Crypto whales deposited about $58 million worth of the Ethereum (ETH) layer-2 scaling solution Arbitrum (ARB) into crypto exchanges after the project had a massive token unlock over the weekend, according to the blockchain tracker Lookonchain. Lookonchain notes that 11 whales deposited 34 million ARB into exchanges after the unlock. Source: Lookonchain/X Arbitrum unlocked 1.11 billion ARB tokens on March 16th, according to the crypto tracker TokenUnlocks. That total represents nearly 42% of the asset’s circulating supply. Blockchain tracking firm Lookonchain notes that 673.5 million ARB worth $1.37 billion was…

Day: March 19, 2024

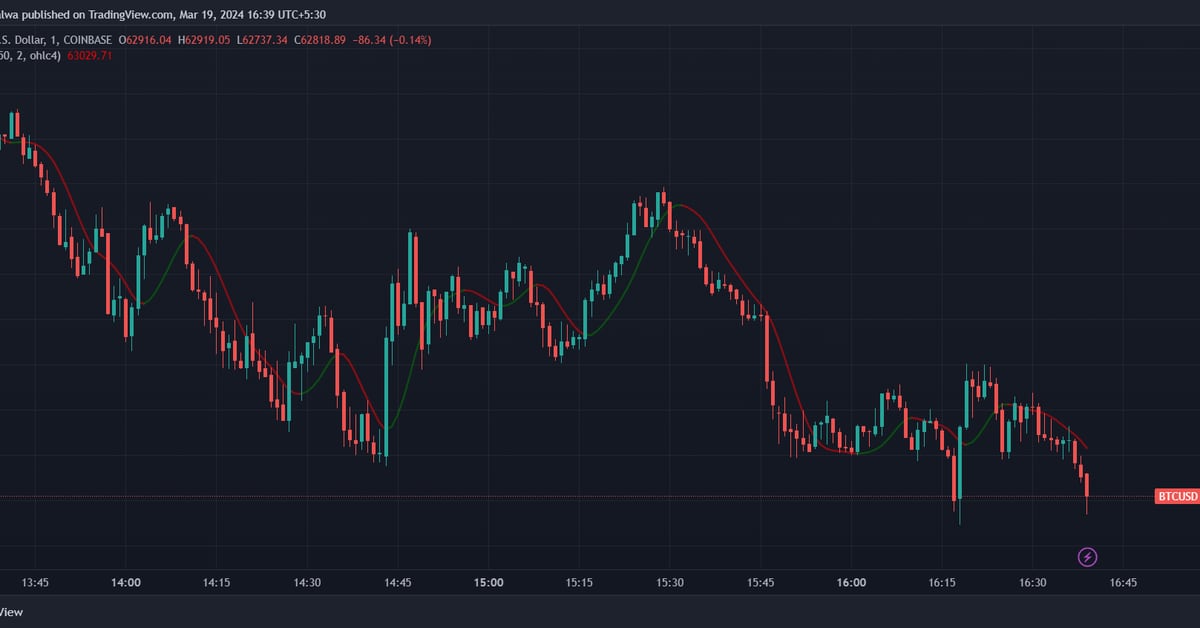

Bitcoin Falls to Sub-$63K as Market Awaits Federal Reserve’s Next Move

On Tuesday, the value of bitcoin fell to a low of $62,355, experiencing a decline of over 7% against the U.S. dollar in the last 24 hours and a decrease of 12.4% in the past week. This downturn led to the liquidation of a substantial number of bitcoin long positions, with more than $180 million […] Original

Galaxy Digital (GLXY) to Introduce Exchange-Traded Products (ETPs) for Europeans in ‘Matter of Weeks’

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…

Bank of Japan Ends Eight-Year Negative Rates Regime; Bitcoin Slides to $62.7K

“The BOJ is now essentially data-dependent, which is a big change in the BOJ reaction function and opens up the scope for greater FX volatility that should discourage a further build-up of yen carry positions at these weaker yen levels. Import inflation is again picking up, and government subsidies that are helping to depress inflation will end on April 30,” Derek Halpenny, head of research, global markets at MUFG Bank, said in a note sent to clients after the rate hike. Original

SLERF Just Clocked More Trading Volume Than Ethereum

Slerf, a sloth-themed token issued in Asian morning hours on Monday, posted trading volume of more than $2.7 billion in the past 24 hours, data from DEXScreener shows. These volume encompasses 800,000 trades from 130,000 individual traders, additional metrics for the SLERF/USD pair show. Source CryptoX Portal

Bitcoin (BTC) Price Falls Under $63K; ETH, SOL, ADA Dumps 8%

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated. CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies. In November 2023, CoinDesk was acquired by the Bullish group, owner of Bullish, a regulated, digital assets exchange. The Bullish group is majority-owned by Block.one; both companies have interests in a variety of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as…

Galaxy Asset Management hits $10 billion milestone; CEO expects Bitcoin correction

Galaxy Asset Management surpassed $10 billion in Assets under Management (AUM) for the first time on Feb. 29, 2024. Galaxy Digital Holdings’ institutional investing division credited the milestone to a growing enthusiasm among institutional investors for digital assets. Mike Novogratz, CEO of Galaxy Digital, announced this accomplishment on March 19 on X, characterizing it as an ongoing effort to broaden investor access to the digital economy. Galaxy Asset Management has exceeded $10 billion in AUM for the first time ever, solidifying our position as a global leader in digital asset management.…

Grayscale CEO Believes Bitcoin ETF Fees Will Drop Over Time: CNBC

GBTC has seen $12 billion in outflows since due in part to its high fees compared to its competitors. Source

UK Regulator FCA Plans to Deliver a Market Abuse Regime for Crypto This Year

The U.K. has been refining it approach to regulating the crypto sector. Source

Grayscale CEO says GBTC Bitcoin ETF fees will come down over time

Michael Sonnenshein, CEO, Grayscale Investments at the NYSE, April 18, 2022. Source: NYSE LONDON — The boss of digital asset management firm Grayscale, which manages the $26 billion exchange-traded fund GBTC, has said that fees on its flagship product will come down over time, after its outflows reached $12 billion. Grayscale CEO Michael Sonnenshein said that the crypto fund manager expects to bring fees on its Grayscale Bitcoin Trust ETF down in the coming months, as the nascent crypto ETF market matures. “I’ll happily confirm that, over time, as this market…