Blackrock’s spot bitcoin exchange-traded fund (ETF), the Ishares Bitcoin Trust (IBIT), single-handedly offset Grayscale’s bitcoin ETF outflow of $600 million on Thursday. Blackrock’s bitcoin ETF has broken both its trading volume and inflow records this week. The fund’s crypto holdings have risen to 161K bitcoins. Blackrock Continues to See Massive Inflows Blackrock’s spot bitcoin exchange-traded […] Original

Day: March 1, 2024

Analyst Forecast Bullish Movement Ahead

XRP witnessed an uptick this week moving closer to its 2024 high, but several trends have been cited by crypto analysts that could drive the token even higher in the coming months. XRP Poised For A Positive Upward Trajectory Crypto Egrag, a well-known cryptocurrency expert and trader, has shared his latest insights on the price action of XRP with the community on the social media platform X (formerly Twitter). His analysis came in light of the general correction witnessed in the crypto market a few days back. Egrag’s latest predictions delve…

Theta Capital Management B.V. Announces $200M Theta Blockchain Ventures IV Fund

Theta Capital introduces a new $200M fund, Theta Blockchain Ventures IV, targeting early-stage blockchain infrastructure. Theta Capital Management B.V., a leading global investor in blockchain venture capital funds, has launched Theta Blockchain Ventures IV, a significant new fund aimed at investing in the foundational infrastructure of blockchain technology. With a targeted total of $200 million in commitments, the fund marks a strategic move to capitalize on what Theta Capital views as a generational investment opportunity within the blockchain sector. Theta Capital has a history of deploying over $650 million in…

Blast, Hyped Layer-2 Chain, Sees Most Deposits Bridge to Yield Manager

CORRECTION (19:08 UTC): An original version of this story misinterpreted data from DefiLlama to suggest that most of the funds in the original Blast deposit contract were withdrawn immediately after the network’s launch this week. The funds were indeed withdrawn from the Blast contract, but further analysis shows that most of the funds were just moved to a new address associated with Blast’s mainnet, not withdrawn from Blast entirely. Source

Blast, Hyped Layer-2 Chain, Sees Most Deposits Leave Within 1 Day of Going Live

The controversial layer-2 network had taken $2.3 billion in deposits since November as it prepared for launch, but within 24 hours of going live, that figure had dwindled to $650 million. Source

Crypto Analyst Reveals Why Most Realistic XRP Price Lies Between $13 And $39

The future of the XRP price has been a hot topic of contention among crypto analysts for a while now. Most of these analyses focus on the possible movements of the price as the bull market unfolds, as well as possible price targets. In the same vein, crypto analyst CryptoBull has presented their own bull case for the altcoin, giving the most realistic price targets. Long Time Price Channel Shows Realistic Price In the analyst CryptoBull posted on X (formerly Twitter), he shows the historical price movement of the altcoin…

Study: Institutions More Bullish on Ethereum in H2 of 2023 — BTC and ETH Holdings Surge to 80%

Between July 2023 and January 2024, the concentration of bitcoin and ethereum in institutional digital asset portfolios increased from 50% to 80%, the latest Bybit user asset allocation report has shown. During this period, institutions appeared to be more bullish on ethereum than bitcoin, a sentiment that contrasted with that of retail investors. Stablecoins and […] Source CryptoX Portal

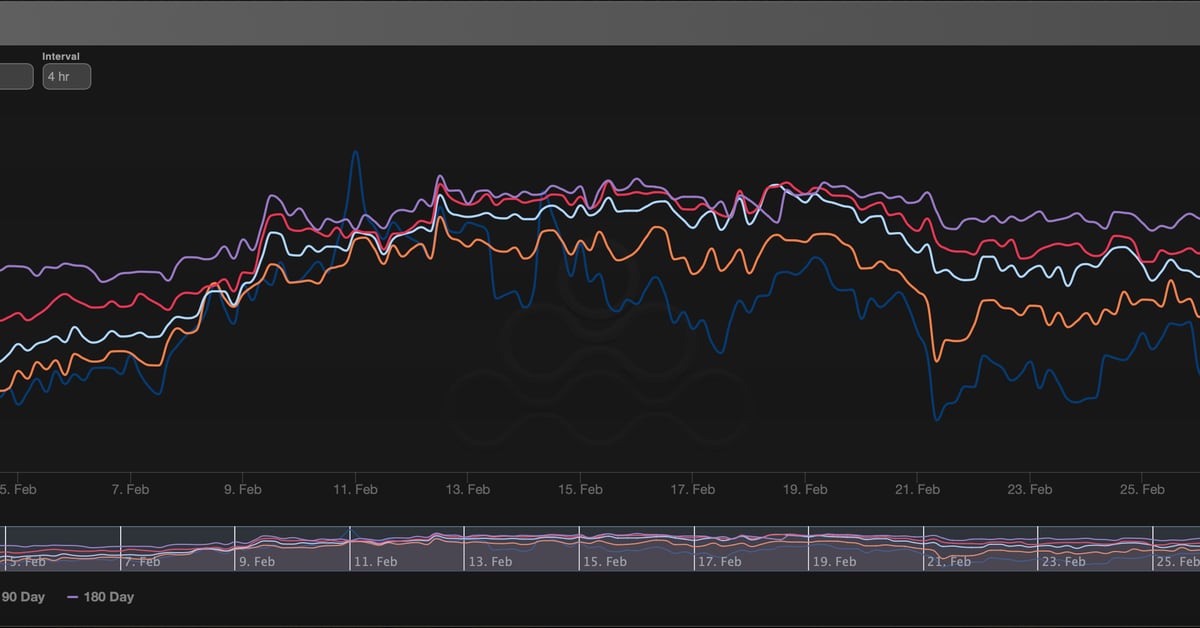

Is Bitcoin Rallying Ahead of Schedule?

Bitcoin (BTC) has gained over 40% in four weeks and is just 10% short of challenging its record high near $69,000. The surge is consistent with the cryptocurrency’s record of rallying ahead of and after the quadrennial mining reward halving. That said, bitcoin call-put skews, which measure the cost of call options relative to puts over different maturities, suggest investors’ bullish expectations have materialized too soon. Data tracked by Amberdata show longer-duration call-put skews no longer exhibit a stronger call bias than short-duration skews and both have converged at around…

Bitcoin Technical Analysis: BTC’s Bullish Rise Continues Amidst Market Optimism

Over the past hour, as bitcoin’s value swings from $62,150 to $62,545 on March 1, 2024, the cryptocurrency market is experiencing a pronounced upward trend. With a trading volume of $55.41 billion over 24 hours and a market cap touching $1.21 trillion, bitcoin’s dominance in the market is clear. Technical indicators, including oscillators and moving […] Original

OKLink Reveals $103M Blockchain Losses in February 2024

OKLink’s February 2024 report details $103M in crypto losses, highlighting the critical need for heightened security measures. The blockchain industry faced significant security challenges in February 2024, as reported by OKLink in a recent review. The cumulative losses across the network approximated a staggering $103 million USD, with phishing scams contributing to 11.76% of these losses, according to the OKLink Security Incident Review. The report highlighted that official social media accounts experienced 37 scams and phishing incidents, mainly concentrated on platforms like Twitter and Discord. These security breaches underscore the…