Deutsche Börse Group has taken a significant step into the realm of digital assets by introducing the Deutsche Börse Digital Exchange (DBDX), a regulated spot trading platform for cryptocurrencies tailored to institutional clients. DBDX fills a gap in the market by offering a fully regulated and secure ecosystem for trading, settlement, and custody of cryptocurrencies. It leverages the existing connectivity to market participants, providing clients with a comprehensive suite of innovative and secure financial solutions for digital assets from a single point of access across the value chain. Initially, trading…

Day: March 5, 2024

Grayscale’s GBTC sees 33% reduction in Bitcoin holdings amid $9.26b outflows

Grayscale, the world’s largest crypto asset manager, has seen nearly a third of its Bitcoin holdings withdrawn since converting its Bitcoin Trust (GBTC) into an ETF on Jan. 10. As of March 4, GBTC witnessed its 36th consecutive day of outflows, with 5,450 BTC, equivalent to $368 million, exiting the trust. This brings the total outflow since the conversion to an astounding $9.26 billion, BitMEX Research reports. 5,450 Bitcoin of GBTC outflow today Total GBTC outflow since 11th Jan 2024 is 202,874 Bitcoin This is a decline in Bitcoin holdings…

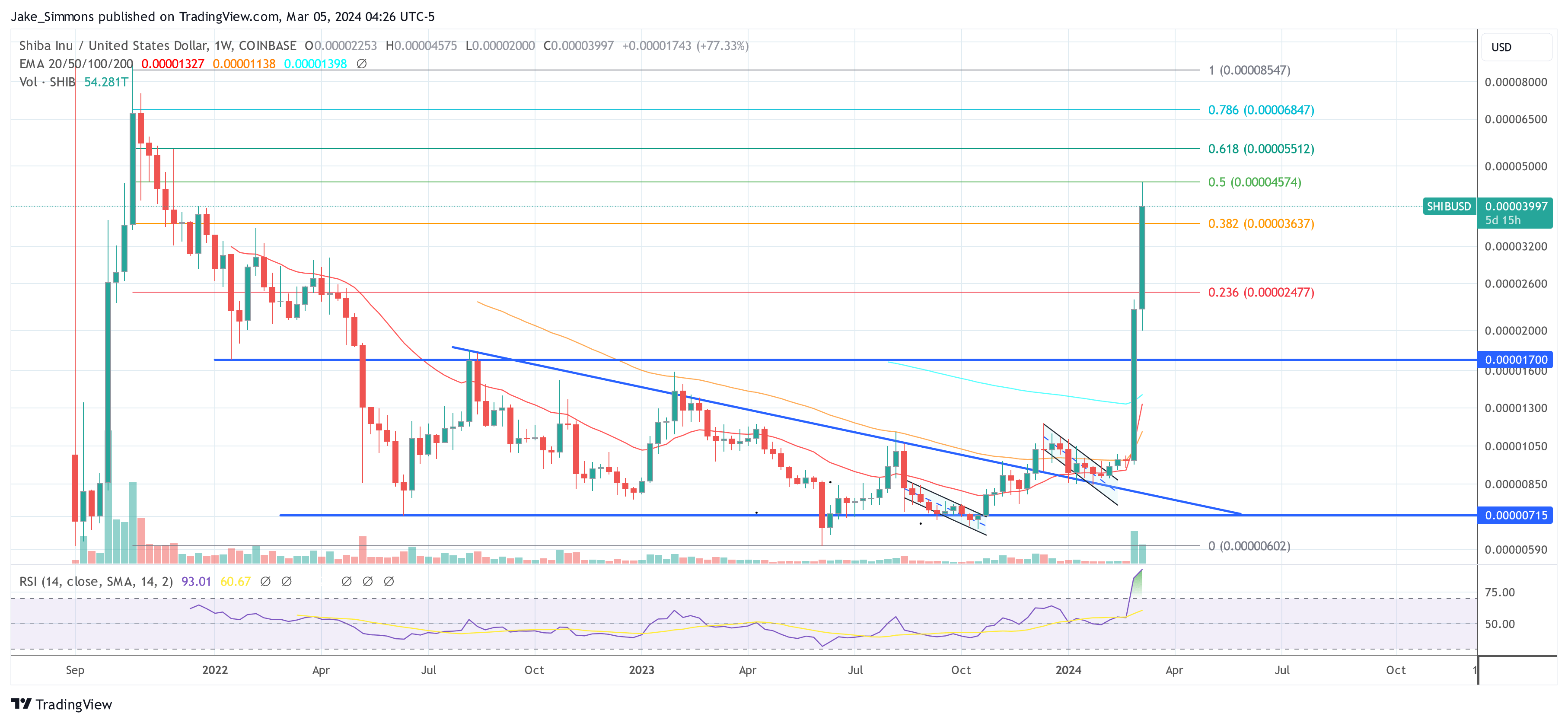

Shiba Inu Price Skyrockets Past $0.000045: Here’s Why

The Shiba Inu price is going absolutely parabolic these days. Within the last 9 days, the SHIB price surged by more than 380%. Today, SHIB marked a two-year high at $0.00004574. Although the price suddenly dropped below $0.00002, marking a 54% within 2 hours, the price already recovered to above $0.000038. Here are four reasons driving the Shiba Inu price: #1 Bitcoin’s Rally And Its Implications For Altcoins Bitcoin’s price rally, particularly after the US Securities and Exchange Commission’s (SEC) approval of spot Bitcoin Exchange-Traded Funds (ETFs) in January, has…

Baanx Raises $20M in Series A Funding From Ledger, Tezos, Chiron, British Business Bank

The investment round, which included Ledger, Tezos, Chiron and British Business Bank, brings the crypto payment enabler’s total funding to over $30 million. London-based Baanx, which runs the Ledger card product, recently signed a three-year partnership with Mastercard for the U.K. and Europe. Source

Shiba Inu Prices Briefly Dropped 50% on Coinbase

The tokens have logged over $1.7 billion in volumes on the regulated exchange in the past 24 hours, the most among counterparts. Source

Bitcoin ETF Issuer VanEck Has Huge Crypto Growth Goals in Europe

“As soon as we got together with Jan, even probably before the acquisition, bitcoin was definitely a topic,” Rozemuller said. “Jan mentioned that he was already looking at ways to maybe do something in the U.S. We told him, ‘Well, we’re actually working on something in Europe, too.’” Original

BTC Halving Forces Crypto Miners to Be Proactive to Maintain Their Competitive Positions: Fidelity Digital Assets

“They must constantly push to acquire more hashrate as well as increase the efficiency of their hashrate, acquire lower-cost energy from cheaper sources, and expand their infrastructure to house any new machines,” Gray wrote. At the same time, every other miner is also bidding for the same resources. Source

BlackRock seeks to purchase more Bitcoin ETFs

Investment giant BlackRock has filed a new application with the U.S. Securities and Exchange Commission (SEC) to buy more Bitcoin (BTC) ETFs. According to an updated filing on the regulator’s website, BlackRock wants to buy more Bitcoin ETFs for its Strategic Income Opportunities Fund. “The Fund may acquire shares in exchange-traded products (“ETPs”) that seek to reflect generally the performance of the price of bitcoin by directly holding bitcoin (“Bitcoin ETPs”), including shares of a Bitcoin ETP sponsored by an affiliate of BlackRock.” BlackRock filing BlackRock’s fund, listed under the…

MicroStrategy’s MSTR stock jumps 23% as it unveils $600m offering to buy more Bitcoin

The largest corporate holder of Bitcoin, MicroStrategy, is about to become even larger with the latest $600 million offering in convertible notes to buy more crypto. MicroStrategy wants to sell $600 million in convertible senior notes to buy more Bitcoin (BTC) as the largest crypto by market capitalization nears its all-time high. According to a press release on MicroStrategy’s official website, the latest offering due 2030 will be to qualified institutional buyers only. The Virginia-headquartered business analytical software provider also plans to grant initial purchasers of the notes an option…

Bitcoin Miner Bitdeer Says It Has Launched Its ‘First Cryptocurrency Mining Chip’

Bitdeer, a bitcoin miner, recently announced the launch of what it refers to as its “first cryptocurrency mining chip.” Bitdeer claimed that the chip could potentially improve bitcoin mining performance without excessive power consumption. New Rig to Help Bitcoin Miners Minimize Operational Costs Bitdeer, a leading bitcoin mining firm, has launched what it describes as […] Original