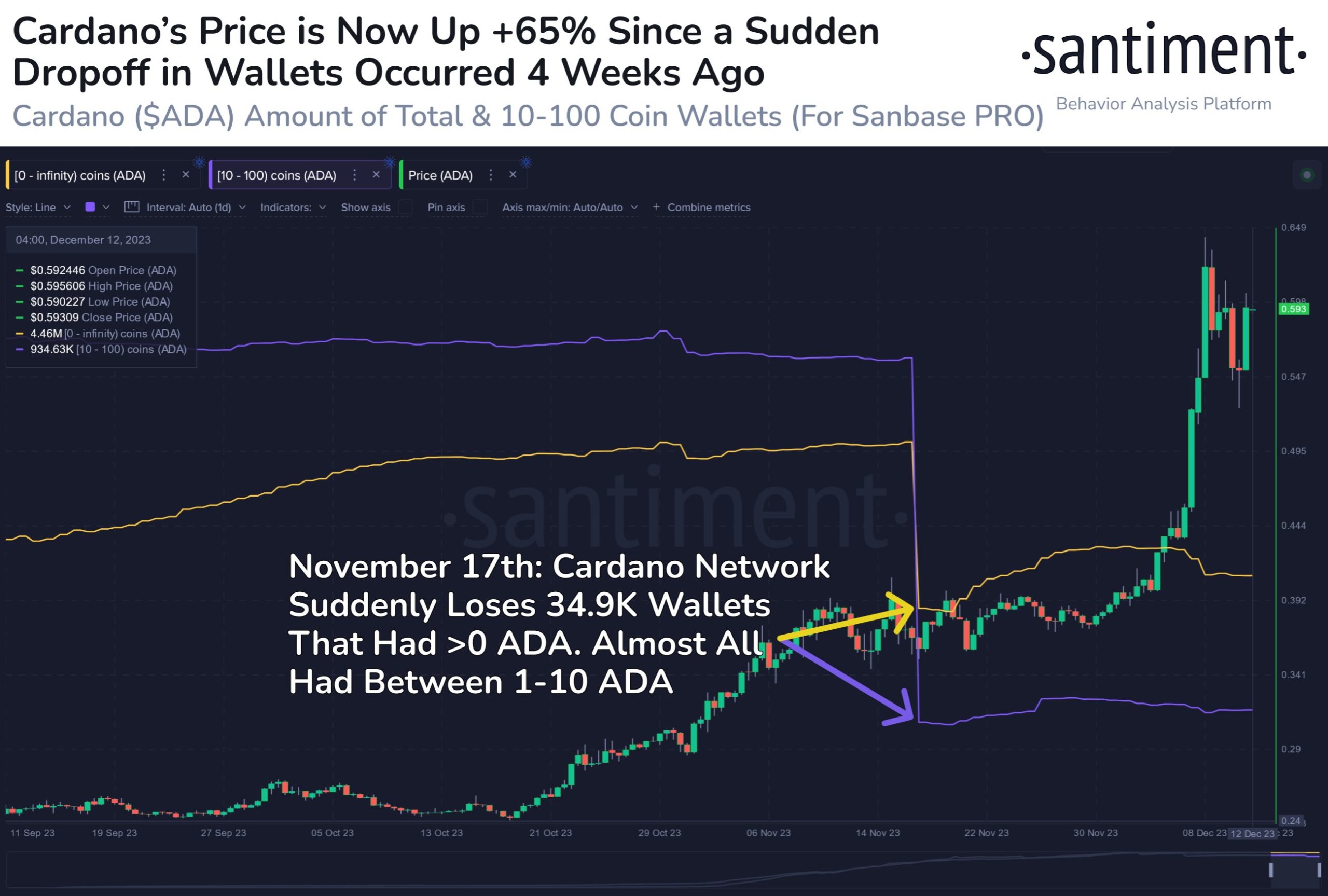

Santiment Points Out Trigger Behind 65% Cardano Rally

The on-chain analytics firm Santiment has revealed a Cardano pattern that may have contributed as a trigger for the recent 65% rally in ADA’s price. Cardano Observed A Sudden Loss Of Wallets Prior To Rally As explained by Santiment in a post on X, ADA witnessed a large number of small wallets clear themselves out last month. The relevant indicator here is the “Supply Distribution,” which keeps track of the total amount of Cardano wallets that belong to the different groups in the market. The wallets or investors are categorized…

FASB Confirms 'Fair Value' Approach for Corporate Crypto Holdings

The Financial Accounting Standards Board, a U.S. entity that details how companies should report assets on their balance sheet, published a standards update on Wednesday that will let corporations recognize “fair value” changes in crypto holdings. Source

USDT Ranked 4 out of 5 in New Stablecoin Stability Assessment From Ratings Agency S&P Global

“As we look to the future, we see stablecoins becoming further embedded into the fabric of financial markets, acting as an important bridge between digital and real-world assets,” Lapo Guadagnuolo, a senior analyst at S&P Global Ratings said in a statement. “Nonetheless, it’s important to acknowledge that stablecoins are not immune to factors such as asset quality, governance, and liquidity.” Source

Coinbase launches spot crypto trading on international exchange

Coinbase is introducing spot cryptocurrency trading on its international exchange, marking a significant step towards its global expansion strategy. Starting Dec. 14th, institutional traders can engage in Bitcoin (BTC) and Ether (ETH) transactions, paired with the USDC stablecoin. Greg Tusar, who leads institutional product development at Coinbase, emphasized the strategic importance of offering both spot and derivatives trading concurrently in an interview with Bloomberg. We are excited to announce the next phase of our Coinbase International Exchange expansion – the launch of non-US spot markets for eligible customers, designed to…

Argentina's Milei, So Far Shunning Bitcoin, Devalues Peso by More Than 50%

The government’s official rate is now 800 pesos to the dollar versus 400 previously. Original

Turkish Banks Akbank, Garanti Go Big on Crypto as Legislation Looms

(CoinDesk Turkey) – Turkey’s government is gearing up to introduce new legislation for the crypto sector. It’s still unclear how restrictive the new laws might be, but it hasn’t spooked adoption even at the institutional level. This week, two of Turkey’s largest banking groups announced crypto initiatives. Source

Crypto.com Inks MOU Deal with Singapore Charities to Accept Crypto Donations

The collaboration not only supports traditional fundraising methods but also aligns with the changing digital ecosystem, challenges with governance, and the evolving nature of fundraising in the non-profit sector. Just in time for the giving season, Crypto.com, a Singapore-based digital assets trading platform, that recently secured regulatory approval in the UK has inked a Memorandum of Understanding (MOU) with six major charities in Singapore to help facilitate the acceptance of donations in cryptocurrencies. Crypto.com Empowering Charities Through Digital Innovation The six charities involved in this groundbreaking partnership are CARE Singapore,…