After touching recent highs of $64,653 for Bitcoin and $2,815 for Ethereum, in a sudden move backward, the cryptocurrency market had sharply backpedaled on Thursday, with Bitcoin shedding more than 6% and Ethereum dropping more than 7%. Related Reading This sudden fall has left many analysts and investors wondering about the future course of some of the top digital assets, hence underlining how volatile the market is wrought by macroeconomic events and changing mood among investors. 📊 Crypto’s latest retrace is coming after longs were pouring in on exchanges like…

Day: August 29, 2024

Missouri Man Arrested for Extorting Former Employer With Bitcoin Ransom

A Missouri man, Daniel Rhyne, was arrested for attempting to extort his former employer, a New Jersey-based industrial company. Rhyne, a former core infrastructure engineer for the company, allegedly sent an extortion email on Nov. 25, 2023, claiming to have locked out or deleted the company’s IT administrators from its computer network and deleted server […] Original

Polymarket Bettors Miss Out on $270K Due to Pavel Durov's Early Release

Bettors were fairly sure the Telegram CEO would be released in September. His release on Wednesday tossed the market on its head. Source

DTX Exchange’s Layer-1 Blockchain Soars After Testnet Launch

DTX Exchange (DTX) has taken center stage in the crypto market after announcing the much-awaited testnet launch. The decentralized trading platform has also surpassed $1.8 million raised in its ongoing presale weeks ahead of expected. This development is expected to accelerate the development of a unified trading ecosystem. Analysis of DTX Exchange’s Unified Platform DTX Exchange (DTX) was envisioned as a cutting-edge platform that brought together conventional and decentralized assets under a single umbrella. The DeFi exchange provides retail traders with maximum capital access along with a suite of trading…

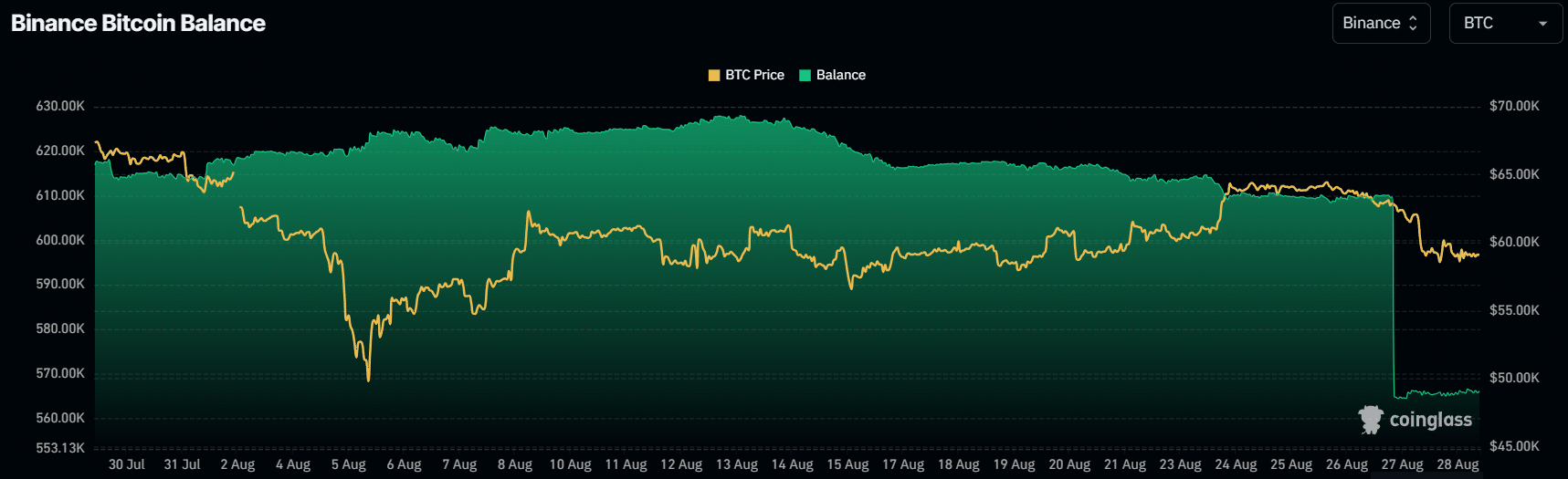

Binance saw $3.7b worth of BTC, ETH leave in 30 days

Following the latest allegations, Binance, the leading cryptocurrency exchange, witnessed a huge number of Bitcoin and Ethereum outflows. According to data provided by Coinglass, a total of 51398 Bitcoin (BTC) tokens left Binance over the past month. Data shows that the majority of the outflows, around 48,000 coins, happened on Aug. 27 as many Palestinian users complained of frozen assets on the exchange. BTC balance on Binance – Aug. 29 | Source: Coinglass In addition, Binance, the largest crypto exchange by trading volume, saw over 275,200 Ethereum (ETH) tokens leave…

The Entire Crypto Bull Run Hinges On These Factors: Analyst

In a thread shared with his 538,000 followers on X, crypto analyst Miles Deutscher highlights the vital importance of retail investors to the sustainability of the crypto bull market. To understand the possible return of the crypto bull run, Deutscher believes it is essential to understand what has happened in recent years. Deutscher recalls the substantial rally from March 2020 through November 2021, highlighting the extreme gains made across various altcoins. Understanding The Crypto Bull Run Dynamics “From March 2020 until November 2021, the crypto market rallied 2,672%, with many…

Spot Bitcoin ETFs see outflows of $105.19m, Ether ETFs break 9-day outflow streak

Spot Bitcoin exchange-traded funds in the United States experienced their second consecutive outflow day on Aug. 28, while spot Ethereum ETFs broke their nine-day outflow streak. According to data from SoSoValue, the 12 spot Bitcoin ETFs logged net outflows of $105.19 million, led by ARK 21Shares ARKB for the second consecutive day, with $59.3 million leaving the fund. The investment product saw an even larger outflow of $102 million the previous day. Fidelity’s FBTC reported net outflows of $10.4 million, while VanEck’s HODL saw $10.1 million in outflows. Meanwhile, Bitwise’s…

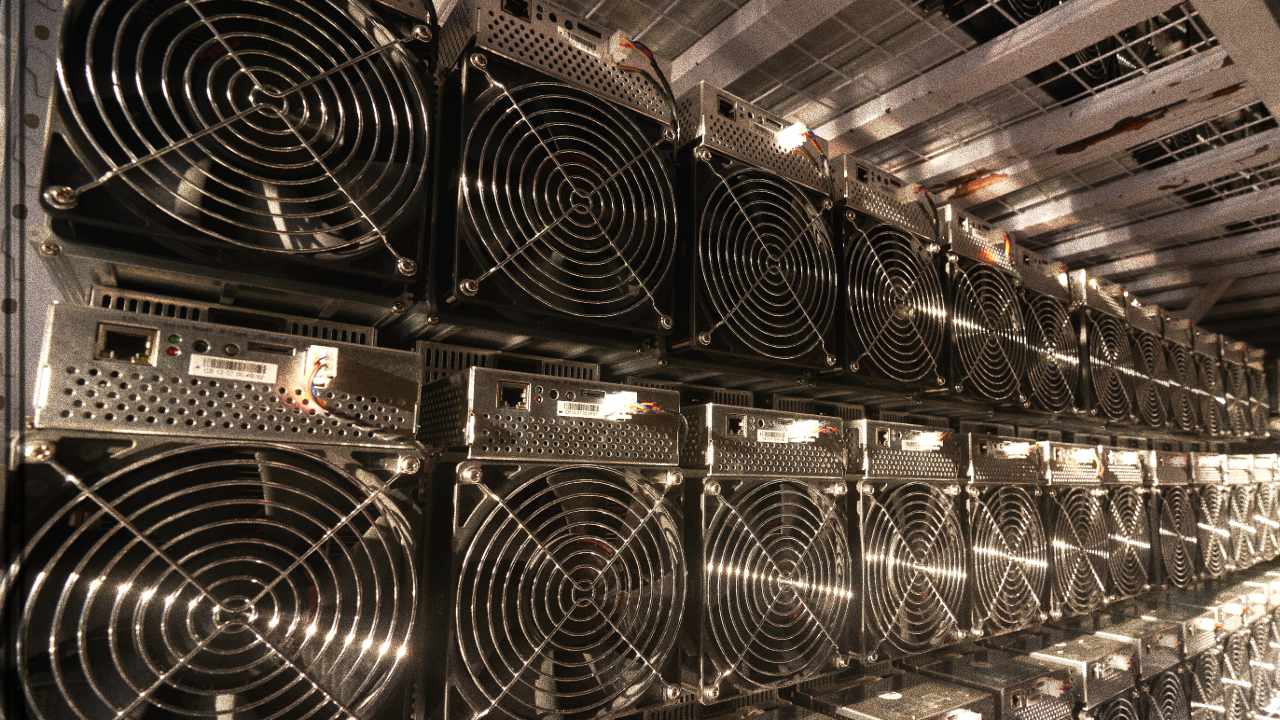

Bitfarms Takes Control of Its First US Mega-Site to Expand Bitcoin Mining Capacity

Bitfarms Ltd., a bitcoin mining company, announced on Tuesday that it has taken control of its new data center in Sharon, Pennsylvania. “This site represents Bitfarms’ first mega-site in the U.S. with access to up to 120 MW,” the company said. Located in the Pennsylvania-New Jersey-Maryland (PJM) grid, the site offers low-cost, flexible power ideal […] Original

Cybercapital Founder Justin Bons: L2s Are ‘Parasitic’ to Ethereum

Justin Bons, founder and CIO of Cybercapital, a Europe-based cryptocurrency fund, has warned about the effect that the rise of Ethereum L2s is having on the main chain. Bons stated that the activity that Ethereum should be experiencing is happening on L2s, and that is bringing fragmentation and more inflation to the ETH ecosystem. Cybercapital […] Source CryptoX Portal

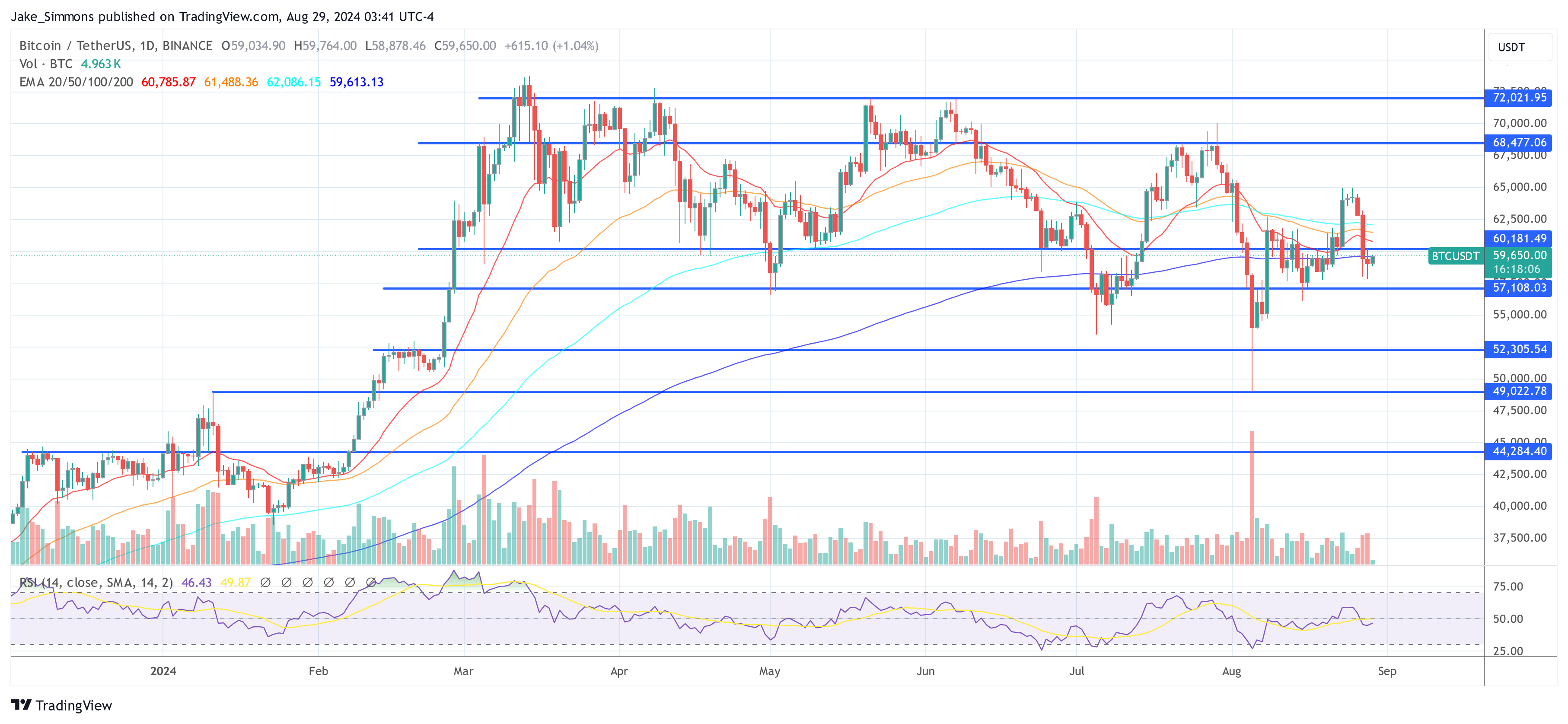

Analysts Eye Potential Rebound At These Levels

Meet Samuel Edyme, Nickname – HIM-buktu. A web3 content writer, journalist, and aspiring trader, Edyme is as versatile as they come. With a knack for words and a nose for trends, he has penned pieces for numerous industry player, including AMBCrypto, Blockchain.News, and Blockchain Reporter, among others. Edyme’s foray into the crypto universe is nothing short of cinematic. His journey began not with a triumphant investment, but with a scam. Yes, a Ponzi scheme that used crypto as payment roped him in. Rather than retreating, he emerged wiser and more…