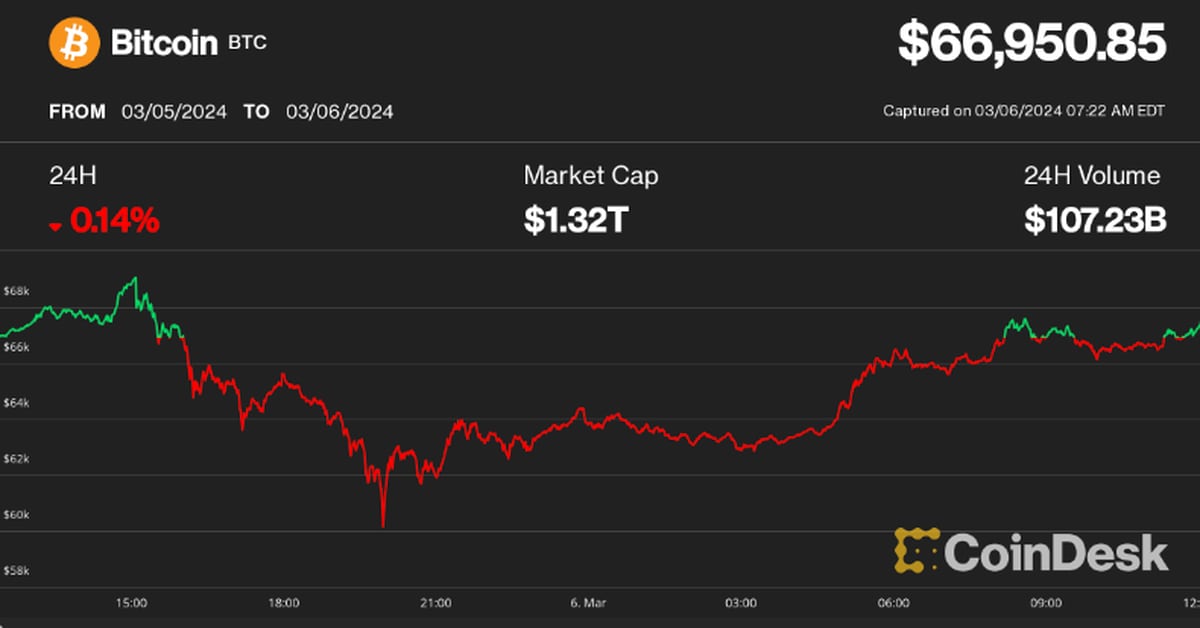

The flagship crypto token, Bitcoin, finally hit a new all-time high (ATH) on March 5 but quickly dipped by over 10% after this price surge. As explained by this market analyst, this sharp correction was to be expected and could become a norm heading into the bull market. “Bull Markets Are Not Straight Lines Up” Alex Thorn, Head of Research at Galaxy Digital, noted in an X (formerly Twitter) post that the market doesn’t move to the upside unfettered, even in a bull market, and corrections are to be expected.…

Day: March 6, 2024

Web3 App Store Magic Square Unveils $66M Grant Program

Magic Square’s Ecosystem Grant Program consists of 120 million SQR, equivalent to 12% of the token’s total supply. Source

Bitcoin (BTC) ETF IBIT Posted Record Inflows

IBIT added 12,600 bitcoin, breaking previous daily highs of around 10,000. Data from Nasdaq show that the fund recorded trading volumes of more than 107 million shares, or over $3.6 billion price-weighted, surpassing the previous record high of $3.3 billion from last week. Original

Digital Currency Group Files for Dismissal of New York Attorney General’s Lawsuit

The crypto firm’s boss, Barry Silbert, also filed a motion to dismiss the Attorney General’s accusation that he concealed losses at the firms and so cheated customers and investors. Source

What Comes After Bitcoin’s (BTC) Flirt With Record High

Bitcoin pushed to a record high on Tuesday, briefly rising above $69,000 on Coinbase, a level first touched on Nov. 10, 2021. The all-time high didn’t last long however; the world’s largest cryptocurrency has since retreated to around $67,000. There was a market-wide sell-off to as low as $60,800 and more than $1 billion in liquidations amid the volatility. Bitcoin rebounded in Asian morning hours, indicating resilience. Some observers said the selling pressure was likely driven by profit-taking at historical highs and miners offloading some of their bitcoin holdings. Institutional…

Bitcoin Crash Or Surge? Fed’s BTFP Program Ends In 5 Days

As the US Federal Reserve’s Bank Term Funding Program (BTFP) approaches its conclusion on March 11, 2024, the Bitcoin and crypto market stands at a critical juncture. Instituted in March 2023 in the aftermath of the sudden collapses of Signature Bank and Silicon Valley Bank, the largest since the 2008 financial crisis, the BTFP has been a lifeline for US banks, offering loans against high-quality collateral to ensure liquidity in turbulent times. The BTFP’s Closure And Its Implications For Bitcoin The BTFP’s conclusion could send ripples through the financial sector,…

Bitcoin Technical Analysis: BTC Bulls Regain Strength After Recent Pullback

In the last day, bitcoin exhibited a dynamic display, marked by significant fluctuations and upward movements across different periods. Upon hitting a peak at $69,210 per unit on Mar. 5, the cryptocurrency dipped below the $60,000 threshold, only to climb again on Wednesday, positioning itself in the $66,500 to $67,500 bracket. Bitcoin Over the course […] Original

Biden and Trump-Themed Meme Coins Take Center Stage on Solana

A new breed of meme coins have spawned on Solana this week with speculators hopping on a new wave of cartoonish coins focused around politicians and celebrities. Source

Coinbase advocates for reevaluation of crypto as securities in legal clash with SEC

Coinbase’s legal team has approached U.S. District Judge Katherine Failla with a request to overlook a prior judgment that defined secondary sales of crypto assets as securities transactions. The plea, part of Coinbase’s ongoing legal dispute with the U.S. Securities and Exchange Commission (SEC), was highlighted in a letter dated March 5. Michael Savitt, representing Coinbase, contended that the SEC’s prior classification of crypto sales in the secondary market as securities contracts, particularly noted in the SEC vs Wahi case, lacks substantial grounding since it was never thoroughly vetted in…

ICO launches “consent or pay” call for views and updates on cookie compliance work

Stephen Almond, Executive Director, Regulatory Risk, leads the ICO’s team responsible for anticipating, understanding and shaping the impacts of emerging technology and innovation on people and society. As part of our cookie compliance work, I committed to providing the online advertising industry with clarity on ways in which it can use advertising cookies in compliance with data protection law. One proposed model is a “consent or pay” mechanism. This gives people the choice to use a website for free, but only if they consent to their personal information being used…