Bitcoin mining stocks trended lower as volatility in the cryptocurrency continued. Marathon Digital, the biggest mining company, dropped by 2.3% on Aug. 28, marking a 38% decline from its highest point this month. CleanSpark stock fell by 1.75% to $11.25, while Riot Platform dropped by over 1.4%. Other large Bitcoin (BTC) mining stocks like Argo Blockchain, Core Scientific, TeraWulf, and Cipher Mining also pulled back. Most of these stocks remain in a deep bear market after falling by over 20% from their highest level this year. Their performance is closely…

Day: August 28, 2024

Mpeppe Casino Presale Attracts Whale FLOKI Investors To Double Profits

Floki (FLOKI) has emerged as a significant player in the memecoin space, and recent analysis suggests that it could be on the brink of a massive breakout. As FLOKI gains momentum, investors are seeking new opportunities to maximize their profits, and many are turning to the Mpeppe (MPEPE) casino presale as a promising avenue. This article explores the growing interest of FLOKI investors in Mpeppe (MPEPE) and the potential for substantial returns. FLOKI’s Potential 200% Surge Floki (FLOKI) has recently captured the attention of analysts and investors alike. A well-known…

New Casino Cryptocurrency Attracts TRX & BNB Investors To Presale

Currently, a new casino-focused cryptocurrency is emerging as a prime opportunity for Tron (TRX) and Binance Coin (BNB) investors. This new player, Mpeppe (MPEPE), is gaining significant attention in its presale phase, attracting investors who are eager to capitalize on its potential to revolutionize the online gambling industry. Here’s why Tron (TRX) and Binance Coin (BNB) holders are flocking to this new presale and what makes Mpeppe (MPEPE) a must-watch token in 2024. The Rise of Casino Cryptocurrencies Online gambling has been a rapidly growing industry, and the integration of…

How Logos Is Onboarding Early Supporters Onto Its Network State Technology Stack With a Bitcoin Ordinals Collection

Logos is a fully decentralized, privacy-preserving, and politically neutral technology stack that provides the necessary support for self-sovereign virtual territories. The stack includes three modular, blockchain-based protocols: Nomos (consensus), Codex (storage), and Waku (messaging). Combined, they provide the technical foundation for cyber states, parallel societies, network states, or any borderless public institution based on voluntary […] Original

Investment Firm Lemniscap Raises $70M Fund Targeting Early Stage Web3 Projects

Lemniscap is targeting zero-knowledge infrastructure, consumer applications and decentralized physical infrastructure (DePIN). Source

WazirX Asks Singapore High Court for 6 Months to Restructure Its Liabilities

The application initiates an automatic moratorium of 30 days. Source

First Mover Americas: TON Blockchain Resumes After 6-Hour Outage

The latest price moves in bitcoin (BTC) and crypto markets in context for Aug. 28, 2024. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets. Source link

Institutional Investors Continue to Increase Digital Asset Allocation: Economist Report

“The positioning of digital assets within institutional portfolios has been focused on trading of cryptocurrencies, with bitcoin and ether representing the largest investment avenues,” the report reads. “But institutional investors are exhibiting greater optimism around digital assets, encouraged by the expanding availability of a wider range of investment vehicles that take them beyond just cryptocurrencies.” Source

Hong Kong Markets Authority Opens up its Tokenization Sandbox, HSBC, GSBN and Hashkey Dive in

“The tokenization of the eBL, a critical document underpinning global trade and serving as a means of legally transferring the title of goods, will for the first time pave way to the securitization of global physical shipping flows,” GSBN said in an emailed statement. Source

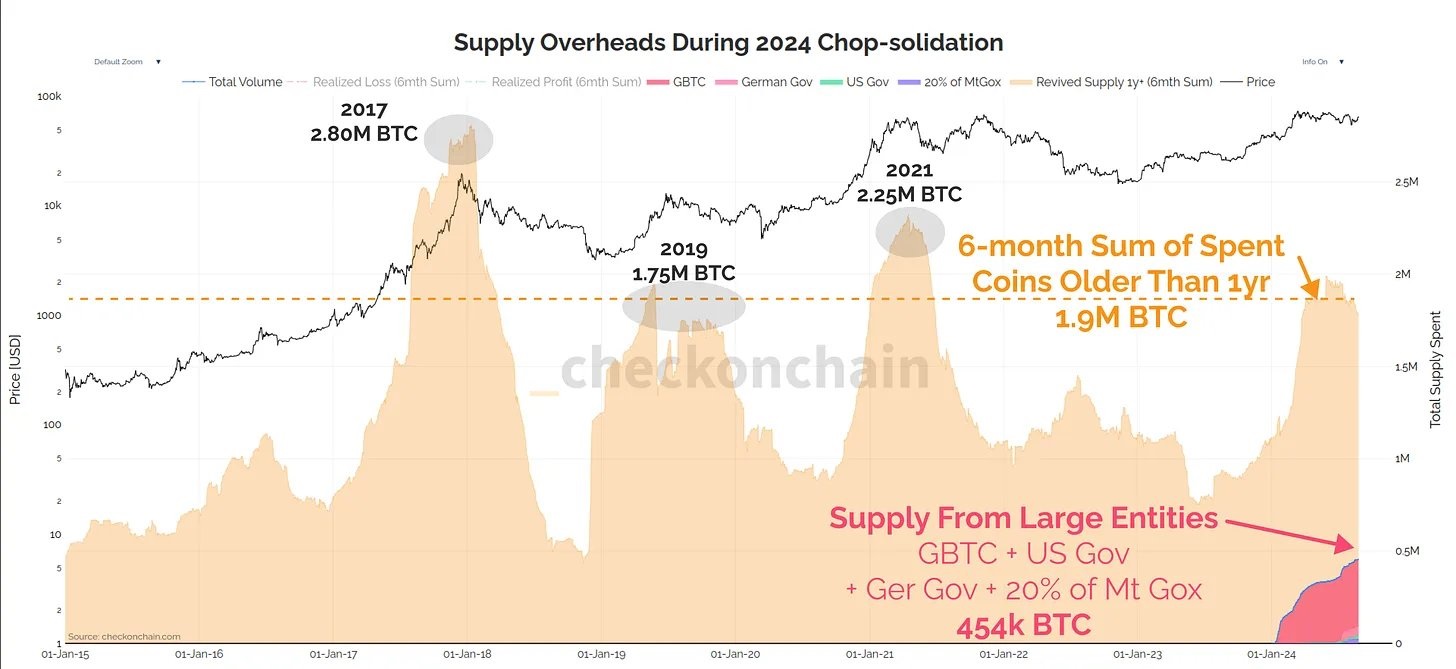

Buying Bitcoin Now Like Sub-$10,000 In 2019: Experts

Bitcoin is weaving through a consolidation phase since marking a new all-time high of $73,777 in mid-March. Since then, Bitcoin’s daily closing prices have exhibited significant restraint, never sealing above $71,500 and maintaining a floor above $54,000, though it has seen a major intraday low touching $49,000. This consolidation phase has nudged the Fear and Greed Index towards a cautious “fear” score of 30, revealing an atmosphere of apprehension amongst traders who find themselves frequently whipsawed by the volatile market dynamics. Is $60,000 The New $10,000 For Bitcoin Price? Despite…