Enter Huione Guarantee. It’s an online marketplace managed by a Cambodian conglomerate where anyone can post offers to buy, or sell, just about anything – including crypto. The marketplace only acts as a facilitator; other than moving money around, it doesn’t regulate who is getting the money, or where they got it from. Source

Day: August 29, 2024

Banks Using Permissionless Blockchains for Transactions Face Multiple Risks: BIS’ Basel Committee Says

Banks are also exposed to political uncertainty as a new legislation could “change validator behaviour,” making the “blockchains themselves operationally unstable.” A ban for instance could “reduce the amount of computing power or staked native tokens available to secure the blockchain, temporarily increasing the risk of a 51% attack,” in which ”a coordinated effort is put forward to control greater than 50% of the validation nodes.” Source

Chainlink (LINK) Could Drop To $8 If It Loses Current Support: On-Chain Data Reveals

Chainlink (LINK) has faced significant volatility this week. Its price dropped over 13% from Monday’s high, bringing LINK to a critical support level of around $11.20. Traders and investors are closely monitoring this crucial area. Related Reading The importance of this level is further emphasized by on-chain data from Santiment, which shows that demand for LINK is cooling off. This adds to the uncertainty surrounding the asset’s near-term price action. The next few days will be pivotal as Chainlink hovers around this crucial support. The outcome here could determine whether…

Crypto ATMs Dominate Cash-to-Crypto Transactions, Become a Law-Enforcement Concern: TRM Labs

The report, released Wednesday, highlights why law enforcement authorities worldwide have concerns about the growing use of crypto ATMs, which take fiat currency and send crypto to the desired digital wallet. In 2023 alone, 79% of all illicit cash-to-crypto tranfers, over $30 million, went to known scam addresses through cash-to-crypto services. Source

Old Bitcoin movements should stop to help price surge

Analyst claims that one of the main reasons behind Bitcoin’s recent downturn was movements from dormant addresses. According to the CryptoQuant analyst, over 52,000 Bitcoins (BTC), held for less than three months, have been moved on-chain over the past three days. In addition, 75,228 coins aged between three and six months have also been moved. These assets belong to short-term and mid-term holders. Per CryptoQuant’s data, 2,834 BTC tokens that have been dormant between six months and two years started making movements on-chain. As the price continues to consolidate below…

CEO of South Korean Crypto Firm Haru Invest Stabbed During Trial: Reuters

The executive was taken to hospital; his injuries were not life threatening. Source

Crypto Market Has Evolved in the Past Year, Canaccord Says

The broker praised Michael Saylor’s MicroStrategy (MSTR) for its “continued evolution into a Bitcoin development company,” and noted that the shares have risen around 325% in the past year, outperforming most asset classes including BTC, which has gained about 148%. Source

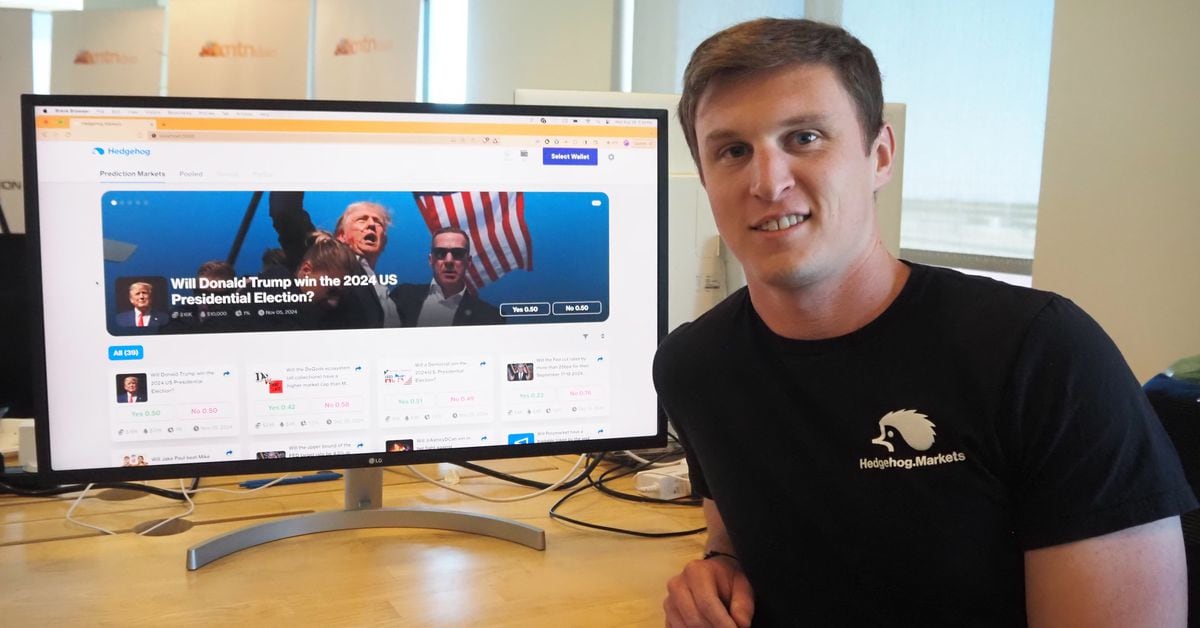

Can Prediction Market Boom Continue After Election? This Crypto Team Has a Plan

Doing away with stock market-type trading gives Hedgehog more flexibility in engaging its user base, said DiPeppe. For example, users can spin up custom prediction markets, place their own bet on the outcome, and hope someone else takes them up on the opposite point of view. (Polymarket allows community members to suggest markets in its Discord server, but the company decides which ones to publish.) Source

Indian Court Orders Scam Websites Using Crypto Exchange Mudrex’s Name to Be Taken Down

Scammers impersonating Mudrex employees on messaging service Telegram would lure retail investors by promising rewards and work opportunities if they performed certain tasks, including writing Google reviews. They also used fake websites under the Mudrex name and “invited the general public to invest on these websites, collecting monies from them illegally and frequently,” the court order said. Source

Ethereum ETFs outpace Bitcoin, but new entry BitNance offers an alternative

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only. As Ethereum ETFs gain traction and Bitcoin loses momentum, investors are turning to new and emerging tokens. We’re a month into the launch of Ethereum ETFs and current data shows that Ethereum is gradually making headway in the ETF space. Meanwhile, Bitcoin ETFs have lost some of the momentum they initially had. Numbers wise, however, Bitcoin still has the upper hand with $49 billion in assets, while Ethereum ETFs…