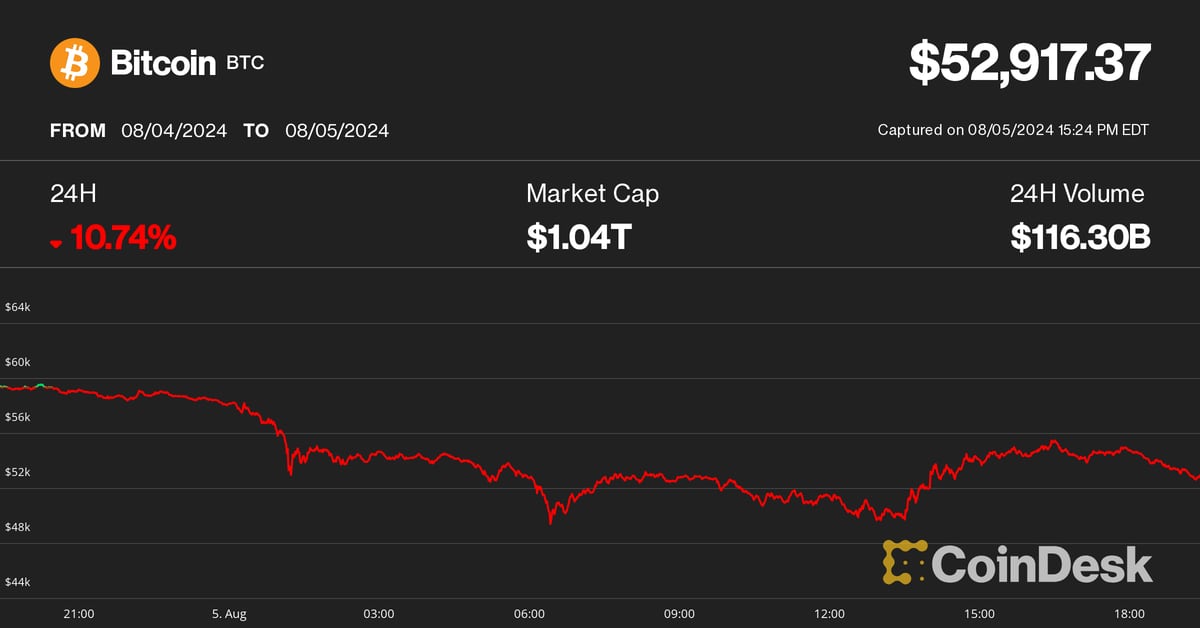

The cryptocurrency market has been rocked by a massive sell-off, with the Bitcoin price plunging 26% from its July highs above $70,000. This dramatic decline comes amid a broader crash in global financial markets, reflecting growing economic uncertainty and investor risk aversion. Crypto Winter Returns? The crypto sphere was not spared from this turbulence, as risk aversion sentiments reverberated across the industry on Monday. Bitcoin witnessed a staggering 16% decline, reaching as low as $48,860 on Binance, while Ethereum, the second-largest cryptocurrency, experienced its most substantial fall since 2021, reaching…

Day: August 5, 2024

Demand for XRP on Crypto Exchanges Rebounds to Pre-Lawsuit Levels: Kaiko Analytics

Demand for XRP is bouncing back on digital asset exchanges, according to crypto analytics firm Kaiko. After a long, drawn-out lawsuit with the U.S. Securities and Exchange Commission (SEC) that ultimately ended in the ruling that XRP sold on exchanges does not constitute a security, Kaiko says demand for XRP is back. “Since last year’s landmark court ruling, which granted Ripple Labs a partial victory against the SEC, demand for XRP in US markets has grown steadily. The share of US platforms in global XRP volume has increased from less…

Feasibility of Trillion-Dollar Platinum Coin Discussed by US Government, FOIA Documents Show

The trillion-dollar coin, an idea that surged as a solution to raising the U.S. debt ceiling on more than one occasion, was recently revealed to have been considered by the government several times. Memos obtained via FOIA requests by journalist Jason Leopold show that, even though it was considered outrageous by some, it was seriously […] Source CryptoX Portal

Cardano Not Spared From Bloodbath, Suffers 30% Loss

Cardano has been among the major coins that suffered miserably in the chaotic crypto market today: the token lost 30% in value in the last week. The broader market’s slip and crash are to be blamed for the token’s poor performance. Related Reading The past 24 hours remain bloody, with the total market cap facing an over 13% decrease. Bitcoin and Ethereum, the two top cryptocurrencies, saw their prices decrease by 24% and 31% respectively since last week, showing the market’s vulnerability to the spreading macroeconomic fears in private equity. …

Celestia (TIA), Helium (HNT) lead gainers as Bitcoin retests $55k

Celestia and Helium led the top gaining altcoins among the top 100 cryptocurrencies by market cap as the price of Bitcoin rebounded to test the $55k mark. After crypto prices tanked hard during the Asian trading session on Aug. 5, the market saw some relief during the U.S. session. Bitcoin (BTC) has narrowed 24-hour losses after rebounding from its intraday lows under $50k, with the recovery aiding some altcoins. Notable among the gainers are Celestia (TIA) and Helium (HNT), both of which posted double-digit gains before paring these slightly amid…

Bitcoin Bounces to $53K After Brutal Sell-Off Reminiscent of Covid Crash

Bitcoin’s 30% decline in a week was for some observers reminiscent of the March 2020 crash, but there’s been multiple occasions of similar drawdowns during previous bull markets. Source

Analyst Says A Break Above This Level Will Trigger FOMO

A popular Bitcoin analyst has suggested a key breakout point for Bitcoin amidst a bearish market price action. While Bitcoin’s price has been experiencing a downward trend, dynamics and movements over the past few months have established several significant price levels. These levels might offer traders valuable insights into Bitcoin’s potential future actions. The $65,000 price mark is one such level, and according to a crypto analyst, a break above it should eventually trigger serious FOMO among market participants. Break Above $65,000 The Bitcoin analysis in question was brought to…

Bitcoin bill gains support, thousands push US senators to back it

U.S. citizens are backing a bill to create a Strategic Bitcoin Reserve following remarks from former President Donald Trump and Wyoming Senator Cynthia Lummis. According to Bitcoin (BTC) proponent Dennis Porter, nearly 3,000 U.S. constituents requested Senatorial support for a “Strategic Bitcoin Reserve” bill. Porter highlighted that Democratic Senators received the lion’s share of letters from Americans, about 1,746 in number. The petitions to co-sponsor are likely in response to and support of Senator Lummis’s crypto legislation. BRREAKING: Nearly 3,000 letters sent to U.S. Senators asking them to co-sponsor the…

Following the Crypto Downturn, Market Observers Predict a 2020-Style Comeback

Over the past 24 hours, as market values have declined significantly, many observers have begun discussing the current crypto market cycle and the potential for digital currency prices to recover. Data indicates that hundreds of billions of dollars have exited the crypto economy, but some believe a rebound similar to 2020 could still occur. Onlookers […] Source CryptoX Portal

Is Bitcoin Still a Store of Value?

“It’s still undoubtedly a volatile, in many cases speculative, in many cases levered, in many cases traded asset,” Baehr said. “But its properties hold promise that, over time, its scarcity, its portability, and its lack of attachment to any government or corporation’s policies make it a really interesting asset to consider as a store of value.” Source