Matrixport, a digital asset financial services group born from Bitmain, an industry leader in Bitcoin mining, projects a bullish breakout for Bitcoin in the upcoming fourth quarter of 2024. In their latest research report titled “Matrix on Target: Bullish Prospects for Bitcoin in Q4,” the firm provides four reasons to be bullish in the upcoming weeks. #1 Narrowing Trading Range Signals Breakout Matrixport’s analysis begins with a technical assessment of the recent Bitcoin price action. Historically, Q3 has posed significant challenges with frequent breakout failures. This year, however, Bitcoin has…

Day: August 2, 2024

How DePINs Address AI’s GPU Gap and Ethics Problems

Furthermore, DePINs give data owners more control over their information, enhancing privacy while encouraging widespread data sharing. For instance, consider a healthcare scenario where a patient’s data from various hospitals and clinics can be securely shared without compromising on privacy. By leveraging DePINs, researchers can access a rich, diverse dataset that enhances their ability to develop better diagnostic tools and treatment plans. Similarly, in the environmental science field, DePINs can facilitate sharing climate data from various sensors, often located on private homes and properties worldwide, leading to more accurate models…

Coinbase's 'Solid' Earnings May Get Derailed by Low Volume, Fed Headwinds, Analysts Say

The company reported better-than-expected second-quarter earnings on Thursday but saw a strong downtick in revenue from transaction fees, its main source of income. Source

Bitcoin Down But Not Out: BTC To $700,000 Highly Probable Says Analyst

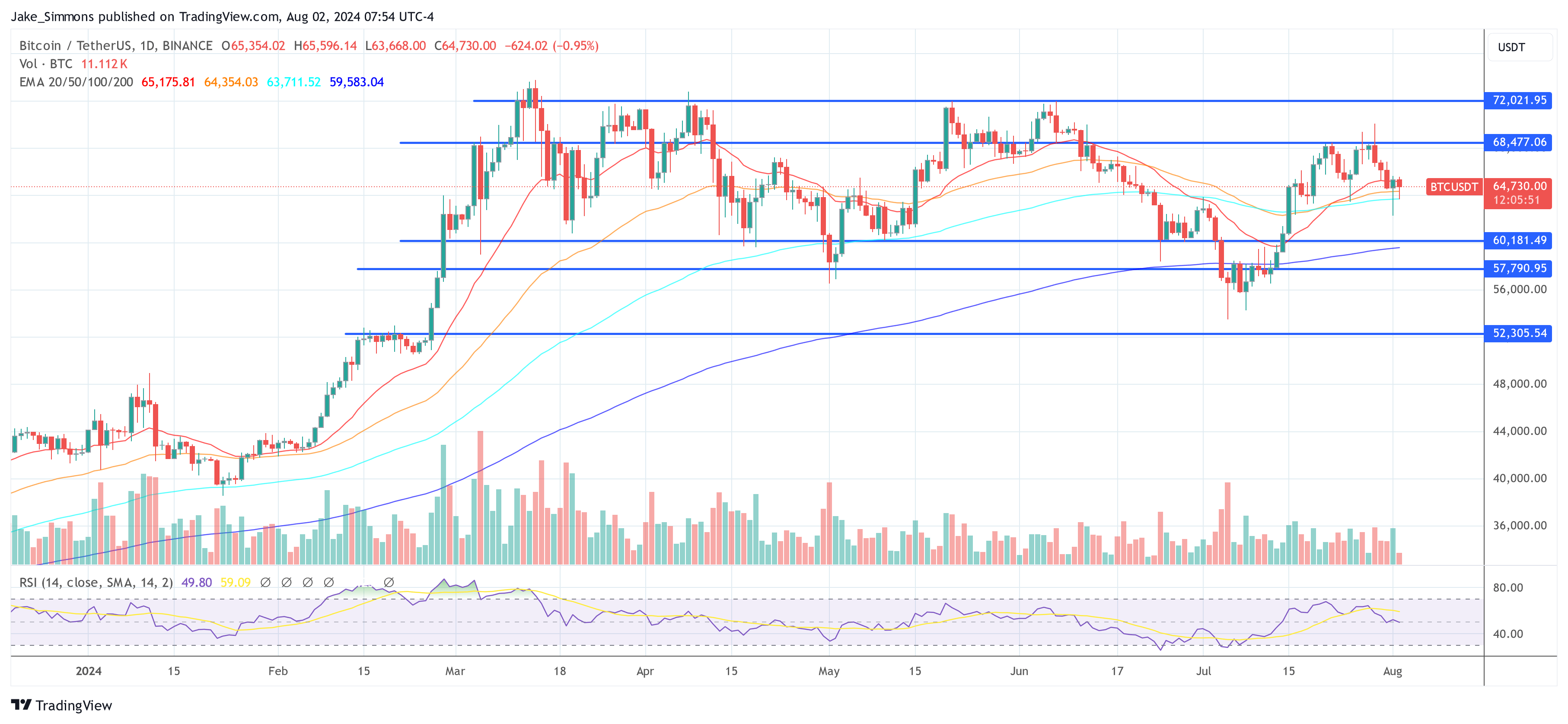

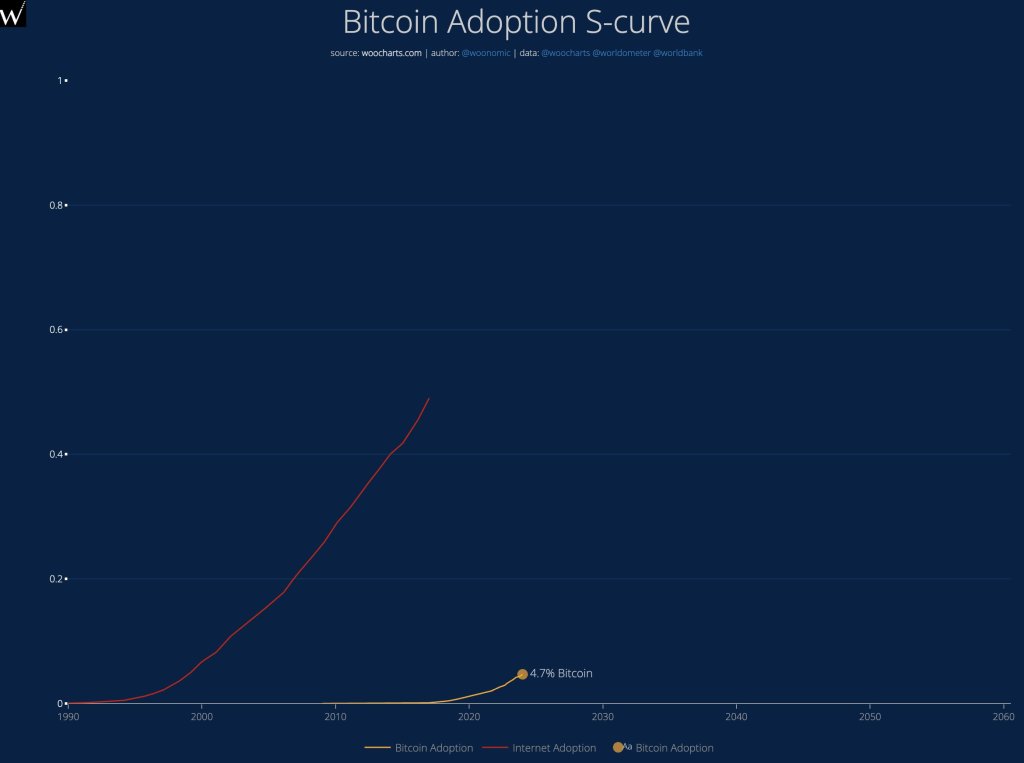

Bitcoin remains volatile at spot rates. Despite the spectacular recovery yesterday, August 1, the downtrend remains, at least for now. Specifically, looking at the candlestick arrangement in the daily chart, there could be more growth once prices break $70,000. Before then, traders are closely monitoring price action aware that there could be more losses, pushing the coin below $60,000. Amid this, some analysts are bullish in the long term, ignoring short-term price volatility. Bitcoin Remains Bullish Despite Recent Price Drops In a post on X, Willy Woo, an on-chain analyst,…

MARA Reports Q2 2024 Earnings: Revenue Surges Amid Rising Losses and Hashrate Increase

MARA, a leader in digital asset compute, reported a significant revenue increase of 78% to $145.1 million for the second quarter of 2024. Despite this growth, the company faced a substantial net loss of $199.7 million, driven by a $148 million fair value loss on digital assets. MARA Reports Q2 Earnings: Revenue Rises 78% Despite […] Source CryptoX Portal

MicroStrategy (MSTR) Bull Doubles Down on The Stock by Raising Price Target to Street High of $2,150

Since adopting bitcoin as its primary treasury reserve asset in August 2020, Executive Chairman Michael Saylor-led company has appreciated 1,206%, Benchmark’s analyst Mark Palmer wrote in a research report on Friday. The stock’s performance, since then, stands in contrast to bitcoin (BTC), the S&P 500 and Nasdaq which have gained 442% 64% and 60%, respectively, he noted. Source

France Regulator AMF Opens for MiCA Applications, First Among Biggest EU Economies

The French markets regulator said it started accepting applications for crypto asset services provider (CASP) licenses on July 1, the first major European Union economy to do so, as more provisions of the bloc’s Markets in Crypto Assets (MiCA) rules are set to take effect at the end of the year. Source

Bitcoin reserve bill could be a ‘disaster in the making’

As Senator Lummis pushes for Bitcoin to stabilize the U.S. dollar, Moe Vela warns of the risks. Read on. During the Bitcoin 2024 conference in Nashville on July 27, US Senator Cynthia Lummis proposed that the U.S. government consider Bitcoin (BTC) as a strategic reserve asset to stabilize the dollar’s value and counter inflation. In a follow-up to her initial announcement, on July 31, Senator Lummis officially introduced the Bitcoin Strategic Reserve bill. This legislation aims to direct the U.S. government to establish a reserve fund specifically for Bitcoin, ensuring it…

Bitcoin Price (BTC) Hit by Slumping Nasdaq, Genesis Trading Coin Movement

Having already suffered the sale of 50,000 bitcoin by the German government in early July, the beginning of distributions from bankrupt exchange Mt. Gox, and looming sales from the U.S. government’s BTC stash, the Genesis action can now be added to the growing list of supply shocks for the crypto market. Source

Cardano Goes Toe-To-Toe With Ethereum As Whales Scoop Up 120 Million ADA

Cardano (ADA) is currently competing with Ethereum in terms of large transaction volume. This is undoubtedly a positive development for the ADA ecosystem, especially since it indicates a wave of accumulation among the token’s large holders. Cardano Matches Ethereum In Large Transaction Volume Data from the market intelligence platform IntoTheBlock shows that Cardano is witnessing a similar large transaction volume as Ethereum. In the last 24 hours, Cardano recorded a large transaction volume of $6.7 billion, while Ethereum witnessed a large transaction volume of $6.71 billion. Related Reading This development…