South Korean financial regulators are currently in discussions about potentially allowing spot Bitcoin exchange-traded funds (ETFs) within the country. Lee Bok-hyun, serving as the governor of the Financial Supervisory Service (FSS), revealed ongoing discussions within South Korea’s regulatory bodies. In a recent radio interview, he highlighted that authorities are contemplating the approval of Bitcoin Spot ETFs, with Lee pointing out the mixed opinions within the regulatory bodies. He emphasized ann optimistic stance towards virtual assets against a backdrop of more cautious perspectives from other officials. The discussion around the approval…

Day: March 5, 2024

Binance Will Discontinue Its Nigerian Naira Services After Government Scrutiny

Two Binance executives were recently detained in the country, and the exchange’s CEO Richard Teng, has been summoned to appear before a committee. Source

Deutsche Boerse Starts Regulated Crypto Trading Platform DBDX

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…

Stanford University’s Blyth Fund buys Bitcoin (BTC)

Stanford University’s Blyth Fund has committed 7% of its portfolio to Bitcoin (BTC). The endowment purchased BTC for $45,000 token. Stanford’s Blyth Fund, under the leadership of Computer Science Major Kole Lee, has embraced Bitcoin as a pivotal element of its diversified investment portfolio. This comes alongside BlackRock’s SEC filing to incorporate Bitcoin exposure, signalling a paradigm shift in institutional attitudes toward cryptocurrencies. Stanford’s decision reflects the broader trend of institutional interest in digital assets, as BlackRock moves to integrate Bitcoin into its $36.5 billion Strategic Income Opportunities Fund. Kole…

Tether announces USDT migration tool in a bid to safeguard against blockchain network failures

Major stablecoin issuer Tether has launched a recovery tool designed for migrating its USDT stablecoin across different blockchains. According to a March 4 announcement, the tool aims to safeguard continuous access to USDT (Tether stablecoin) in the face of potential disruptions across the multiple blockchain networks it operates on. USDT’s architecture, per Tether, is notably independent of any specific blockchain, relying on them purely as a means of transmission. This design philosophy enables its presence on approximately 15 blockchains, such as Bitcoin, Ethereum, Polygon, Solana, Tron, and Tezos. However, network…

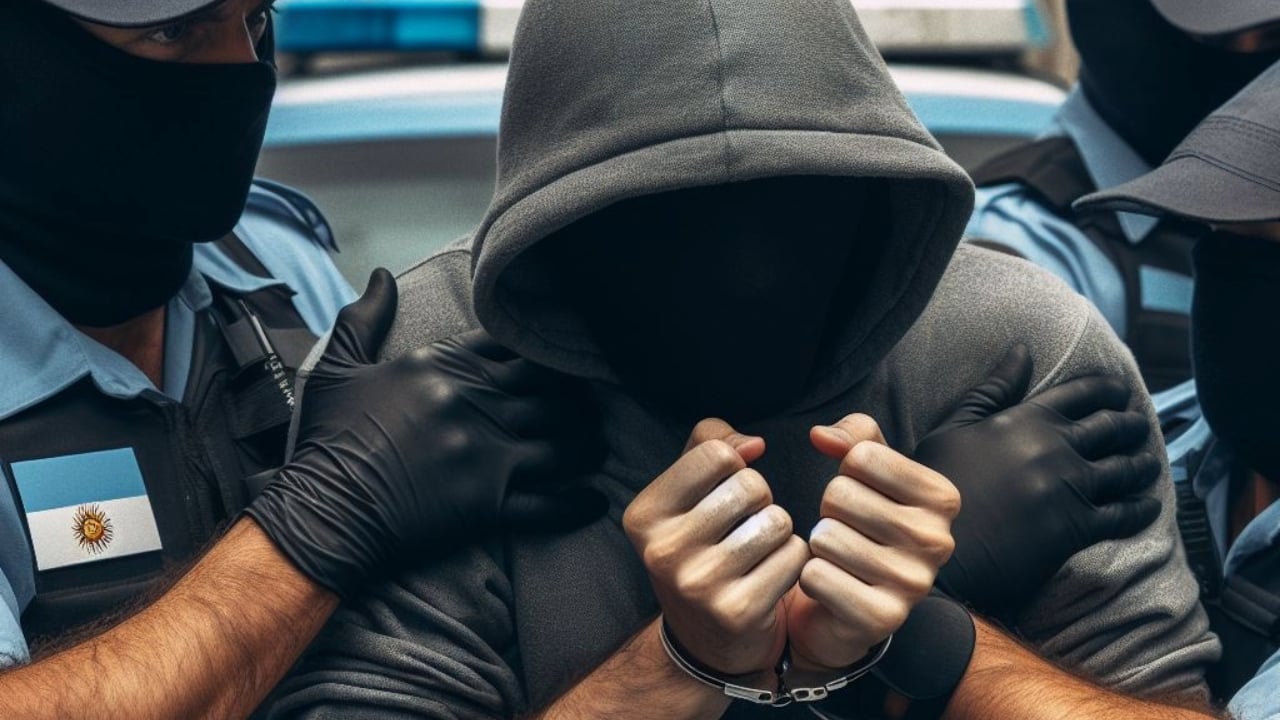

Founders of $400 Million Cryptocurrency Ponzi Scheme Arrested in Argentina

Two individuals, a woman and a man, were captured in Argentina on charges of having perpetuated a Ponzi scheme that moved over $400 million in cryptocurrency in Brazil. The operation managed to track the couple’s whereabouts with the help of the Argentine Federal Police and Interpol. Argentina Captures Couple Accused of Orchestrating a $400 Million […] Source

Fantom Foundation Seeks to Wind Up Multichain to Recover Funds Lost in $200M Exploit

The foundation, which said it won a default judgment in Singapore in January when Multichain failed to respond, is now seeking to liquidate the company, a process that’s equivalent to a Chapter 7 bankruptcy in the U.S., so that any assets can be recovered and distributed. Source

Bitcoin trade volume hits highest level since 2021, Kaiko says

Even though Bitcoin has not yet reached its all-time high, its daily trade volume has already exceeded $40 billion, the highest level since the May 2021 sell-off. The daily trading volume of Bitcoin (BTC) has reached its highest level last seen in three years ago as BTC is continuously climbing to its all-time high, Kaiko revealed in a recent research report. According to the published data, Bitcoin’s daily trade volume exceeded $40 billion in early March, surpassing its previous peak hit in the aftermath of the FTX collapse in November…

Hong Kong to Kickstart New Web3 and Digital Yuan Initiatives This Year

The city of Hong Kong has detailed the advancement of new Web3 and digital yuan initiatives as part of its 2024-2025 budget. In a speech, Hong Kong Financial Secretary Paul Chan stated that the city would expedite a Web3 sandbox for stablecoins and expand the digital yuan pilot as part of its digital finance policies. […] Source CryptoX Portal

Spot Bitcoin ETFs start the week strong, attracting $562 million in inflows

Spot Bitcoin ETFs began the week on a strong note, attracting over $562 million in inflows on Monday amid the impressive Bitcoin (BTC) market run that has seen the asset surge 21% over the past week. BitMEX Research disclosed this in its latest update on capital flows into the Bitcoin ETF market. Data confirms that the entire market saw an influx of 8,377 BTC tokens valued at $562.7 million on March 4 despite the Grayscale Bitcoin Trust (GBTC) sustaining its trend of capital outflows. [1/4] Bitcoin ETF Flow – 04…