Recent observations by Eric Balchunas, a senior ETF analyst at Bloomberg, suggest that the movements in Bitcoin’s price are influenced by factors beyond just the flows of spot Bitcoin Exchange Traded Funds (ETFs). According to Balchunas, who shared his insights on X, “bigger forces at work” shape the largest cryptocurrency’s valuation. This indicates that the correlation between spot ETF flows and Bitcoin’s price action is less direct than some assume. The ETF Influence And Market Movements This analysis emerges amid a period of significant financial activity for Grayscale, which has…

Day: March 22, 2024

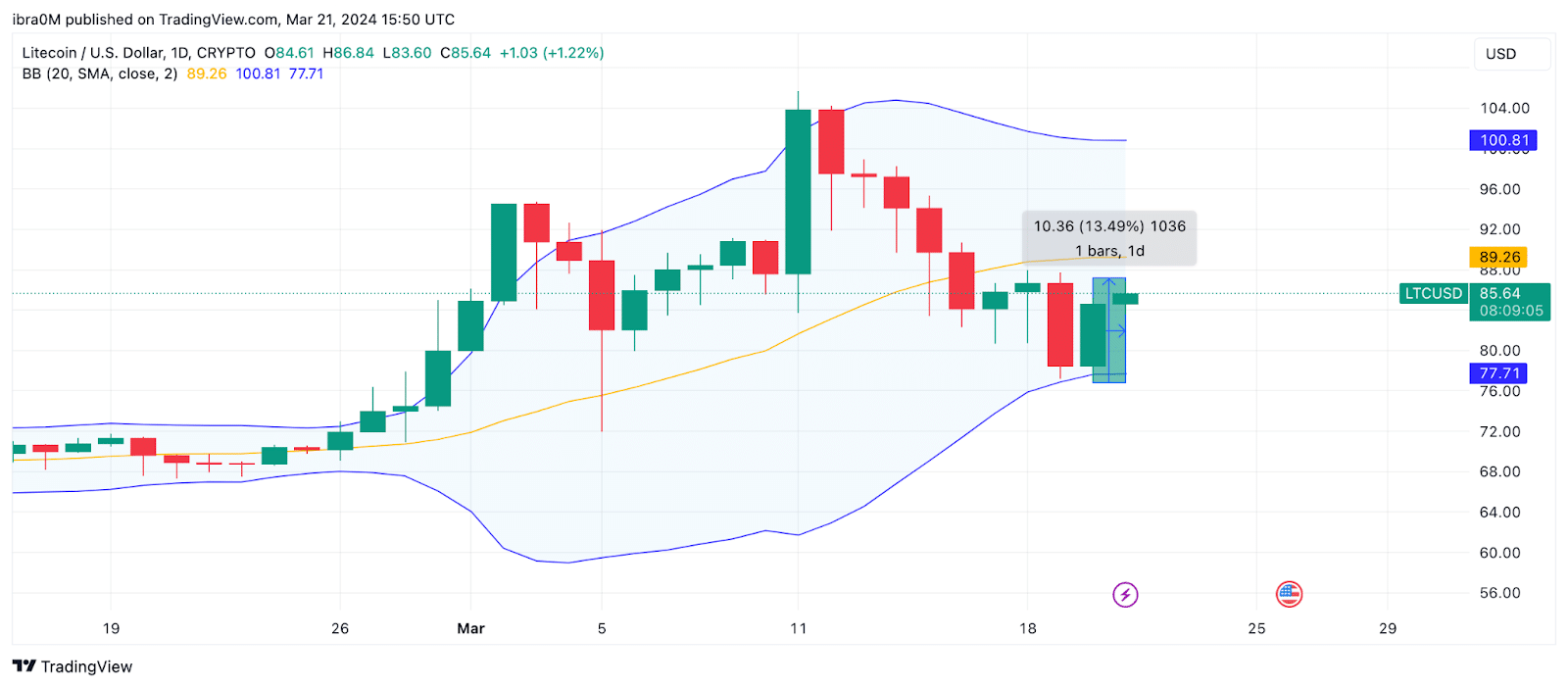

Coinbase announcement to drive LTC above $100?

The price of Litecoin grew 8% on March 20, surging from $77 to $86 within the 24-hour timeframe. A rare network transactions trend suggests Litcoin (LTC) could advance towards $100 in the days ahead. A recent announcement by Coinbase and rising volumes of large LTC transactions have emerged as major bullish catalysts for Litecoin’s price this week. Litecoin price pumps after Coinbase LTC futures announcement On March 20, Coinbase derivatives announced plans to list futures contracts for Dogecoin (DOGE), Litecoin, and Bitcoin Cash (BCH). According to Coinbase’s filing with the Commodity…

MakerDAO Stakeholder-Focused Updates Drive MKR Price Up By 10%

Blockchain protocol MakerDAO (MKR) continues to see significant gains, maintaining a strong upward trend throughout the year. MKR has seen significant growth of over 358%, accompanied by positive metrics reflecting increased adoption and usage of the protocol. In addition, upcoming voting initiatives aim to further increase the platform’s benefits for its stakeholders. MakerDAO Announces Plans For Rate System Changes In a recent announcement, MakerDAO stated that it closely monitors developments in the cryptocurrency market and has gained a better understanding of the impact of recent proposals. As a result, the protocol…

Rich Dad Poor Dad Author Robert Kiyosaki Advises Buying as Much Bitcoin as You Can Afford

Rich Dad Poor Dad author Robert Kiyosaki has advised investors to buy as many bitcoins as they can afford, noting that China is in trouble and this is not the time to buy stocks and bonds. “This is the time to buy real gold, real silver, and as many bitcoin as you can afford,” he […] Original

Triggers Nearly $300 Million In Total Liquidations

The crypto market has recently experienced a wave of liquidations, amounting to nearly $300 million, closely following Bitcoin’s sharp reclaim of the $67,000 mark. This surge in Bitcoin’s value, a stark reversal from its previous downtrend, caught many traders off guard, especially those who had placed bets on the continuation of the market’s decline. Over 80,000 Traders Faces Liquidation The data provided by Coinglass sheds light on the magnitude of the liquidations, revealing that approximately 86,047 traders suffered losses exceeding $250 million within a mere 24-hour period. Major exchanges like…