Over the past few weeks, the Web3 industry has witnessed a surge in funds from major capital firms, indicating a strong belief in the growth of this emerging economy. GBA Capital Fund, one of China’s leading venture capital companies, has announced the launch of a $10 billion investment fund dedicated to the Web3 ecosystem. According to local news media, the company announced during the just-concluded blockchain conference, the Guangdong-Hong Kong-Macao Greater Bay Area Digital Economy Development Conference held on December 26. Supporting Innovation Across Web3 The $10 billion investment fund…

Day: December 28, 2023

MicroStrategy Spends Another $615 Million On Bitcoin, Do They Know Something You Don’t?

In a strategic move that has effectively caught the attention of the crypto space, Microstrategy has once more fortified its Bitcoin portfolio, strengthening its position as the largest corporate holder of BTC globally. MicroStrategy Boost BTC Holdings In a recent filing on December 27, the United States Securities and Exchange Commission (SEC) announced that business intelligence software company, Microstrategy has increased its Bitcoin holdings by 14,620 BTC valued approximately at $615.7 million. “On December 27, 2023, MicroStrategy Incorporated (“MicroStrategy”) announced that, during the period between November 30, 2023, and December…

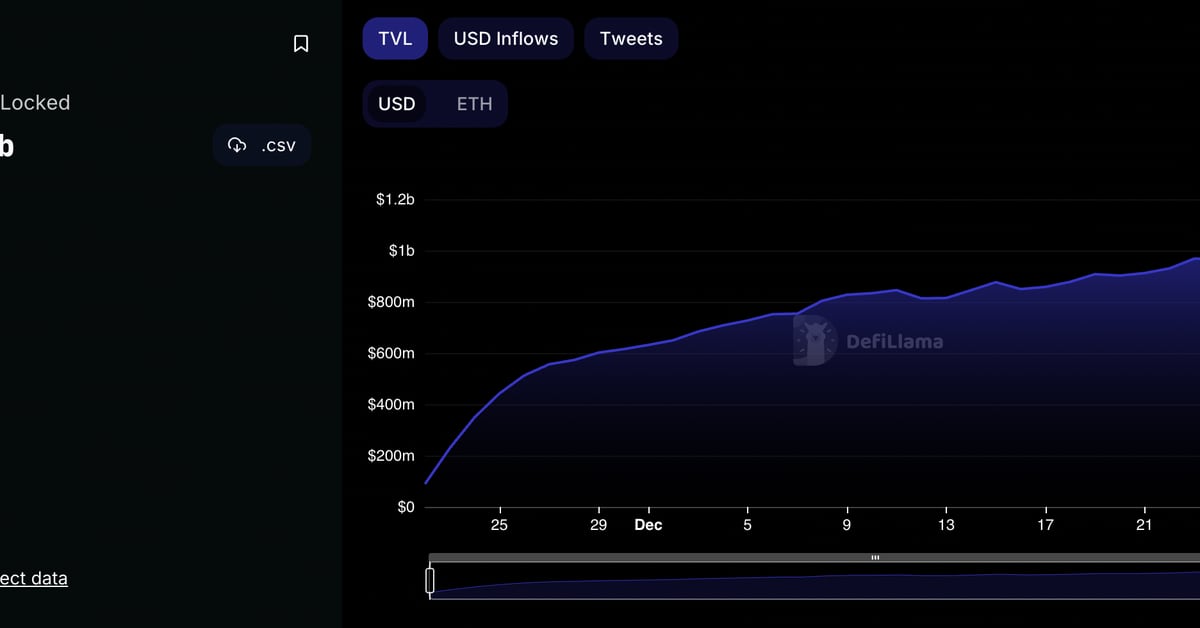

Blast Hits $1.1B in Deposits More Than a Month Before It’s Due to Go Live

It’s worth noting that crypto asset prices have surged across this board this year. Bitcoin (BTC) has risen more than 150% to around $43,000 while ether (ETH) has doubled to $2,400. The increase has spurred a wave of optimism across investors, which is highlighted by the rapid rise of projects like Blast. Source

Cathie Wood’s ARK Invests in ProShares Bitcoin ETF After Dumping GBTC Holdings

The ProShares exchange-traded fund, which started trading in October 2021 as the first U.S. bitcoin-linked ETF, now accounts for 5.03% of the ARK Next Generation Internet ETF (ARKW), its sixth-largest holding. The fund no longer holds any GBTC shares, with the last reported sale on Dec. 20. At just under 12%, Coinbase remains the fund’s largest holding even after Wednesday’s sale of 148,885 shares. Original

MicroStrategy Buys $615M Worth of Bitcoin, MSTR Stock Outperforms BTC 2:1

Analysts are characterizing MicroStrategy’s stock as akin to an “essentially a leveraged Bitcoin ETF” due to its exposure to the cryptocurrency. In the latest announcement on Wednesday, December 27, MicroStrategy Inc (NASDAQ: MSTR) acquired an additional 14,620 Bitcoins in the past month, spending $615.7 million at an average price of $42,110 per bitcoin, as outlined in a recent Form 8-K filing on its website. After MicroStrategy’s purchase, the Bitcoin (BTC) price has surged past $43,000 as of press time. As per the filing, MicroStrategy conducted the purchases between November 30…

Bitcoin Rally in 2023 Helped Crypto Firms to Contribute to Wall Street

Bitcoin mining inherently involves high energy costs due to the operation of supercomputers. The world’s largest cryptocurrency Bitcoin (BTC) made substantial gains surging by 160% this year in 2023. The rally in Bitcoin and the broader crypto market has also helped some of the US-listed crypto companies recover from the wounds of the 2022 crypto winter. While Bitcoin experienced a notable 150% rally throughout the year, shares of Coinbase, MicroStrategy, and the Grayscale Bitcoin Trust, closely linked to the digital currency, performed even more impressively, surging over 300% in value.…

Indonesian Crypto Exchanges Must Register With National Digital Asset Bourse or Face Shutdown

“There is a deadline for prospective crypto exchanges. If they do not register by the specified time, they will automatically be unable to operate in Indonesia,” Robby said, adding that the deadline is Aug. 17, 2024. If they want to continue operating, crypto exchanges must also obtain licenses, Robby said. Source

PancakeSwap Proposes to Reduce CAKE Token Supply by 300 Million

“With a current circulating supply of 388 million CAKE, the team believes this new and lower cap will be sufficient to gain market share across all chains and sustain the veCAKE model,” Chef Mochi, head of PancakeSwap, said in a Telegram message. Source

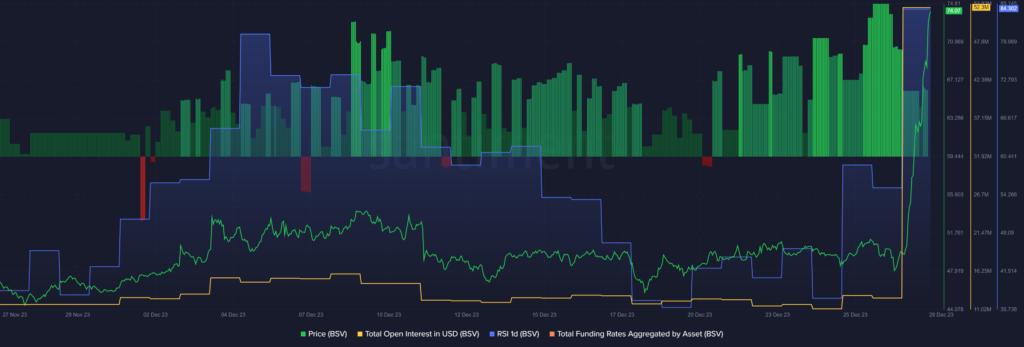

BSV rallies 66%, reaching 21-month high

Bitcoin SV’s (BSV) recent rally helped it reach a 21-month-high of $93.7 — a level last seen in early April 2022. BSV is up 66% in the past 24 hours and is trading at $91 at the time of writing. The asset’s market cap surged to $1.76 billion, making it the 51st-largest cryptocurrency. Data shows that BSV’s daily trading volume recorded a 617% rally, reaching $652 million. BSV price, open interest, funding rate and RSI – Dec. 28 | Source: Santiment Data from CoinGecko shows that the majority of Bitcoin…

$2 In Sight? Mina Protocol’s 47% Growth Raises Price Target Hopes

In the whirlwind landscape of cryptocurrency, the Mina Protocol has taken center stage with an extraordinary 47% surge in its native token, MINA, within the past week. Currently riding high at $1.40, a level not witnessed since May 2022, MINA’s impressive rally has ignited contemplation among investors: Can it breach the elusive $2 mark in the immediate future? MINA price action today. Source: Coingecko Mina’s Surge: CEO Appointment And Swiss Relocation This surge in MINA’s value is not a mere coincidence; it’s the result of a convergence of significant developments…