It’s not something we have historically written a lot about – bridging yields. But a new report from the crypto investment firm Exponentia.fi included a chart on these yields, and it caught our eye because they’ve been rising fast recently, pushing above 15%. Co-founder Mehdi Lebbar attributes the rising yields to higher demand from users, in part a reflection of the trend toward greater interoperability between blockchains, along with the proliferation of layer-2 and layer-3 networks. “As the DeFi ecosystem extends across networks, third-party bridging protocols like Across and Synapse…

Month: March 2024

Crypto Stocks Like MicroStrategy (MSTR), Coinbase (COIN) Could Shoot Up if Short Sellers Exit

“These crypto related stocks are extremely crowded and very squeezable relative to the U.S. market, with an average Crowded score of 57.34 versus the street average of 32.41 and an average Squeeze score of 78.69 versus the street average of 34.41,” the report said, adding that “MSTR, COIN and CLSK are the most squeezable names in the sector.” Source

Fezoo presale gains momentum among Bitcoin Cash and Polkadot circles

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. Fezoo’s emergence in the presale market draws attention, signaling a potential shake-up in established crypto circles. Speculation swirls around its capacity to challenge incumbents like Binance. Binance is known as the biggest crypto exchange platform in the market. Over the years, we have seen innovations try to disrupt the market and beat Binance at its game, but they have yet to come close. However, a new protocol for its…

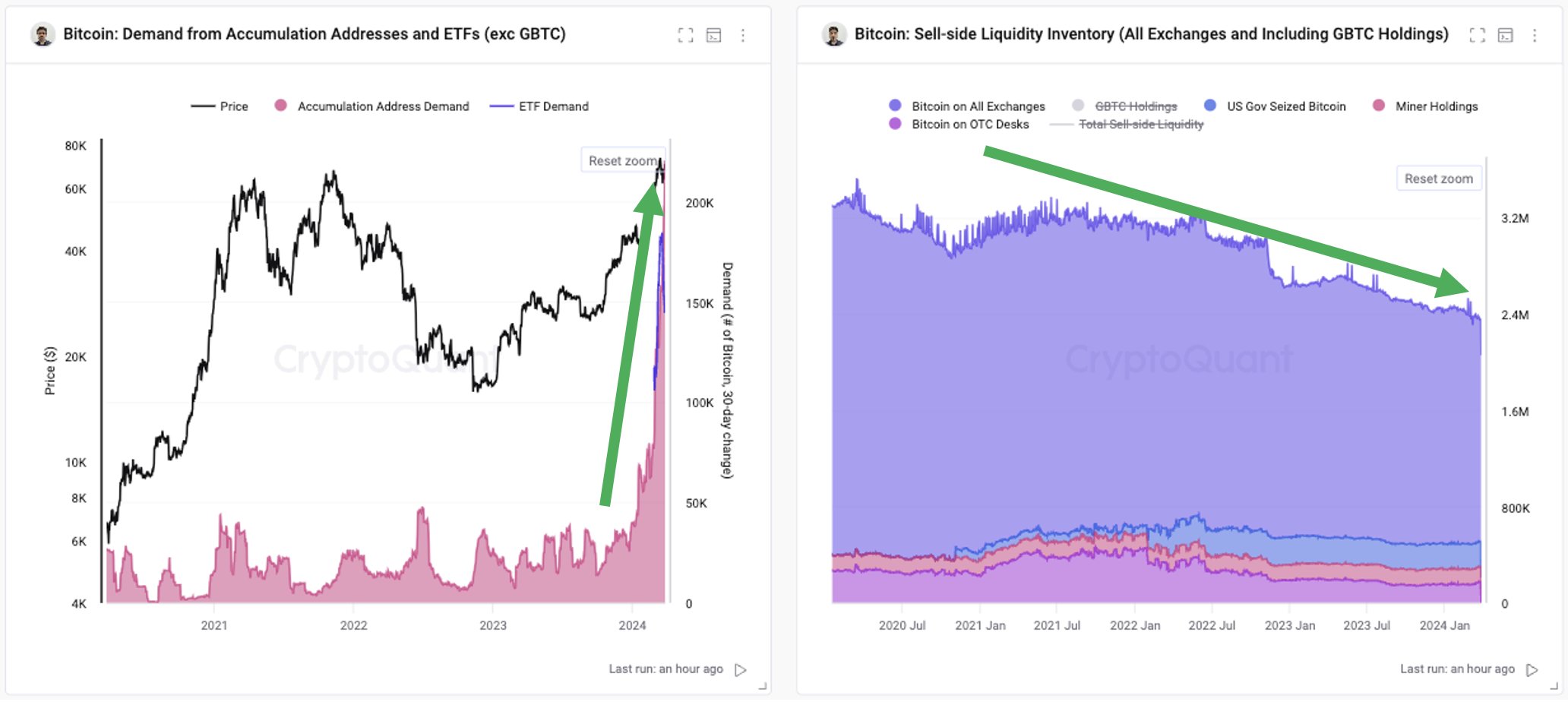

Bitcoin “Liquid Inventory Ratio” Hits All-Time Low, What It Means

On-chain data shows the Bitcoin “Liquid Inventory Ratio” has dropped to an all-time low. Here’s what this could mean for the asset. Bitcoin Sell Side Liquidity Is Low Relative To Demand Right Now In a post on X, CryptoQuant founder and CEO Ki Young Ju discussed the recent trend in the Liquid Inventory Ratio for Bitcoin. The Liquid Inventory Ratio is an on-chain indicator that tells us about how the total sell-side liquidity inventory of the asset compares against its demand. The sell-side liquidity inventory of the asset is gauged…

US Spot Bitcoin ETFs Rebound With $418 Million Inflow

On Monday, the U.S. spot bitcoin exchange-traded funds (ETFs) experienced their first positive inflows, breaking a streak of five consecutive days of outflows totaling $887.6 million. The momentum continued into Tuesday, with the ETFs amassing $418 million in inflows, building on the $15.4 million gained the previous day. Bitcoin ETFs’ Fortunes Flip The week prior […] Original

ceτi AI Announces Partnership Innovation Fund to Accelerate Innovation in Decentralized AI

PRESS RELEASE. Vancouver, March 27th, 2024 – In a significant move to fuel the growth of decentralized artificial intelligence, ceτi AI is proud to announce the establishment of the ceτi AI Partnership Innovation Fund with an initial allocation of $500k USD. This strategic fund is designed to catalyze innovation by forging partnerships with emerging projects […] Source CryptoX Portal

Dutch Prosecutors Seek 64-Month Jail Sentence for Tornado Cash Dev Alexey Pertsev

Pertsev has been accused of laundering $1.2 billion worth of crypto through the anonymizing tool Tornado Cash, the Dutch prosecutors detailed in an indictment that was shared ahead of the trial. The indictment said that between July 9, 2019 and Aug. 10, 2022 Pertsev made “a habit of committing money laundering.” Source

RWA Platform Ondo Finance Will Use BlackRock’s Ethereum-Based BUIDL Fund to Back Its T-Bill Token OUSG

Ondo’s action marks the first example of a crypto protocol leveraging asset management giant BlackRock’s tokenized fund offering, which debuted last week. The fund, represented by the Ethereum-based BUIDL token backed by U.S. Treasury bills and repo agreements, is targeted for white-listed, institutional clients and requires at least $5 million minimum allocation. While the strict requirements prohibits smaller investors to invest in BlackRock’s BUIDL, it allows other platforms such as Ondo to leverage the fund for its own retail-facing offerings. Source

The Munchables Hack Is Way Worse Than It Seems

After an hour of negotiations led by Munchables, along with independent blockchain investigator ZachXBT and security firm PeckShield, Werewolves0943 was convinced to return all the funds. “The Munchables developer has shared all private keys involved to assist in recovering the user funds. Specifically, the key which holds $62,535,441.24 USD, the key which holds 73 WETH, and the owner key which contains the rest of the funds,” the Munchables’ team posted at 4:40 a.m. UTC. Source

Aerodrome Propels Coinbase’s Base Layer 2 Network to $1 Billion TVL Milestone

CoinspeakerAerodrome Propels Coinbase’s Base Layer 2 Network to $1 Billion TVL Milestone The spike in TVL suggests that the cryptocurrency community is becoming more and more interested in and using Base. As per the latest DeFiLlama data, the total value locked on the Base Network stands at $1.062 billion as of writing. The spike in TVL suggests that the cryptocurrency community is becoming more and more interested in and using Base. Coinbase’s Base Network is an Ethereum Layer 2 blockchain created by Coinbase Global, a leading cryptocurrency exchange. It made…