Joe Biden administration’s ongoing efforts to deny cryptocurrency companies access to banking services have become known as Choke Point 2.0. Operation Choke Point Background Introduced by former president Barack Obama’s administration in 2013, Operation Choke Point was intended to combat fraud and illegal activity by denying criminals access to the banking system. By forcing financial institutions to cut ties with high-risk businesses, regulators hoped to “choke off” how illicit actors could continue to fund their operations. Despite the good intentions, there were concerns in the community that legitimate businesses were…

Day: August 2, 2024

Bitcoin price spared from Intel and Nvidia stocks meltdown

Bitcoin price held steady above $64,000 on Friday, even as technology stocks like Intel and Nvidia slumped. Bitcoin (BTC) was trading at $64,700, up by 4% above its lowest point this week and 8% below its highest level on Monday despite a very red day on Wall Street on Thursday. Semiconductor companies were among the worst performers. Intel stock dropped by over 22%, reaching its lowest point since 2015. It has dropped by over 65% from its highest point since April 2022. The sell-off happened after the company published weak…

U.S. Added Just 114K Jobs in July, Unemployment Rate Shoots Up to 4.3%

U.S. Added Just 114K Jobs in July, Unemployment Rate Shoots Up to 4.3% Source

Crypto Exchange Bybit Withdraws From France in Response to Regulations After AMF Warnings

“It has always been Bybit’s primary objective to operate our business in compliance with all relevant rules and regulations,” the company said in its release. “In light of recent regulatory developments from the French regulator, Bybit will stop offering our products and services to French nationals and residents.” Source

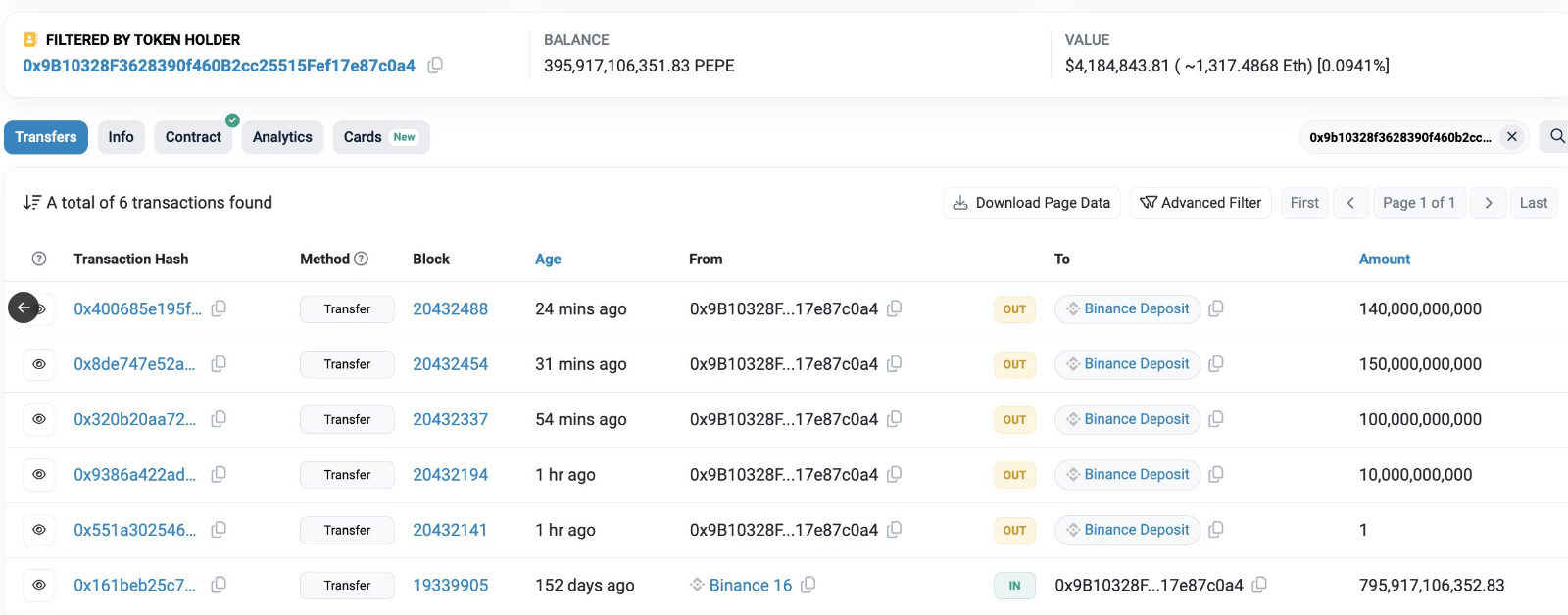

Whale Transfers $4.2 Million PEPE To Binance

Recently, a massive transaction shook the digital currency ecosystem. A prominent whale transferred 400 billion PEPE tokens—worth about $4.22 million—to Binance. Related Reading Strategically timed among the general negative market mood, this move seems to be a deliberate one for partial profit booking. The whale’s behavior corresponds to the breach of a critical support level around $0.00001075, a key threshold that has lately increased the downward pressure on PEPE’s price. A whale deposited 400B $PEPE($4.22M) to #Binance to take profits in the past hour. The whale withdrew 795.92B $PEPE($2.55M at…

Is Aave on the brink of a breakout or pullback?

Aave (AAVE) has surged by 64.7% in less than a month. With such a strong rally, the question now is whether AAVE can continue its upward momentum or if it faces a potential pullback. In this week’s analysis, we examine the key technical indicators, resistance levels, and strategic considerations to determine the most likely direction for AAVE in the coming days. Resistance and support analysis Aave (AAVE) faces a critical juncture as it approaches a very strong resistance level at $115. This level has a significant history, having acted as…

First Mover Americas: BTC Warnings Finger Drop to $55K

The latest price moves in bitcoin (BTC) and crypto markets in context for Aug. 2, 2024. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets. Source

Kujira Foundation's Tokens Stung by Its Own Leveraged Positions as Bets Backfire

The developers said the team’s positions were “targeted” and they plan to create an operational DAO to take ownership of the Kujira Treasury and core protocols. Source

Ditobanx and ICP Hub Mexico Launch Initiative Promoting Cryptocurrency Use at Universities

Ditobanx and ICP Hub Mexico recently partnered to launch an initiative promoting the use of cryptocurrencies at Mexican universities. As part of this program, over 4,000 students received $5.42 (100 pesos) worth of Ckbtc, the so-called bitcoin twin, to use at campus cafes, restaurants, and copy shops. Boosting Cryptocurrency Usage at Mexican Universities Salvadoran fintech […] Source

Polygon Price Risks Plunge With 90 Million MATIC Tokens Selling At $0.5

Polygon (MATIC) recently broke below the crucial support level at $0.5 and is at risk of further price declines. This price drop is thanks to several traders who offloaded their tokens as soon as Polygon reached this support level amid the downtrend in the broader crypto market. Polygon Faces Significant Selling Pressure The Exchange-Onchain Market Depth indicator on the market intelligence platform IntoTheBlock shows that Polygon is currently facing significant selling pressure. Over 90 million tokens were sold after the coin hit $0.5. This indicator tracks the order books of…