Even though Bitcoin has not yet reached its all-time high, its daily trade volume has already exceeded $40 billion, the highest level since the May 2021 sell-off. The daily trading volume of Bitcoin (BTC) has reached its highest level last seen in three years ago as BTC is continuously climbing to its all-time high, Kaiko revealed in a recent research report. According to the published data, Bitcoin’s daily trade volume exceeded $40 billion in early March, surpassing its previous peak hit in the aftermath of the FTX collapse in November…

Month: March 2024

Hong Kong to Kickstart New Web3 and Digital Yuan Initiatives This Year

The city of Hong Kong has detailed the advancement of new Web3 and digital yuan initiatives as part of its 2024-2025 budget. In a speech, Hong Kong Financial Secretary Paul Chan stated that the city would expedite a Web3 sandbox for stablecoins and expand the digital yuan pilot as part of its digital finance policies. […] Source CryptoX Portal

Spot Bitcoin ETFs start the week strong, attracting $562 million in inflows

Spot Bitcoin ETFs began the week on a strong note, attracting over $562 million in inflows on Monday amid the impressive Bitcoin (BTC) market run that has seen the asset surge 21% over the past week. BitMEX Research disclosed this in its latest update on capital flows into the Bitcoin ETF market. Data confirms that the entire market saw an influx of 8,377 BTC tokens valued at $562.7 million on March 4 despite the Grayscale Bitcoin Trust (GBTC) sustaining its trend of capital outflows. [1/4] Bitcoin ETF Flow – 04…

Germany’s Biggest Stock Exchange Goes Crypto

Deutsche Börse Group has taken a significant step into the realm of digital assets by introducing the Deutsche Börse Digital Exchange (DBDX), a regulated spot trading platform for cryptocurrencies tailored to institutional clients. DBDX fills a gap in the market by offering a fully regulated and secure ecosystem for trading, settlement, and custody of cryptocurrencies. It leverages the existing connectivity to market participants, providing clients with a comprehensive suite of innovative and secure financial solutions for digital assets from a single point of access across the value chain. Initially, trading…

Grayscale’s GBTC sees 33% reduction in Bitcoin holdings amid $9.26b outflows

Grayscale, the world’s largest crypto asset manager, has seen nearly a third of its Bitcoin holdings withdrawn since converting its Bitcoin Trust (GBTC) into an ETF on Jan. 10. As of March 4, GBTC witnessed its 36th consecutive day of outflows, with 5,450 BTC, equivalent to $368 million, exiting the trust. This brings the total outflow since the conversion to an astounding $9.26 billion, BitMEX Research reports. 5,450 Bitcoin of GBTC outflow today Total GBTC outflow since 11th Jan 2024 is 202,874 Bitcoin This is a decline in Bitcoin holdings…

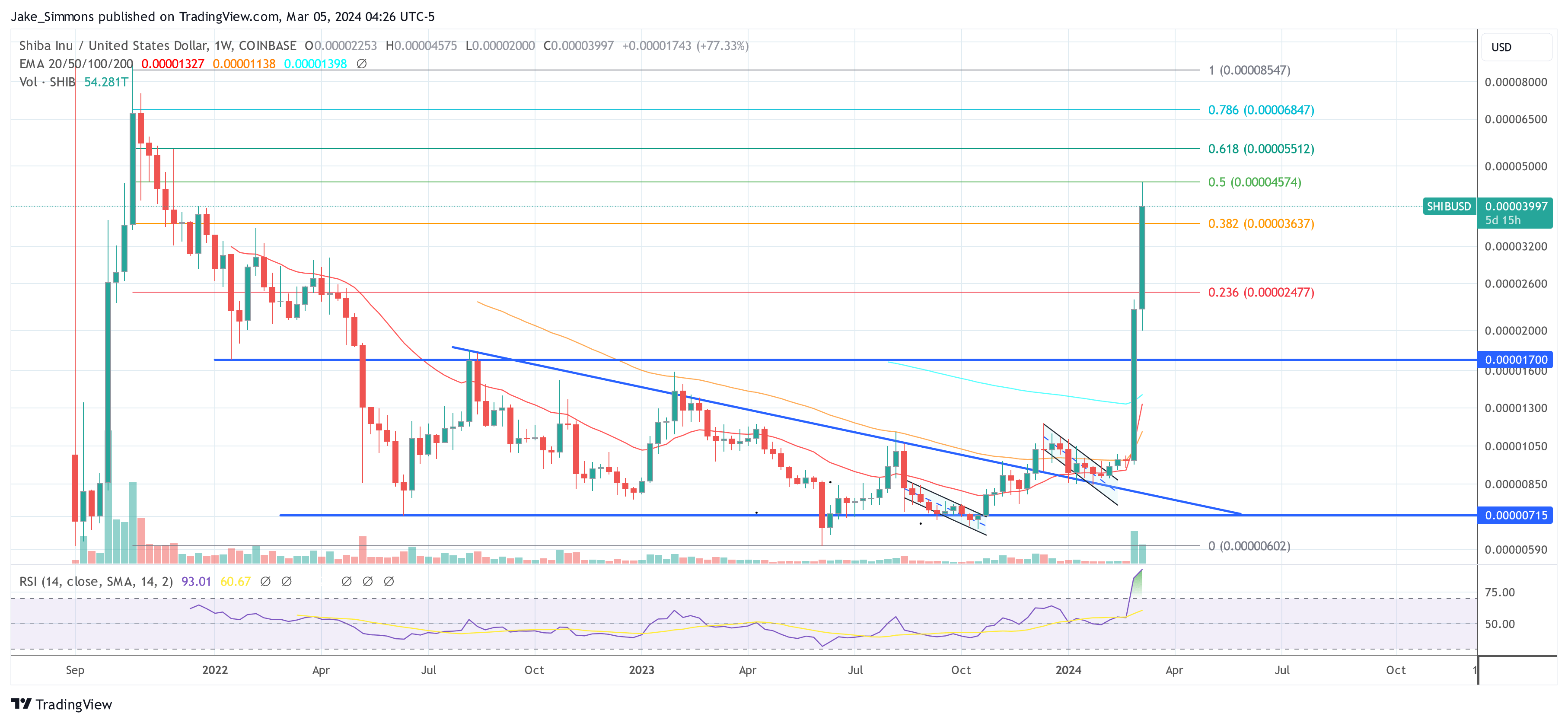

Shiba Inu Price Skyrockets Past $0.000045: Here’s Why

The Shiba Inu price is going absolutely parabolic these days. Within the last 9 days, the SHIB price surged by more than 380%. Today, SHIB marked a two-year high at $0.00004574. Although the price suddenly dropped below $0.00002, marking a 54% within 2 hours, the price already recovered to above $0.000038. Here are four reasons driving the Shiba Inu price: #1 Bitcoin’s Rally And Its Implications For Altcoins Bitcoin’s price rally, particularly after the US Securities and Exchange Commission’s (SEC) approval of spot Bitcoin Exchange-Traded Funds (ETFs) in January, has…

Baanx Raises $20M in Series A Funding From Ledger, Tezos, Chiron, British Business Bank

The investment round, which included Ledger, Tezos, Chiron and British Business Bank, brings the crypto payment enabler’s total funding to over $30 million. London-based Baanx, which runs the Ledger card product, recently signed a three-year partnership with Mastercard for the U.K. and Europe. Source

Shiba Inu Prices Briefly Dropped 50% on Coinbase

The tokens have logged over $1.7 billion in volumes on the regulated exchange in the past 24 hours, the most among counterparts. Source

Bitcoin ETF Issuer VanEck Has Huge Crypto Growth Goals in Europe

“As soon as we got together with Jan, even probably before the acquisition, bitcoin was definitely a topic,” Rozemuller said. “Jan mentioned that he was already looking at ways to maybe do something in the U.S. We told him, ‘Well, we’re actually working on something in Europe, too.’” Original

BTC Halving Forces Crypto Miners to Be Proactive to Maintain Their Competitive Positions: Fidelity Digital Assets

“They must constantly push to acquire more hashrate as well as increase the efficiency of their hashrate, acquire lower-cost energy from cheaper sources, and expand their infrastructure to house any new machines,” Gray wrote. At the same time, every other miner is also bidding for the same resources. Source